The EUR/USD currency pair started a new downward movement on Wednesday. The fall began in the morning, even before the release of the European inflation report. We have already said earlier that the report's value was known in advance; apart from that, this report does not change anything at this time. Additionally, the American market still pays much more attention to American statistics and the "foundation" than the European one. Thus, a new fall in the euro currency is unlikely due to European inflation rising to 9.9% y/y in September. Or with the fact that it has not grown to 10% after all, as expected. Recall that rising inflation means the central bank will have to raise the key rate longer and harder, raising the cost of borrowing. This is good for its currency, but in the case of the euro, this scheme does not work. The market has serious reasons to doubt that the ECB will raise the rate "to the bitter end" at all. It has already been said that a strong rate increase could be fatal for the economies of some problematic EU states. Thus, we will certainly see one or two more rate hikes from the ECB, but hardly more. And this will not be enough for inflation to slow down significantly and even more so to return to the target level. Thus, for the euro now, what is rising inflation, and what is falling inflation is the same.

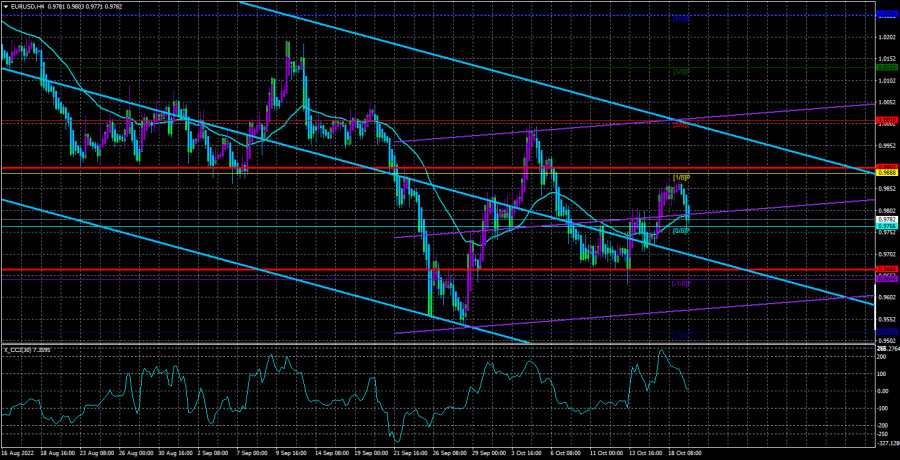

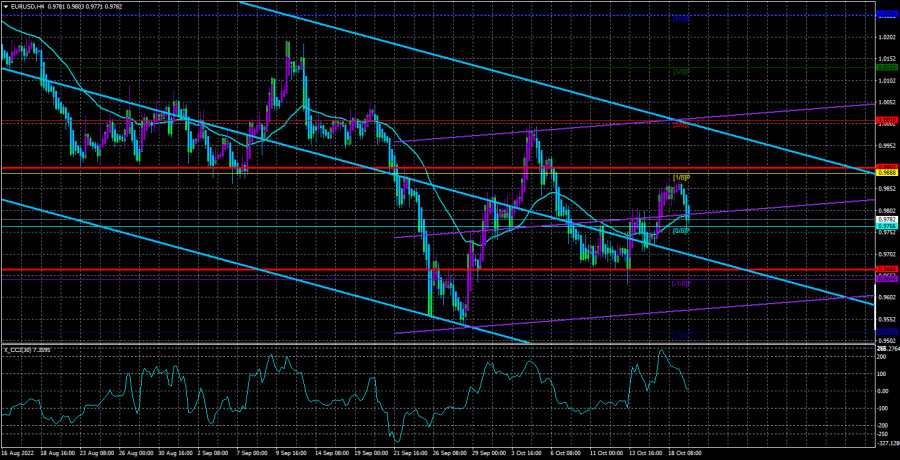

From a technical point of view, things are still bad for the euro currency. On the 4-hour TF, we see that each subsequent price peak is lower than the previous one. On the 24-hour TF, the price is located below all the lines of the Ichimoku indicator. It will most likely be possible to overcome the moving on the 4-hour TF in the coming hours. Therefore, we do not have a single serious signal for the growth of the currency pair. Luis de Guindos said at the beginning of the week that he was waiting for the dollar to stabilize, and even then, we wondered what such optimism was based on. There is no answer to this question. The ECB needs to take concrete actions to stabilize the euro exchange rate if it sets itself such a task. The exchange rate itself is not stabilizing. All this is very much reminiscent of Lagarde's optimism at the beginning of the year regarding inflation.

Inflation in the EU is growing, and could it be otherwise?

