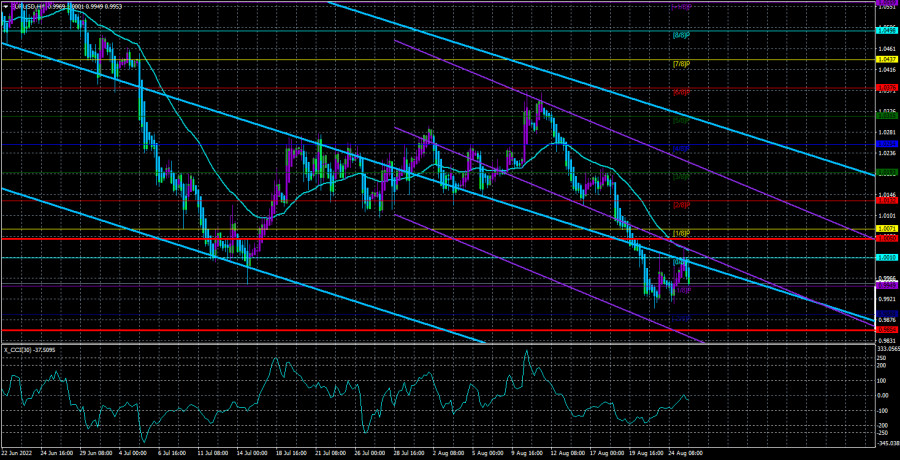

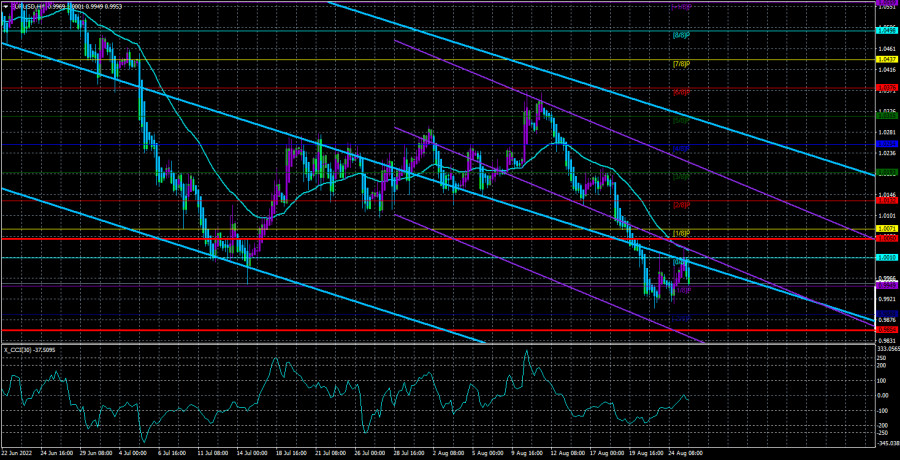

The EUR/USD currency pair worked out the moving average line on Thursday, bounced off it, and resumed its downward movement. In the last few days, the European currency has managed to avoid serious losses, but at the same time, it could not adjust normally. Recall that all recent local and global corrections were, in fact, minimal. Looking at the 24-hour timeframe, we see that the maximum correction within the entire downtrend was 400 points. If you look at the 4-hour TF, the corrections often end around the moving. Thus, the rebound from the moving average can be considered a strong sell signal. Both linear regression channels are pointing downwards, and the pair is close to its 20-year lows, which have already been updated twice. We also remind traders that when the next trend ends, there is usually a fairly strong and sharp pullback from the minimum or maximum point of the trend, which is the beginning of a new trend. That is, a correction of 100 points in the current conditions may begin a new trend with a probability of 5 percent. It turns out that all technical indicators are now in favor of resuming the fall of the euro and the growth of the dollar.

It doesn't even make sense to talk about other factors that continue to provoke the market to more and more new sales. It is because they have not changed at all in recent months. The foundation remains the same: the Fed raises the rate quickly and strongly, and the ECB pretends to raise the rate. Geopolitics remains the same: the conflict in Ukraine will be protracted, and the longer it persists, the more those countries that are as close to the conflict as possible will suffer. And this is just Europe and the UK. The states are far away, and this conflict practically does not affect them in any way.

Moreover, in 2022, more than ever, what matters is not how much money a country has but what natural resources it has. If earlier everything was built through business, when everything was bought that was not in the country itself, now, because of sanctions against the Russian Federation, many people have problems with oil and gas. The gas shortage in the European Union, in the absence of a gas shortage in the world, has already led to the price rising to $ 3,300 per thousand cubic meters. But the era of gas in the world has not ended. It's just that the European Union imposes sanctions against the Russian Federation, and the Russian Federation responds to the European Union with "reciprocity."

Jerome Powell's rhetoric won't change.

Based on the first paragraph, in which we touched on 90% of all the reasons for the growth of the dollar and the fall of the euro in the near future, we can conclude that macroeconomic reports, ordinary fundamental events, and news from the world of geopolitics have practically no effect on the movement of the pair now. Recently, so many "hot spots" have appeared on the world map that one or two more do not change the overall picture. The conflict between Serbia and Kosovo? Well, another military clash. China's claims to Taiwan: What's so surprising about that? All this does not affect the euro/dollar exchange rate anymore.

