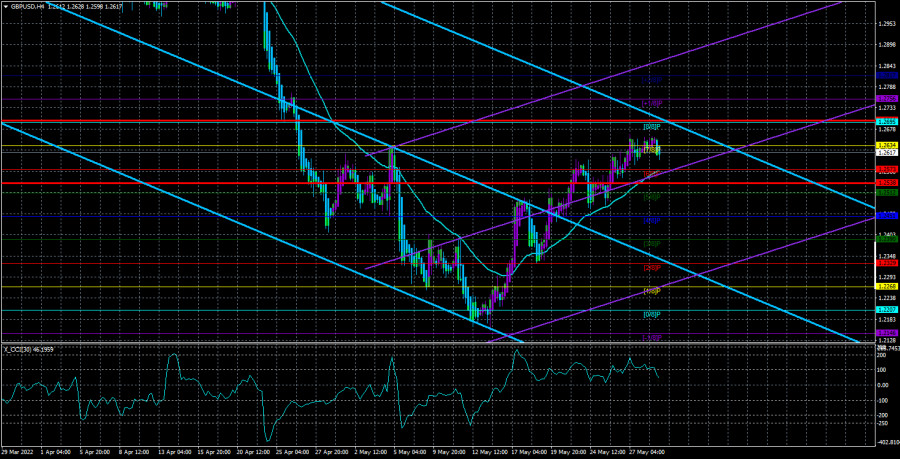

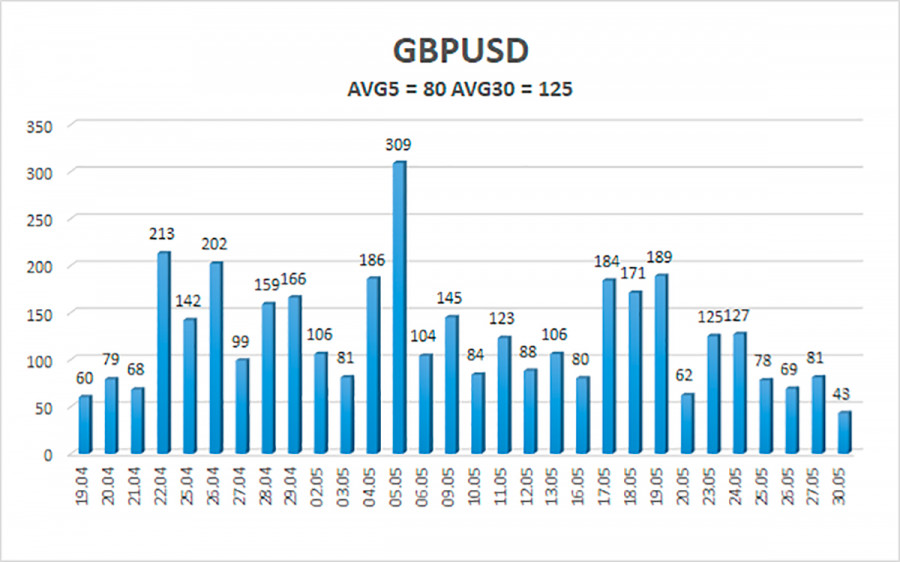

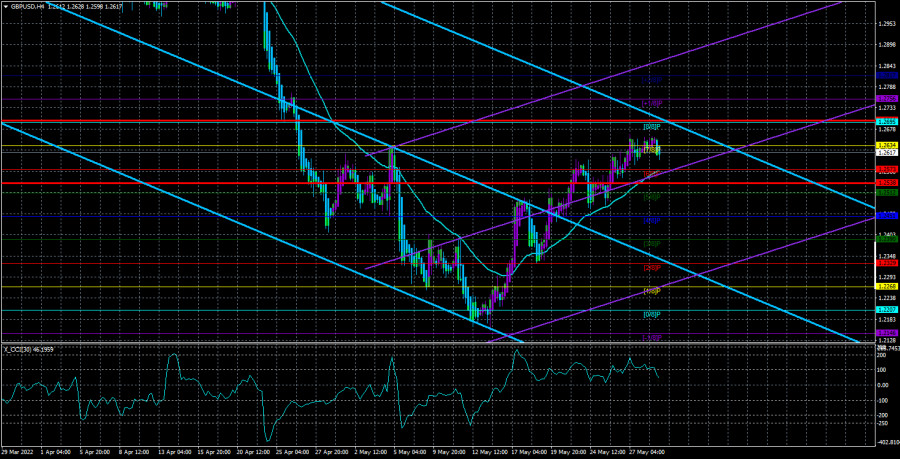

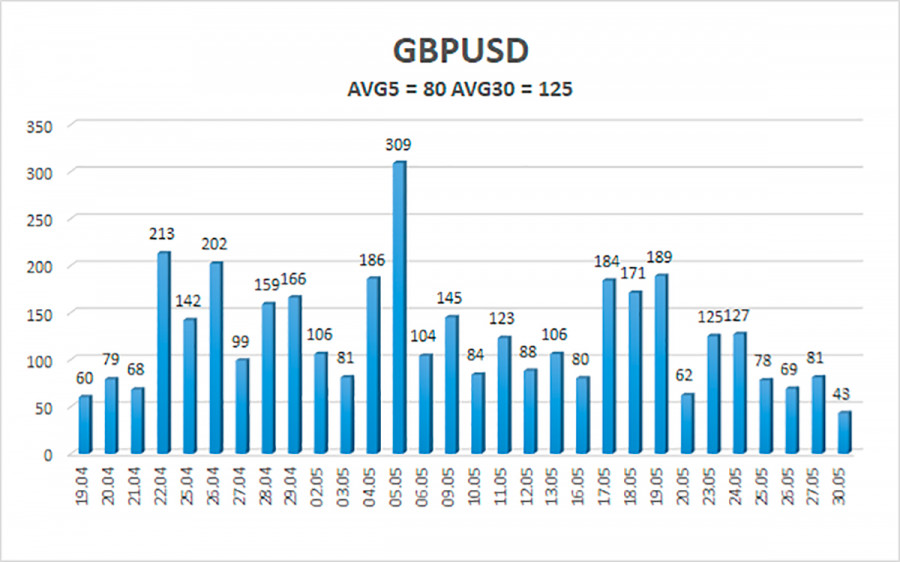

The GBP/USD currency pair did not show anything special on Monday. The pound sterling, as well as the euro, tried to continue the upward movement, but could not do it because of the "semi-exit" status of the day. There was no important news yesterday, and there won't be any today. If at least the consumer price index is published in the European Union, then in the UK and the USA today there is a complete wasteland in the calendars. Thus, it is not surprising that the volatility of the pound/dollar pair was low on Monday and generally continues to decline. Pay attention to the illustration below, which just shows the volatility of the pair over the last 30 trading days. This indicator has decreased very much over the past 2-3 weeks, and in the last five days, it is "average in strength" at all. This means that the market has already moved away from the shock that was provoked by the events of February 24, after which the pound fell to record values itself. If so, then the recovery plan for the pound and the euro looks logical now. It doesn't even need a strong fundamental or macroeconomic background. The euro, like the pound, has fallen very low, so now is the time for a global technical correction. Unfortunately, the upward movement of the British currency can be very difficult to work out. The problem is that there were specific reasons for the fall of the pound. Maybe they were not always unambiguous, but the market was selling the pound because of the difficult geopolitical situation, which could lead to many problems for Europe. Now the pound is growing exclusively on "technology", respectively, the movement to the north can be very slow, with frequent corrections and pullbacks, because the geopolitical and fundamental backgrounds have not changed much in the last few weeks. Thus, we believe that the growth of the pound will continue in the next few weeks, but it is unlikely to expect an increase of 400-500 points.

Nothing prevents the pound from continuing to grow, but this growth will be weak and sluggish.

By and large, the market is now in desperate need of new data. But what kind of "new data" can there be for a reaction to follow? There is simply no news on the conflict between Ukraine and Russia right now. Fierce fighting continues in the Donbas, and the Ukrainian army continues to accumulate Western weapons to launch a counteroffensive in a month or a month and a half. Ukrainian ports remain blocked, so we are not talking about the export of grain from Ukraine now either. The military conflict promises to drag on not just for many months, but for many years. All this time, it is the European economy that will be in the "risk zone".

