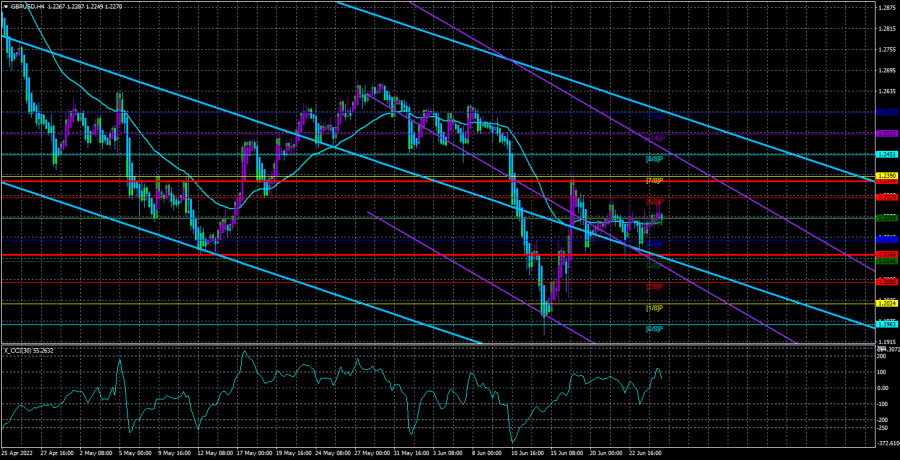

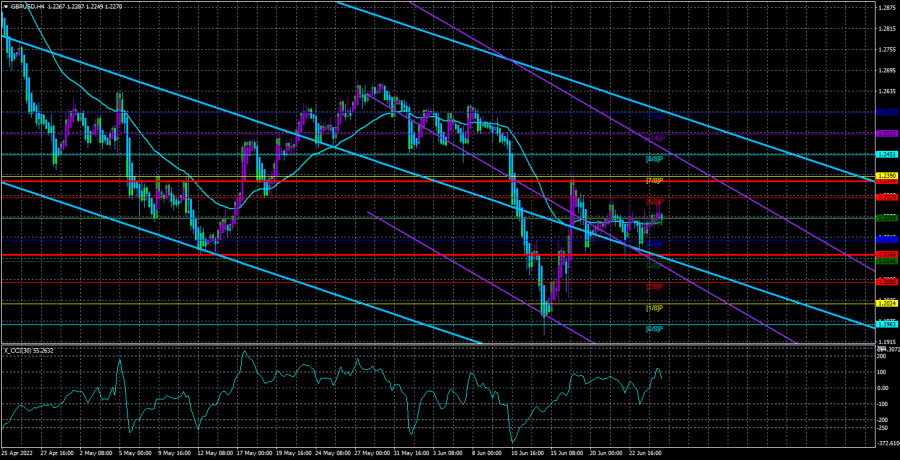

The GBP/USD currency pair was also trading frankly reluctantly on Friday. If for the euro currency we characterize the movement in the last week as a "swing", then for the pound it is almost a classic flat. The pair is trading strictly between the levels of 1.2165 and 1.2320. Yes, the side channel is far from the narrowest, but at the same time, the price does not even try to leave its limits. Consequently, there is a situation in which trading a pair is, in principle, very difficult and inconvenient. Of course, you can always switch to the lower TF, recommendations for which we also provide every day, and trade on it. But even there, everything is not good every day. Flat is always bad for traders. With this understanding, it is necessary to conduct trade. As for the prospects of the British currency, they remain very bleak. We would now like to inform traders of some news that hypothetically can affect the mood of the market, but there simply aren't any. Macroeconomic statistics, as before, have only a local impact on the movement of the pair. The fundamental and geopolitical backgrounds have not changed for several months. And the most important thing for the pound is the mood of the market itself.

Recall that the pound has much more reason to grow than the euro currency. After all, the Bank of England has already raised the rate five times in a row and everything is going to the point that we will see the sixth increase already at the next meeting since inflation practically does not react to all the efforts of the regulator. But at the same time, several reasonable questions arise. Economic growth. Are BA willing to sacrifice it to bring inflation back to the target level? If inflation does not react in any way to the tightening of monetary policy, then does it make sense to raise the rate at all? And to what value does it need to be raised so that inflation at least starts to slow down? In the States, these questions can be answered with highly probable answers, but in the UK – it does not work.

Brexit, Scotland, and Boris Johnson.

The British pound also has problems that the European Union does not have. Recall that many experts consider Brexit a blow to the British economy. Perhaps it is not noticeable too much, but a lot of unresolved issues in relations between the EU and the Kingdom hang like a "sword of Damocles" over the latter's economy. The most pressing issue is the "Northern Ireland Protocol". While negotiations are underway, the market does not react to them in any way. But, let us remind you that the case may well end in legal proceedings at the international level. And then there will be demands to pay fines or penalties, sanctions will follow, and even a trade war is possible. Is it worth saying that a trade war is a blow to the economy?