A little above, it was already said that inflation at the end of September rose to 9.9% y/y. This is a lot, but it can be much more. Recall that the ECB raised the key rate only twice, which is very little to expect a serious slowdown in the consumer price index. Therefore, inflation in the Eurozone can continue to grow quite freely for a few more months. What does this mean for the euro currency? Nothing is good since the regulator will continue to raise the rate, but only up to a certain limit. And while the Fed rate is higher than the ECB rate, the dollar can have an advantage in the foreign exchange market. Thus, the "foundation" remains on the side of the dollar and may remain there for a very long time. We have already talked about geopolitics more than once, and what do we have in the end? The most important factor for the euro/dollar pair is that it supports the US currency. If there are at least technical reasons to expect the pair to grow in the case of the pound, then there are none in the case of the euro. Overcoming the moving average line will mean that the global downtrend continues, and the pair will return to its 20-year lows.

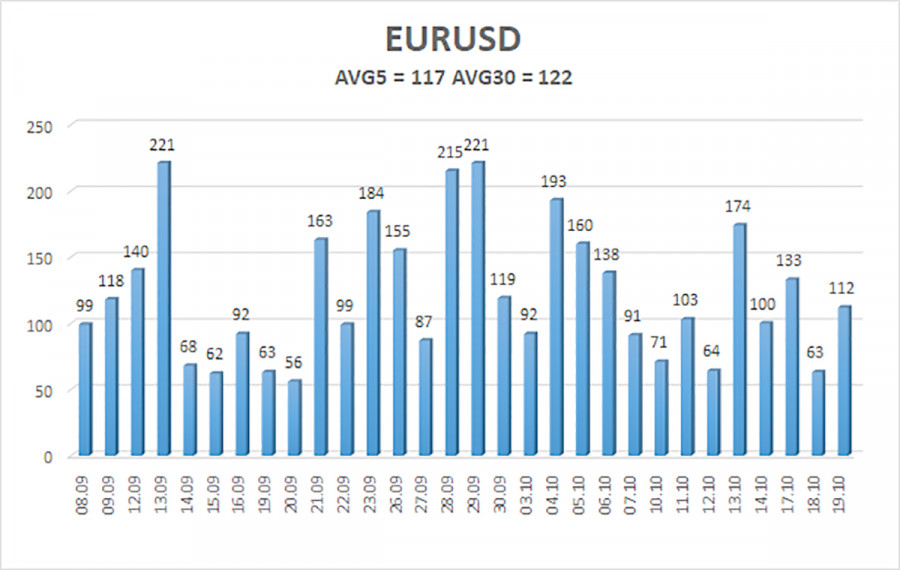

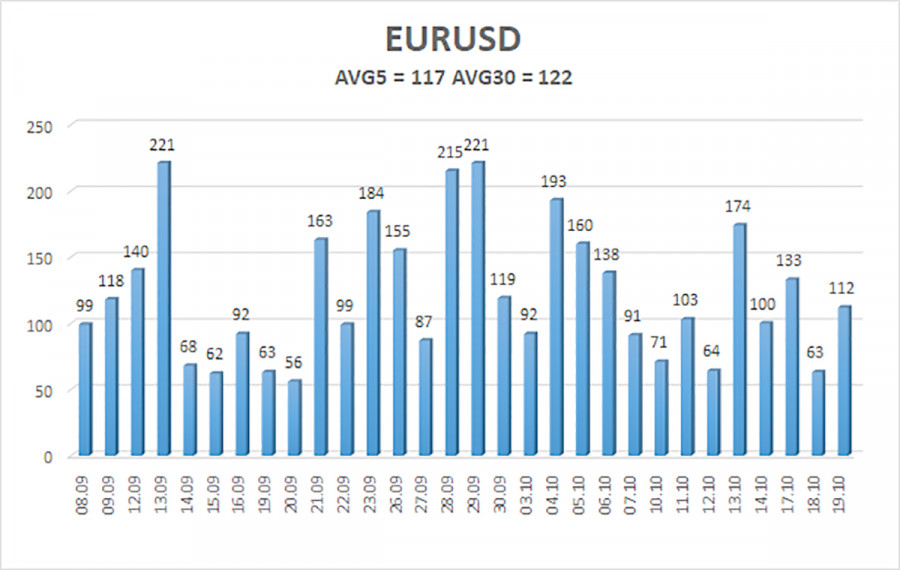

The average volatility of the euro/dollar currency pair over the last five trading days as of October 20 is 117 points and is characterized as "high." Thus, on Thursday, we expect the pair to move between the 0.9666 and 0.9901 levels. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of the upward movement.

Nearest support levels:

S1 – 0.9766

S2 – 0.9644

S3 – 0.9521

Nearest resistance levels:

R1 – 0.9888

R2 – 1.0010

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair has adjusted to the moving average. Thus, now we should consider new long positions with targets of 0.9888 and 0.9901 in the event of a reversal of the Heiken Ashi indicator up or a price rebound from the moving average line. Sales will become relevant again no earlier than fixing the price below the moving average with goals of 0.9666 and 0.9644.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction to trade now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.