However, the UK now has its problems. The main one is related to the "Northern Ireland Protocol" and a possible conflict with the EU over this issue. But it should be understood that the "Northern Ireland Protocol" and negotiations on it are a new series that can drag on for several seasons. Remember how long the negotiations between London and Brussels on Brexit lasted! That is, news on this topic is also not to be expected.

Possible negotiations between Vladimir Putin and Vladimir Zelensky mediated by Erdogan? It has been more than 3 months of military operation in Ukraine. If at first peace talks were still underway, then they were officially recognized as failed by both sides. The positions of Kyiv and Moscow are so different from each other that it is difficult to even imagine what they can agree on? Therefore, we do not expect any positive news on this topic either. Kyiv will not give up its territories and will strive to return to Donbas and Crimea at any cost. Moscow, of course, will not give up the "liberated" territories, the price of which was unprecedented sanctions from the whole world and huge financial and military losses. Europe and the United States will not agree to the lifting of sanctions until Russia fully withdraws its troops from the territory of Ukraine. Therefore, most likely, events will develop the same as before. Sanctions will be imposed, bloody battles will continue on Ukrainian lands, and peace talks are an attempt to create the appearance that the parties are still trying to agree.

The average volatility of the GBP/USD pair over the last 5 trading days is 80 points. For the pound/dollar pair, this value is "average". On Tuesday, May 31, thus, we expect movement inside the channel, limited by the levels of 1.2538 and 1.2698. A reversal of the Heiken Ashi indicator downwards will signal a round of corrective movement.

Nearest support levels:

S1 – 1.2573

S2 – 1.2512

S3 – 1.2451

Nearest resistance levels:

R1 – 1.2634

R2 – 1.2695

R3 – 1.2756

Trading recommendations:

The GBP/USD pair continues to form a new upward trend in the 4-hour timeframe. Thus, at this time, you should stay in open buy orders with targets of 1.2695 and 1.2756 until the Heiken Ashi indicator turns down. It will be possible to consider short positions if the price is fixed below the moving average line with targets of 1.2512 and 1.2451.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.