The EUR/USD currency pair ended the previous week very boring, with a correction to the moving average line. Thus, the new week will begin with a dilemma: will there be a rebound from the moving or overcoming? Recall that formally, a new upward trend is now being maintained, and the pair has already managed to move away from its 20-year lows by 550 points, which has not happened to it for a very long time. However, the upward movement still does not look convincing as the beginning of a new long-term upward trend. Well, the fundamental and geopolitical backgrounds remain on the side of the US dollar. However, recently, there has been an increase in risk sentiment, and the dollar has sunk against many of its competitors. However, the dollar has not fallen in price so much as to give up on it. Thus, we fully assume that the downward trend may still resume.

The last round of the upward movement of interest by 60% was due to the ECB meeting, at which the rate was raised by 0.75%. This was known in advance, so traders began to buy the euro currency in advance. However, the Fed will hold a meeting this week, at which the rate will also be increased by 0.75%. Logically, we should now see the growth of the US currency. Theoretically, the market may have already worked out "in advance" all future rate increases in the United States, of which few are left. However, we cannot know for sure whether their market has worked out or not. We have to consider both options, so we assume that the demand for the US currency will continue to grow.

Moreover, we should not forget that the geopolitical conflict in Ukraine and the aggravation of relations between Russia and the West have not gone away. From time to time, the parties, it seems, take a short pause, and there is an information calm for several weeks. However, a new escalation, explosions, sabotage, terrorist attacks, or other important events force traders to turn to the US dollar again and again as the safest currency.

Inflation in the European Union will continue to grow.

Usually, important publications rarely happen on Mondays. However, today is not the case. Data on GDP and inflation will be published in the European Union today. And both of these reports may be as weak as possible. For example, GDP may grow by only 0.2-0.3% in the third quarter. Then it turns out that the growth of the European economy over the past four quarters will be as follows: +0,5%, +0,7%, +0,8%, +0,2-0,3%. We see a minimal increase, so the European economy is walking on the edge of the abyss called recession. The situation is sure to get worse this winter.

Inflation report - you can't expect anything optimistic from it either. According to experts, the consumer price index will accelerate to 10.2-10.4%. Of course, it's too early to expect a serious slowdown from this indicator since this report is from October, and at the end of October, the ECB only raised the key rate twice, which is frankly not enough. Therefore, we do not see anything surprising in the fact that inflation will accelerate again. This report may even support the euro, as it will mean that the ECB will have to continue to aggressively raise the rate if it wants to achieve price stability at 2%. However, we do not believe that the market will buy euros due to high inflation.

On Wednesday, the index of business activity in the manufacturing sector for October will be published, which is likely to fall even more and amount to 46.6. On Thursday, the unemployment rate will likely remain unchanged at 6.6%. Well, on Friday – the speech of ECB President Christine Lagarde and the index of business activity in the service sector. We do not expect any new information from Lagarde or a change in her rhetoric. Just last week, she gave a speech, but she didn't say anything super important. Therefore, the key events of the week for the euro currency are scheduled for Monday and Wednesday, when the results of the Fed meeting will be announced.

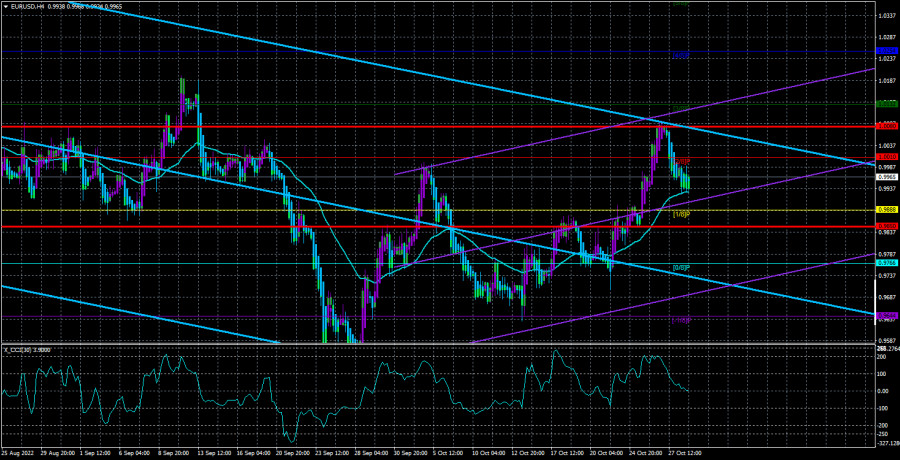

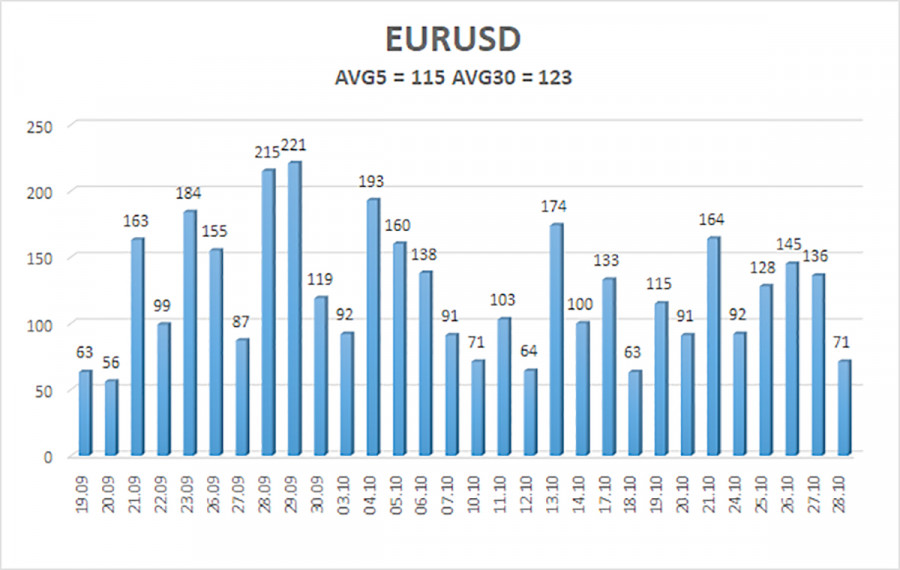

The average volatility of the euro/dollar currency pair over the last five trading days as of October 31 is 115 points and is characterized as "high." Thus, on Monday, we expect the pair to move between 0.9850 and 1.0080 levels. The upward reversal of the Heiken Ashi indicator signals the resumption of the upward movement.

Nearest support levels:

S1 – 0.9888

S2 – 0.9766

S3 – 0.9644

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0132

R3 – 1.0254

Trading Recommendations:

The EUR/USD pair continues to be located above the moving average. Thus, it is necessary to consider long positions with targets of 1.0010 and 1.0080 in case of a reversal of the Heiken Ashi indicator up or a rebound of the price from the moving. Sales will become relevant no earlier than fixing the price below the moving average with goals of 0.9850 and 0.9766.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. The trend is strong if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which you should trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.