The figure of Boris Johnson is also a source of eternal instability. Johnson has probably already broken the record for the number of scandals and various "stories" as Prime Minister. He recently received immunity from a vote of no confidence for 12 months, but few believe that he will be re-elected for a second term. Moreover, confidence among the British in the Conservatives is falling, which means that the next parliamentary elections may be lost. Moreover, if Johnson is opposed already within his party, it means that not only the British are dissatisfied with him, but also the deputies themselves. Thus, so far everything is going to the fact that Johnson will repeat the fate of Donald Trump, and the next prime minister in the UK will be chosen on the principle of "anyone, just not Johnson."

Well, the issue of Scotland and its possible secession from the Kingdom is another potential global problem. If the UK loses a third of its territory, it will be a serious blow to its economy. So far, Johnson is holding out and does not grant permission to hold a new referendum, and without this permission, any referendum will be illegal. At the same time, Nicola Sturgeon promised that the referendum would be held before the end of 2023. This was her election promise, after which her SNP strengthened its position in Parliament. Now, if Sturgeon does not keep her promise, then her ratings will collapse, and the excuse that we were not given permission will not matter to the Scottish electorate.

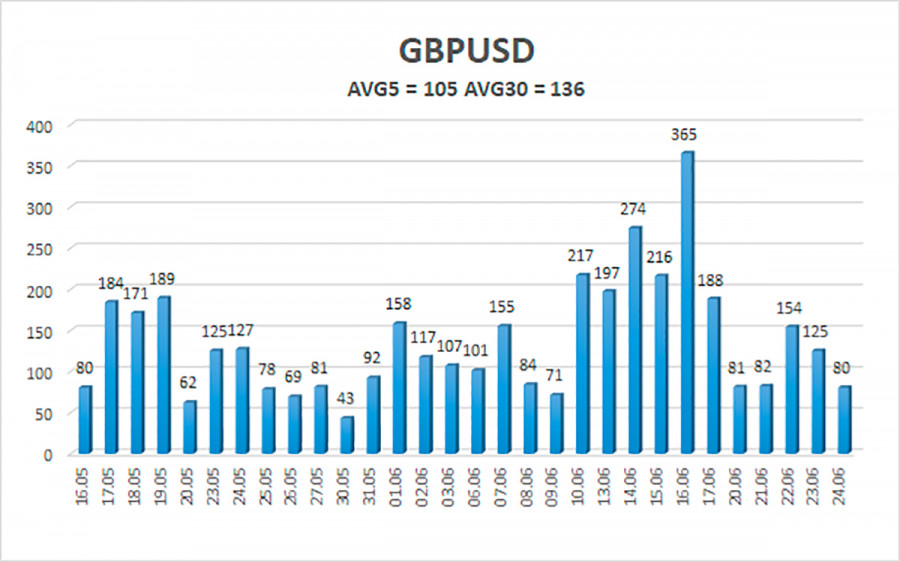

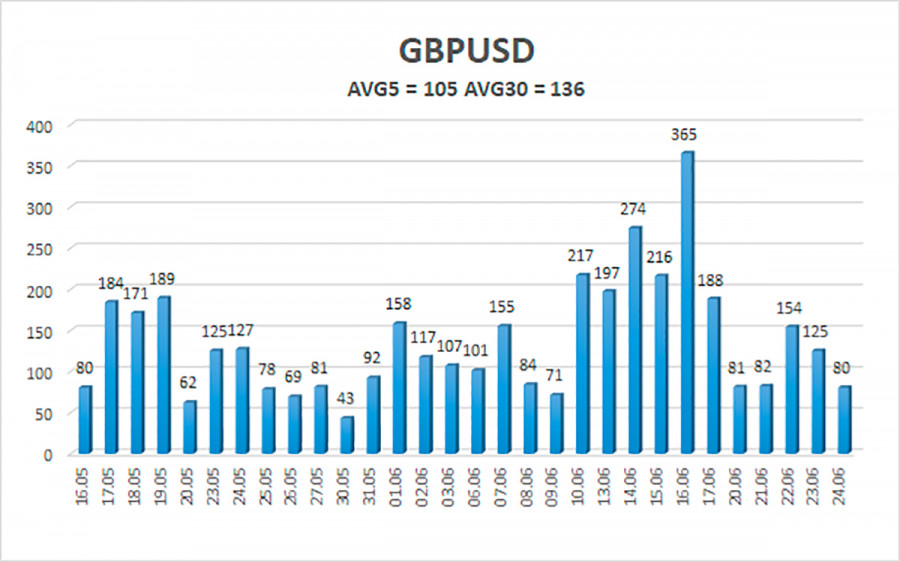

The average volatility of the GBP/USD pair over the last 5 trading days is 105 points. For the pound/dollar pair, this value is "high". On Monday, June 27, thus, we expect movement inside the channel, limited by the levels of 1.2165 and 1.2376. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement within the flat.

Nearest support levels:

S1 – 1.2268

S2 – 1.2207

S3 – 1.2146

Nearest resistance levels:

R1 – 1.2329

R2 – 1.2390

R3 – 1.2451

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues the "swing", flat, and daily overcoming of the moving average. Thus, at this time, you can trade on the reversals of the Heiken Ashi indicator. Or not to trade at all until the trend movement resumes.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.