The same applies to ordinary events, such as the speech of Jerome Powell or Christine Lagarde, who seems to have been on vacation for several weeks. What could Jerome say tonight in Jackson? Will his rhetoric change dramatically because of one successful inflation report? From our point of view, no. Maybe there will be a couple of half-hints of changes in the monetary approach, but the "core" of his rhetoric will remain unchanged. The Fed has no other way but to continue raising the rate until inflation slows down to at least 5%. It is because almost all members of the monetary committee declared a million times in 2022 that price stability is the regulator's main task. Therefore, the rate will be increased in September by 0.75% or 0.5% - this is not particularly important. The rate will continue to rise throughout the current year – and this is important. And this is a factor in the further growth of the US currency.

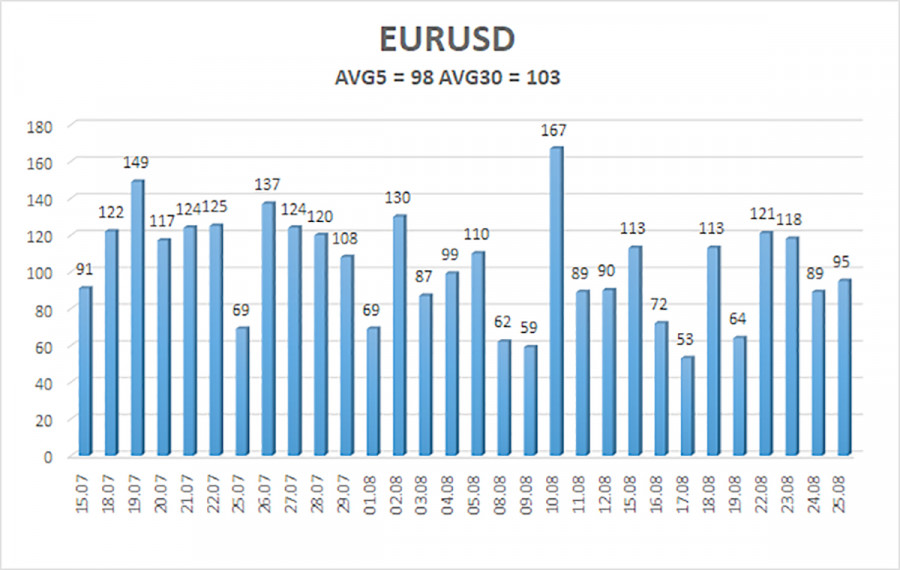

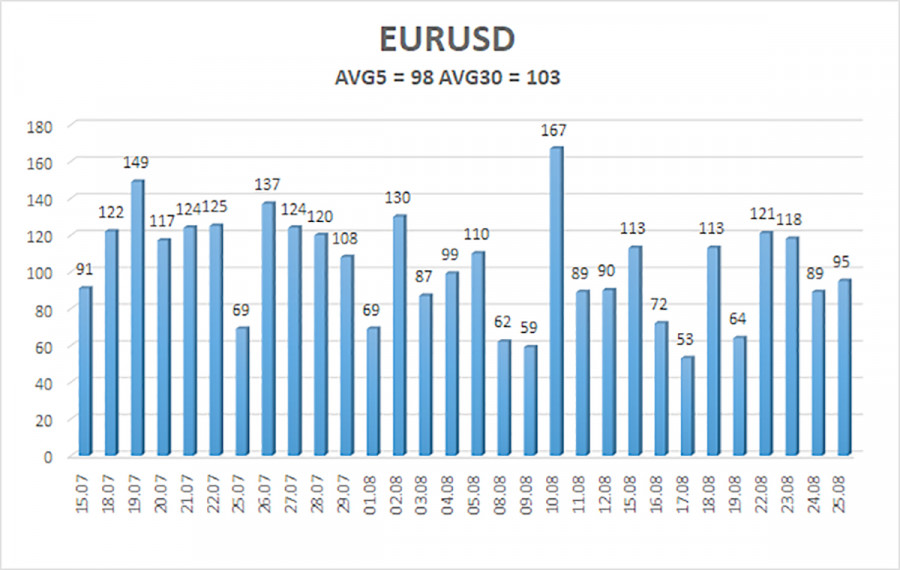

The average volatility of the euro/dollar currency pair over the last 5 trading days as of August 26 is 98 points and is characterized as "high." Thus, we expect the pair to move today between 0.9854 and 1.0050. A reversal of the Heiken Ashi indicator upwards will signal a new round of corrective movement.

Nearest support levels:

S1 – 0.9949

S2 – 0.9888

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0071

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair is trying to resume its downward movement. Thus, it is necessary to maintain new short positions with targets of 0.9888 and 0.9854 until the Heiken Ashi indicator turns up. It will be possible to consider long positions after fixing the price above the moving average with targets of 1.0071 and 1.0132.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.