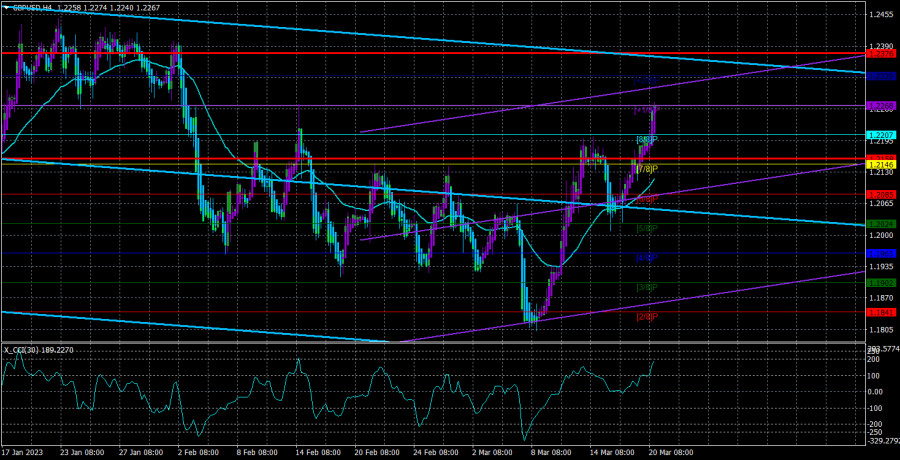

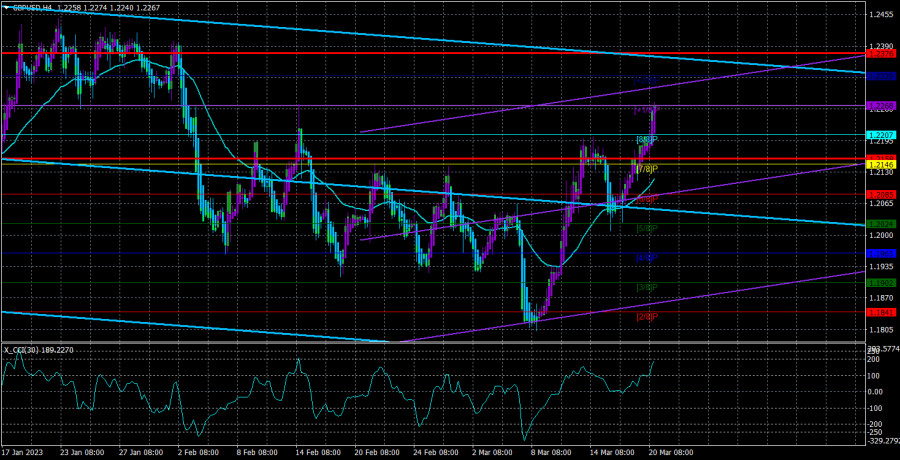

On Monday, the GBP/USD currency pair confidently continued on its upward trend, which no longer exactly fits the definition of a "swing." The pair did surpass both its most recent local maximum and several earlier ones on the 4-hour TF. Naturally, the upward trend may come to a halt at the Murray level of "+1/8"-1.2268, where one of the "swing's" initial turns came to an end. Nonetheless, for the 4-hour TF, we can say that the "swing" is over. On the 24-hour TF, however, the 1.1840–1.2440 side channel is still significant. The pair can grow up to its upper limit, or around 200 points further, without risking a long-term decline. Nevertheless, if it does reach this limit, it will bounce off it and begin another 600-point decline. There was not a single significant event or publication in the UK or the US on Monday; therefore, we do not see any justification for the pound to increase. The euro was rising on this day, and there were at least some theoretical justifications for this movement (Christine Lagarde's speech, the information regarding the Credit Suisse takeover), but why was the pound also rising? As a result, we continue to think that it grew based on a flat on a 24-hour TF.

It becomes considerably more challenging to identify factors contributing to the growth of the British pound if we choose a long-term strategy. The pair has increased by more than 2,100 points, although it has only adjusted by 600, as can be seen on the daily TF. This is, in our opinion, insufficient for the continuation of an upward trend, which has a strong likelihood of developing into a long-term trend. The 38.2% Fibonacci level was too great for the pair to overcome. So on what basis, if any, is the pound aiming for yet another upward trend? The situation in the UK is no better than it is in the US, where the US economy is stronger and the Fed rate is higher than the BA rate. Based on these considerations, how might the pound increase? If only the Bank of England had more "strong" language and intentions concerning the rate today, but this is not the case. In contrast, official predictions indicate that the BA rate will increase by 0.25% this week, which will result in a slower rate of tightening to the level of the US.

The Credit Suisse issue is over at this point.

