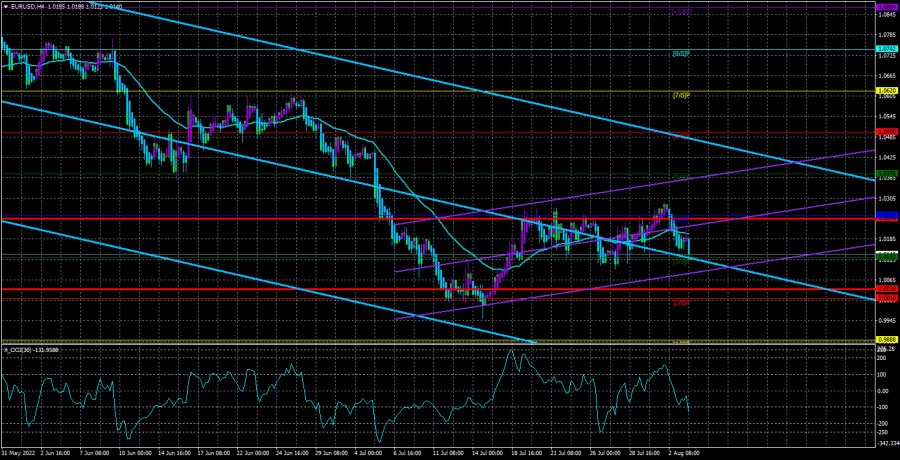

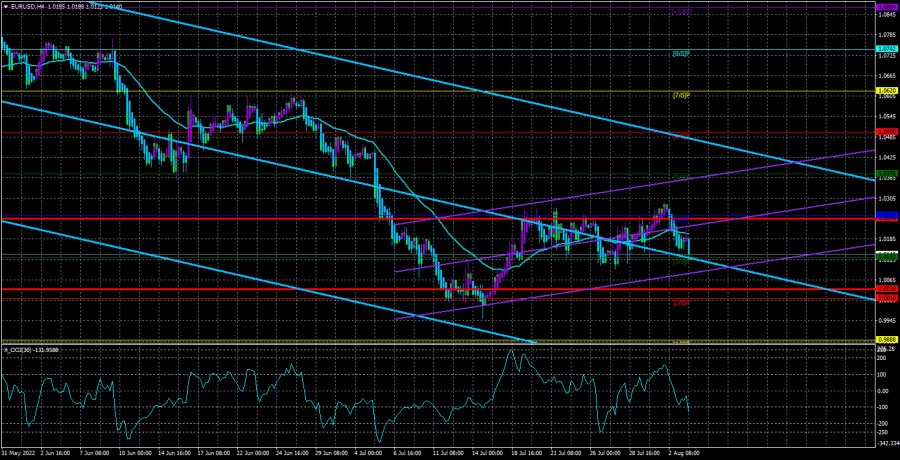

The EUR/USD currency pair on Wednesday still turned out to be below the moving average line, but it does not matter much for traders now. The pair continues to trade stubbornly inside the 1.0132-1.0254 side channel. From time to time, attempts are made to consolidate above or below this channel, but the pair still spends 90% of the time inside it. Therefore, even with all the desire, it is impossible to identify a trend movement on a 4-hour TF. The macroeconomic background was completely absent yesterday, which did not prevent the European currency from falling by 100 points. However, this movement does not mean anything since the pair remains in the flat. It's just that this flat is not the narrowest, and the price moves along the channel quite cheerfully, spending no more than a day to pass from one of its borders to another. The fact that the price constantly overcomes the moving average, which is directed sideways most of the time, also speaks in favor of the flat. Why did the pair decide to go flat?

From our point of view, there are two possible reasons for the flat in recent weeks. First, we recall that the European currency has much less resistance against the dollar than the pound. The pound is getting cheaper more slowly and grows more confidently during periods of correction. Since the pound has been strengthening over the past three weeks, it was reasonable to assume that the euro would show either weak growth or nothing. Both European currencies remain extremely weak against the dollar, and here the pound's growth should not be misleading since one only has to look at the daily TF to understand the whole situation. Second, the fundamental and geopolitical backgrounds remain not in favor of the European currency, so now there is simply no reason to buy this currency. And the fact that these purchases have not been made in recent weeks suggests that bulls are not ready to invest in euros, and bears are not ready to give up selling euros and keep short positions open.

Pelosi's visit may complicate relations with China, but there is no reason to panic.

Yesterday can be safely called "Pelosi Day." The Speaker of the US Congress voluntarily decided to visit Taiwan, although Joe Biden was against this trip. China has been scaring Washington with a "backlash" for more than a day and talked about "serious interference in China's internal affairs" but failed to prevent Pelosi's visit to Taiwan. Today, military exercises have begun around the island of Taiwan, and it is also unknown how they will end. Recall that Taiwan also did not sit idly by. In recent weeks, amid increased concerns about Beijing's attempt to seize the island by military means, it was actively preparing for defense. However, the media, as usual, "made a big deal out of a molehill." The situation could end badly, but smart people are sitting in Beijing who would hardly attack Pelosi's plane to start World War III. And because of what? Because of the ordinary visit of the Speaker of Congress?

