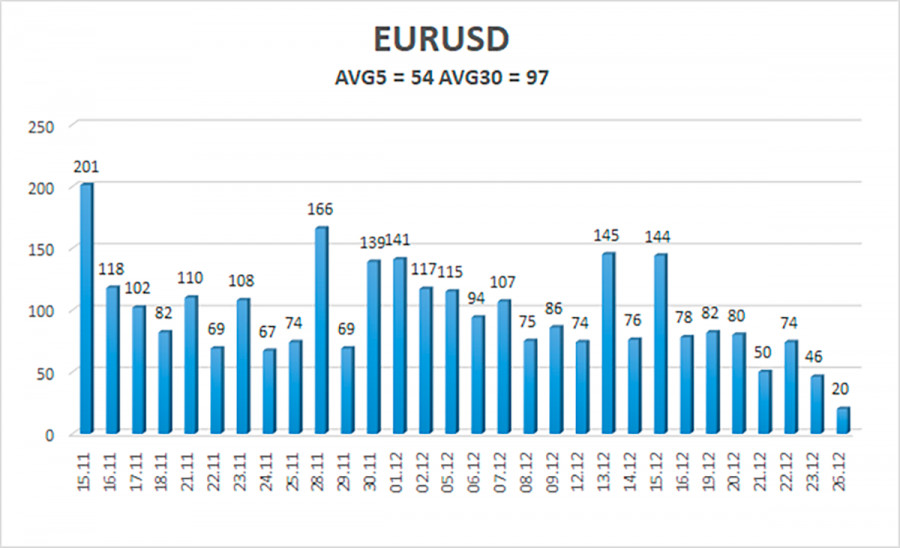

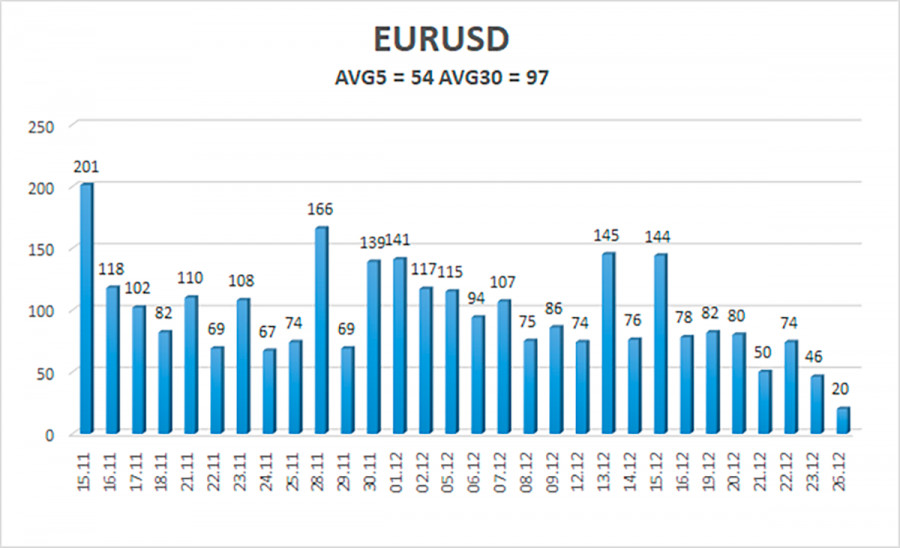

On Monday, the EUR/USD currency pair did not stay in a flat position. It did not move at all. The day's volatility, which was 20 points, can be safely regarded as the lowest level of the year. Regarding the present technical situation, there is nothing more to be said in theory. Additionally, from a fundamental and macroeconomic perspective, given that neither the United States nor the European Union had any notable events on Monday. Now, locating the price's position with the moving average or focusing on the linear regression channels' direction is useless. The pair are motionless. Opening transactions is pointless if the market is stagnant. The flat was evident yesterday because, in theory, the pair has been trading in a very narrow side channel for more than a week. It will probably continue at least through the end of this year. Possibly even longer. We still anticipate a significant downward correction in the medium term, but the flat must first end. We continue to see no justification for the euro to rise against the dollar. This has been covered extensively already, so we won't go over it again.

Does COVID spread outside of China?

