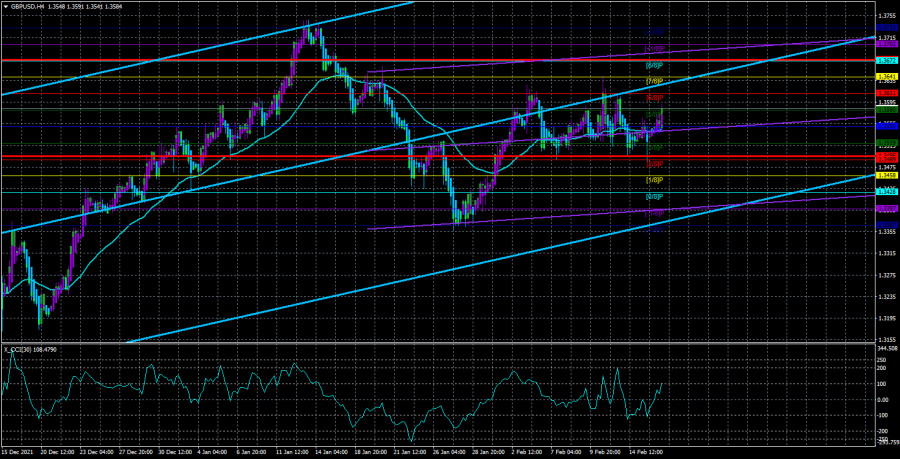

The GBP/USD currency pair continued to trade in its incomprehensible "swing" mode on Wednesday. The price has been between the levels of 1.3500 and 1.3600 for a long time, from time to time making attempts to leave this range. But it's not flat. Flat is usually accompanied by low volatility and very weak movements. In our case, the movements are quite sharp, there are frequent price reversals that are not caused by macroeconomic statistics or fundamental background. Thus, we can still say that the pair is now in a side channel, although there are no clear boundaries for this channel, so it is completely useless for traders. In the 24-hour timeframe, the nature of the movement is even better visible. Rather large candles with long "tails". We can even say that the pound/dollar pair has found a certain "area of full balance" in which a fair exchange rate has been established for the current time.

Now, for a new trend to begin, new fundamental factors are required. And it's not that there aren't any, they are contradictory. For example, take at least the Bank of England and the Fed. On the one hand, the Fed is going to raise the rate for the whole of 2022, which should support the dollar in the long run. On the other hand, it is the Bank of England that has already raised the key rate twice, that is, it is he who is currently engaged in tightening monetary policy, therefore, the pound should grow. On the third hand, the tightening of monetary policy in both the US and the UK is taking place under the auspices of the fight against inflation. But just inflation does not decrease at all if you look at the actions that have already been taken by both banks. It is not a fact that an increase in the rate will lead to a slowdown in inflation both in the Kingdom and in the States. Therefore, the monetary policy of both central banks can be adjusted.

Boris Johnson cannot get enough of the Ukrainian-Russian conflict.

At the same time, the British Prime Minister continues to comment on the crisis in Eastern Europe almost every day. His behavior is very similar to the tactics of Donald Trump, the former US president. We have repeatedly compared the behavior of Johnson and Trump, there is a lot in common. At the moment, Johnson is doing his best to distract the attention of the media and the public from his person. We are all aware of the history of the "coronavirus parties" of the British government. Thanks to them, several members of the British Parliament have already left their posts, but not Johnson. He understands that the story of the "working meetings with wine" at 10 Downing Street may cost him the prime minister's chair, and the second term can already be forgotten. Here at least until the end of the first term to sit. Not only the opposition is against him now, but also his party members, who understand that the lower Johnson's ratings, the lower the ratings of the Conservative Party, so they may suffer the same crushing defeat in the next parliamentary elections as the Labor Party a few years ago. Naturally, they would like to avoid this, and Johnson wants to avoid a vote of no confidence. Therefore, the stream of comments from the British Prime Minister flows endlessly.

He has already threatened Moscow with a "tough response" if an invasion of Ukraine begins, suggested that Europe get off the Gazprom needle and find an alternative to Russian gas, suggested abandoning the Nord Stream 2 project, and also almost every day declares that Moscow may launch an attack "in the next 48 hours." Also, according to British intelligence, Russia is deploying field hospitals on the border with Ukraine and is getting closer to the Ukrainian border. According to Johnson, this can only indicate an impending attack. If Moscow continues to escalate the conflict in Eastern Europe, Johnson promises to "expose Russian possessions" in London. In other words, he promised to publish a list of individuals who own luxury real estate and companies in London, as well as prohibit Russian companies from raising capital in the UK financial market. In general, the conflict is still very far from being resolved, and all its participants are trying to use it to the maximum, often pursuing personal goals.

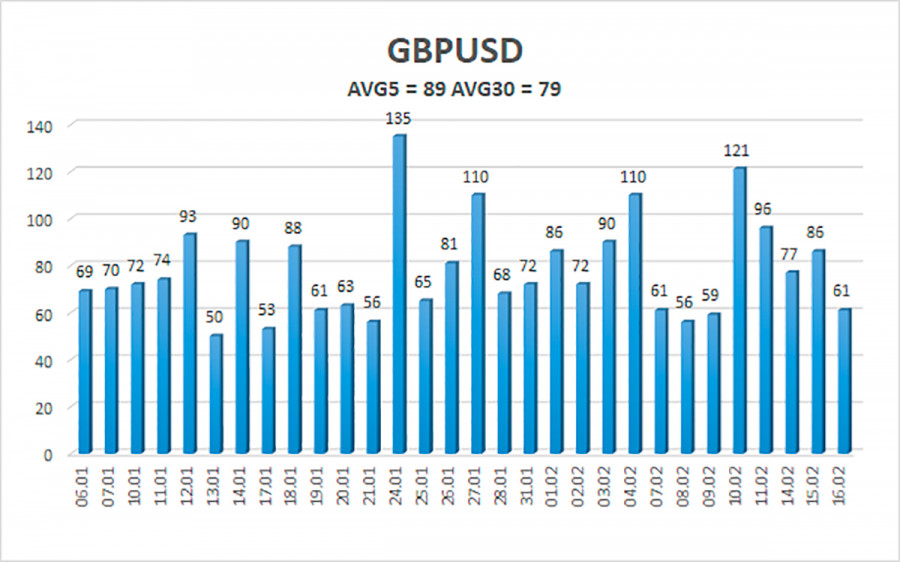

The average volatility of the GBP/USD pair is currently 89 points per day. For the pound/dollar pair, this value is "average". On Thursday, February 17, thus, we expect movement inside the channel, limited by the levels of 1.3495 and 1.3673. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement within the framework of the "swing".

Nearest support levels:

S1 – 1.3550

S2 – 1.3519

S3 – 1.3489

Nearest resistance levels:

R1 – 1.3580

R2 – 1.3611

R3 – 1.3641

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues to trade near the moving in the "swing" mode. Thus, at this time, long positions with targets of 1.3611 and 1.3641 can be considered before the Heiken Ashi indicator turns down, but the high probability of a flat should be taken into account. It is recommended to consider short positions if the pair is fixed back below the moving average, with targets of 1.3519 and 1.3495, but you should also be wary of a flat.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.