Of course, Pelosi didn't come to Taipei to drink coffee and wave her hand. Serious issues that directly affect global geopolitics have certainly been resolved. At the same time, since when has it been forbidden for American officials to visit Taiwan? There is no relevant legislation in this regard. Beijing does not control Taiwan, so Beijing does not have the right to "issue permits" to visit Taiwan. The fact that Beijing considers Taiwan its own, again, is China's problem, not the States or Taiwan itself. Therefore, we believe that, in this case, it is China that provokes the emergence of a new point of tension on the world map. Plus, we should not forget that China is an ally of Russia, and Taiwan is in friendly relations with the United States, which are allies with the European Union and the United Kingdom. Therefore, we see another "geopolitical game" where one of the parties will seize certain territories under various plausible pretexts and excuses. And the territory that can be captured asks for help from its allies (in particular, the United States, which supplies Taiwan with weapons and air defense). We have seen such a picture many times over the past decades.

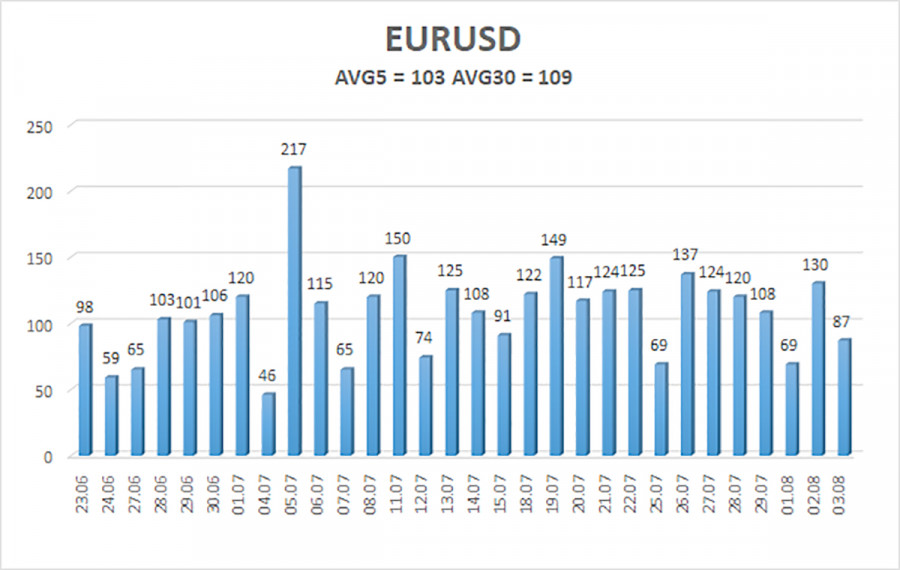

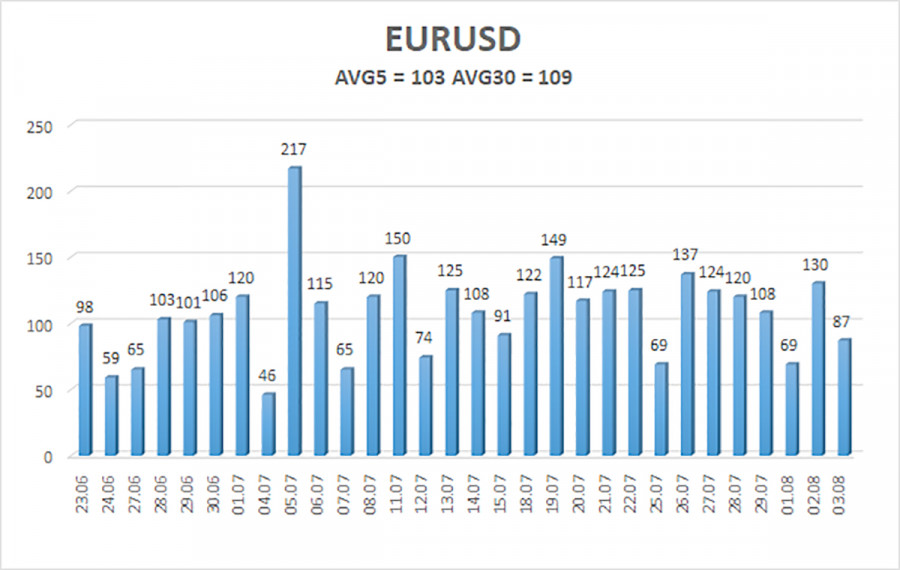

The average volatility of the euro/dollar currency pair over the last 5 trading days as of August 4 is 103 points and is characterized as "high." Thus, we expect the pair to move today between 1.0038 and 1.0244. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

Trading Recommendations:

The EUR/USD pair is trying to resume the trend movement but is moving flat instead. Thus, it is now possible to trade on the reversals of the Heiken Ashi indicator between the levels of 1.0132 and 1.0254 until the price leaves this channel.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.