Our discussion about Credit Cuisse, which is on the verge of bankruptcy, being acquired by Swiss giant UBS was only yesterday. And so it happened, as revealed on Monday night. The deal will be worth more than $3 billion, and UBS will assume all of Credit Cuisse's debts. But the agreement was not made without the help of the Swiss government, which was keen to maintain the country's reputation as the most secure and stable for financial assets. It should be mentioned that the discussions on the sale of the bank were particularly difficult. In light of this, the euro/dollar currency pair might show growth, and the pound might perhaps follow suit. The close correlation between the euro and the pound is well known, so one-way traffic does not come as a huge surprise. Only the overall pattern is unexpected because the euro and the pound increased within the current growth segments rather than increasing after a protracted decline. In any case, the Credit Suisse rescue factor cannot sustain the euro for an extended period, so soon we will learn the genuine motivations of traders. The difficulty may occur solely as a result of the week's strongest essential background. No one can predict how the Bank of England and the Fed meetings will finish, even though a few people are anticipating significant decisions and comments from both institutions. Even if nothing unforeseen occurs, the response may be intense. Moreover, traders' "emotional" responses might further confuse the technical picture and lead them to form incorrect conclusions. We think the pair should be traded on junior TF this week, and long-term assessments and projections ought to be made by the end of the weekend. Even more significant than the decisions made by the BA and the Fed themselves is how the market responded to them to determine its current point of view.

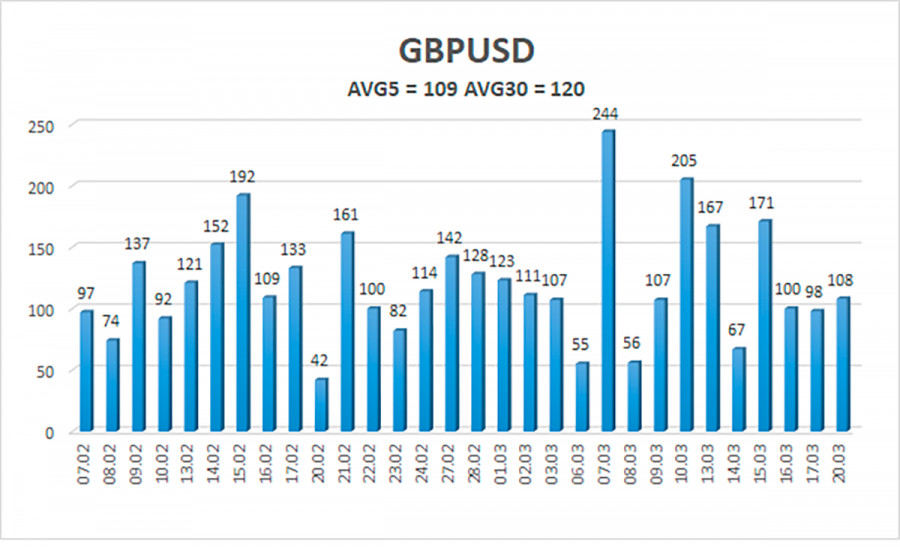

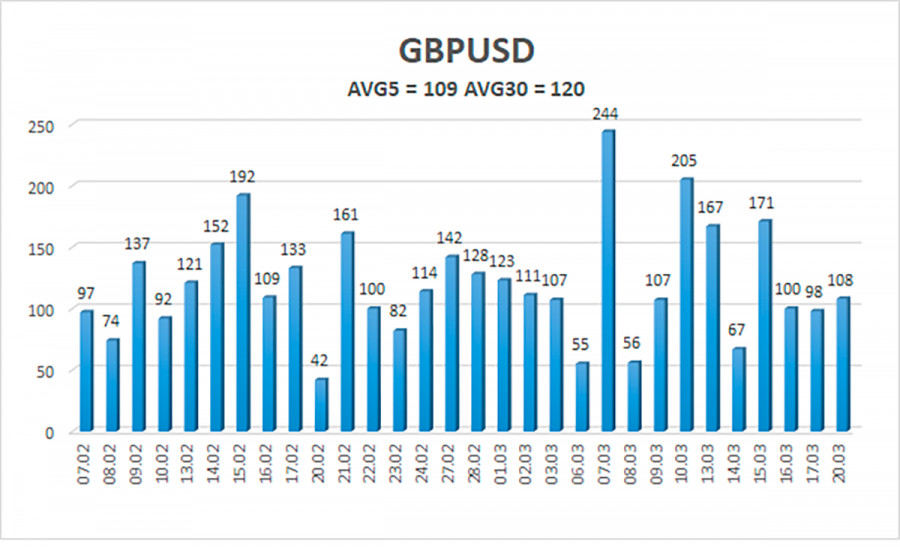

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 109 points. This value is "high" for the dollar/pound exchange rate. So, on Tuesday, March 21, we anticipate movement that is contained inside the channel and is limited by the levels of 1.2158 and 1.2376. A new round of downward correction is indicated by the Heiken Ashi indicator's downward reversal.

Nearest levels of support

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest levels of resistance

R1 – 1.2268

R2 – 1.2329

Trade Suggestions:

In the 4-hour period, the GBP/USD pair bounced off the moving average and started going north again. Unless the Heiken Ashi indicator turns down, you can continue holding long positions with targets of 1.2329 and 1.2376. If the price is fixed below the moving average, short positions may be taken with targets of 1.2024 and 1.1963.

Explanations for the examples:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.