On Tuesday, the GBP/USD currency pair moved relatively calmly. At least, the day passed without strong movements. However, it only went with sharp ones. Several relatively important reports were published in Britain in the morning, the values of which can be called resonant. Therefore, the reaction to them followed, but at the end of the day, it cannot be concluded that it was logical. The pound sterling is again desperately unwilling to fall, even when there are all the necessary factors for it. The price has consolidated below the moving average, the pound sterling is overbought, it has risen for two months, and there was no significant correction during this time. There are no factors for further growth, and the Bank of England is preparing to complete the monetary policy tightening cycle. What else is needed for the pair to start falling?

Formally, it has already started, but we cannot shake off the feeling that this time, everything may end with a sluggish rollback down and a brisk resumption of the upward trend. How many times has this happened in recent months? The pair regularly broke through ascending trend lines and the moving average line, and each time it all ended with a resumption of growth. Of course, now you can expect a rebound from the moving average and a resumption of the fall, but there are still serious doubts about this.

A couple of words about the eternally suffering British economy: in the best-case scenario, the GDP for the last four quarters showed growth of 0.1%. Inflation reached a peak value of 11.1%, and at the moment, after twelve increases in the key rate, it has decreased by 1.0% over the past five months. In the neighboring article on EUR/USD, we discussed the advantages of the American economy over the European one. So, the advantage of the American economy over the British one is even more obvious.

Unemployment is growing, and wages are growing.

Three reports were marked yesterday. The unemployment rate in the US began to rise and has already risen from 3.5% to 3.9%, unlike the American indicator. The number of unemployment benefits claims has been growing for two months and reached a record high in April for the last two years. The number increased by 47 thousand. Wages are growing slower than a few months ago, but still quite fast - 5.8% in March. Thus, the Bank of England still has few reasons for joy. And to be precise, there are none at all. Which of the macroeconomic indicators of the UK could please and inspire optimism in traders so much that the pound rose by 860 points just over the last two months?

Theoretically, this could only be the Bank of England's rate. But, as we have already said, they will stop growing soon. A pause may be taken as early as June (at the next meeting). Andrew Bailey and the company continue to radiate optimism, stating that inflation will halve by the end of the year. However, a couple of months ago, we already heard it would reach 2.9% by the end of the year. As we can see, Mr. Bailey quickly needed to remember this forecast. Rates will not grow, the economy is not growing, and inflation is off the charts, so why is the pound growing?

The only explanation is inertial growth. If initially, the pound could strengthen its positions against the dollar because the Fed was preparing to end the tightening cycle, then now the situation is already the opposite. Therefore, the British currency is growing because it is being bought. There are no reasons for purchases, but you can't command the market not to buy. Such an ambiguous situation developed in the middle of 2023. Perhaps the growth of the dollar is hampered by the unresolved issue of the public debt in the US, but let's remind you that such a problem arises every year, and every time, in the end, Democrats and Republicans come to a common denominator. Few people believe that the US can declare a default. And Janet Yellen scares the public with a possible default every year so that Congress can make the right decision faster.

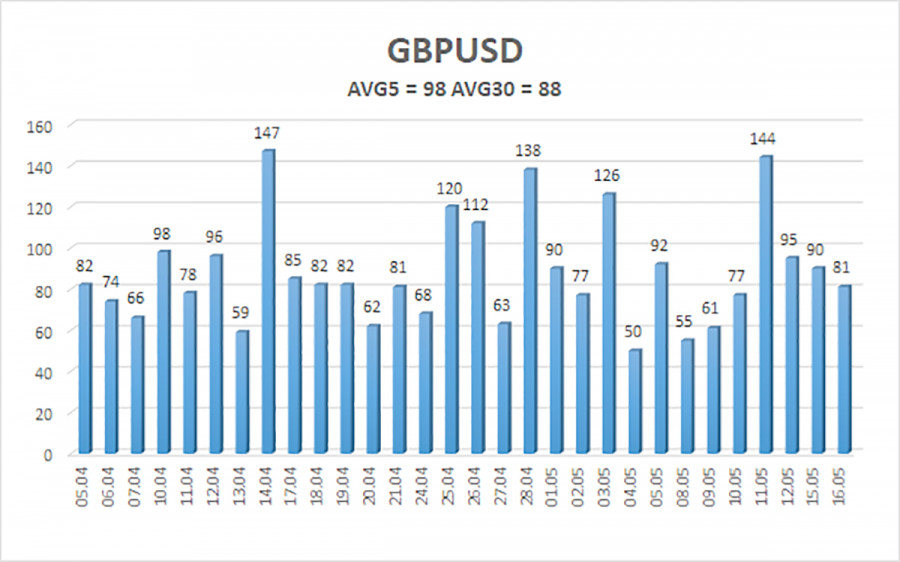

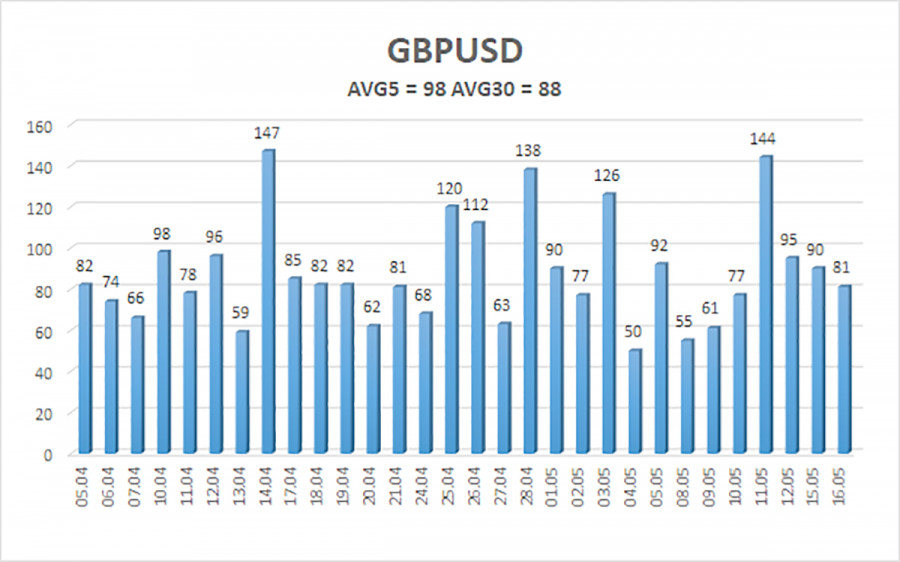

The average volatility of the GBP/USD pair over the last five trading days is 98 points. For the pound/dollar pair, this value is "average." Thus, on Wednesday, May 17, we expect movement within the channel to be limited by levels 1.2388 and 1.2584. The reversal of the Heiken Ashi indicator upwards will signal a new round of corrective movement.

Nearest support levels:

S1 – 1.2482

S2 – 1.2451

S3 – 1.2421

Nearest resistance levels:

R1 – 1.2512

R2 – 1.2543

R3 – 1.2573

Trading recommendations:

The GBP/USD pair on a 4-hour timeframe has consolidated below the moving average and has real chances for further decline. Therefore, you can stay in short positions with targets at 1.2421 and 1.2388 until the Heiken Ashi indicator turns upwards. Long positions can be considered if the price is above the moving average, with first targets at 1.2573 and 1.2604.

Explanation of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in one direction, the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which to trade now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means a trend reversal in the opposite direction is approaching.