The unprecedented rate of the "coronavirus'" spread within their own country may have been the most important news of the previous week. When alarming reports from China first started to arrive a few weeks ago, we issued a warning that the Chinese government might conceal the true number of infections and fatalities. Information about the actual state of things started to leak into the international media, despite the insane rates of dissemination. The number of infected people currently numbers in the hundreds of millions. There aren't enough doctors and hospitals in the nation to treat a fifth or a sixth of the population, making it physically impossible to count every person who has already contracted the disease. Therefore, if the situation is worse in reality, we won't be shocked. According to some reports from unreliable sources, hospitals are overcrowded, which is understandable based solely on the number of infections. The situation is shocking all around.

There is no doubt that the Chinese economy will continue to decline even if COVID does not spread beyond China this time. "Lockdowns," widespread illness-related absences from work, an initial massive economic contraction, and the launch of new stabilization initiatives, all of which will accelerate inflation. And it is extremely challenging to identify a nation in the world today that is not connected to China. Additionally, this implies that other nations' economies will also suffer. The world may enter a state similar to that of the end of 2019 and the beginning of 2020 if the infection escapes the Celestial Empire once more. Even though vaccines are available globally, this in no way implies that "coronavirus" infections and fatalities have decreased among people. We appear to be in for another fantastic year full of interesting surprises.

As of December 27, the euro/dollar currency pair's average volatility over the previous five trading days was 54 points, which is considered "average." So, on Tuesday, we anticipate the pair to fluctuate between 1.0577 and 1.0685 levels. The Heiken Ashi indicator's reversals are now completely irrelevant because the pair is flat.

Nearest levels of support

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest levels of resistance

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading Suggestions:

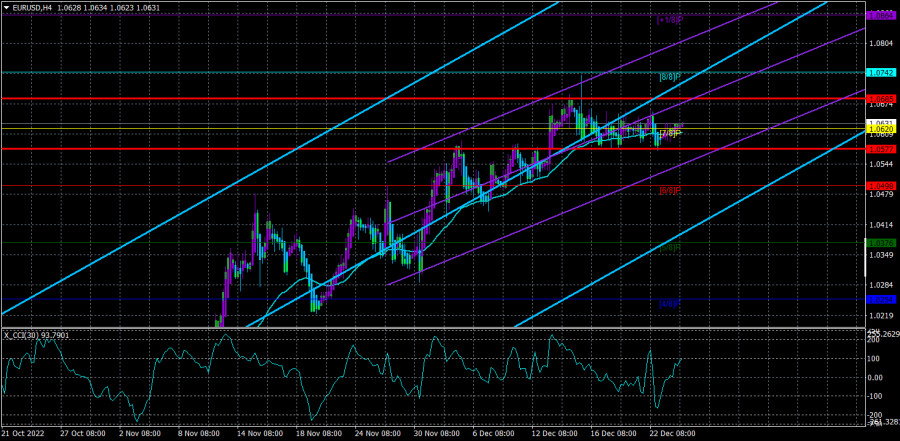

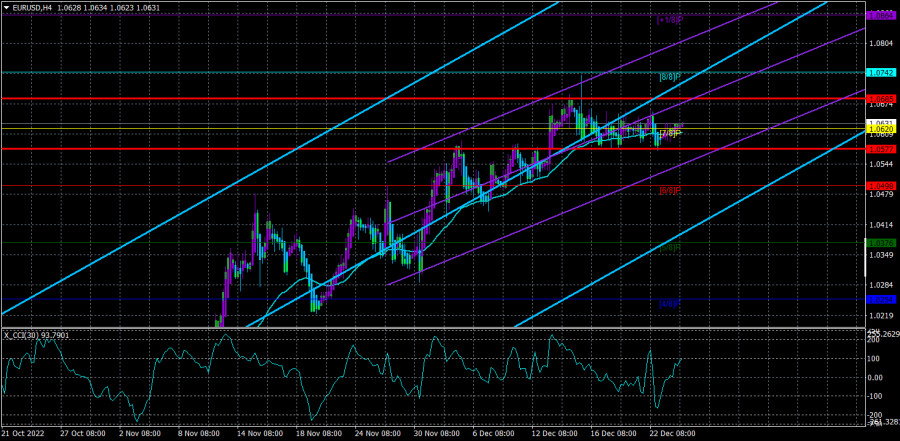

Although the EUR/USD pair continues to move higher, we have been seeing a flat price for more than a week. Trading can only be done on the lower TF inside the side channel because the 4-hour TF hardly ever moves.

Explanations for the illustrations:

Channels for linear regression help identify the current trend. The trend is currently strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.