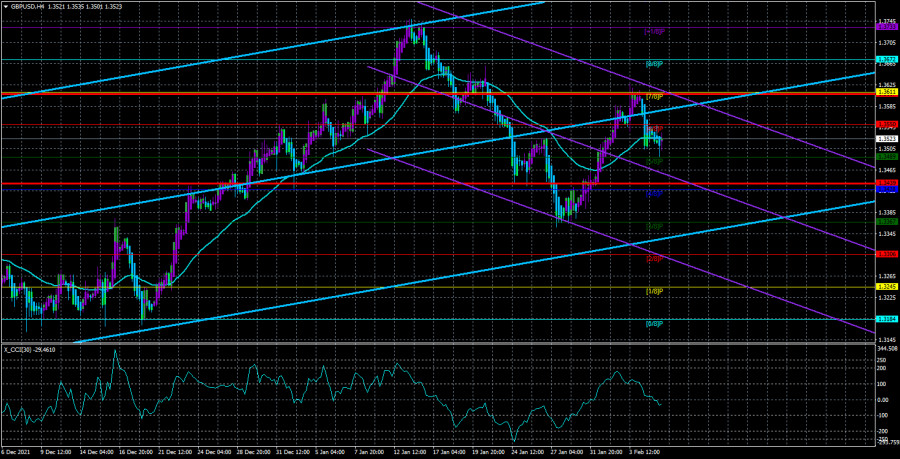

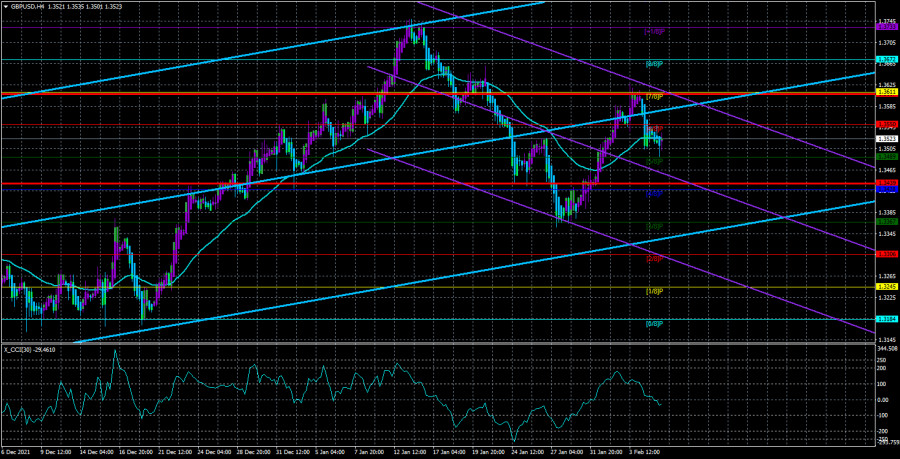

The GBP/USD currency pair continued to adjust on Monday after Friday. Recall that on the last trading day of last week, a package of strong macroeconomic statistics was released in the States, which was supposed to provoke the growth of the US currency. But, if paired with the euro, the dollar fell only slightly, then paired with the pound, it rose by a good 100 points. And continued to grow on Monday. No important macroeconomic statistics were published on Monday. Thus, it cannot be concluded that the dollar grew because of the "foundation". That is, the fall was purely technical and the fact that the price was fixed below the moving average casts doubt on the ability of the British currency to show growth in the near future. We also recall that last week the Bank of England raised the rate for the second time, which could provide medium-term support to the British pound. However, the pound is currently moving very strangely. In the sense that on many timeframes and many trading systems, the readings are very ambiguous. We have already said that on the 24-hour TF, the price crossed the Senkou Span B and Kijun-sen lines several times, so it is impossible to conclude what the current trend is. COT reports somewhat confuse the picture, as professional traders then increase sell contracts, then increase buy contracts. In general, despite quite good movements with a minimum of pullbacks and corrections, it is now quite difficult to say in which direction the pound will eventually move. Therefore, now you should use only "technique" in trading and trade only according to the trend, not paying attention to the fundamental background at all.

A key event for the British economy occurred last week when BA raised its key rate to 0.50%. And now Boris Johnson is gathering all the attention again. To begin with, the media received information that Johnson was angry with his colleagues and subordinates because no one supported him and did not prevent the appearance of information about "coronavirus parties" in the media. Thus, in the coming weeks and months, the Prime Minister may be busy purging the ranks in the government. It is also reported that sponsors have begun to turn away from Boris Johnson, believing that he has already exhausted himself and nothing will help him regain his political ratings. British media also report that in the near future Johnson may make a series of statements aimed at distracting public attention from the scandals with his person. In particular, Johnson may introduce a ban on alcohol at 10 Downing Street and announce new methods of combating illegal immigrants. A little earlier, he had already made a certain "knight's move" when he canceled almost all quarantine restrictions in the country from January 27.

At the same time, one of Johnson's associates said that the Prime Minister was not going to resign and "it would take an entire tank division to get him out of Downing Street." In Johnson's entourage and the Conservative Party, they fear that in the near future the prime minister will gain the necessary number of votes to pass a vote of no confidence in him. One of the members of the Conservative Party, Charles Walker, said that Prime Minister Johnson would resign almost in any case. Another member of the Conservative Party, Stephen Hammond, said that "for Johnson, everything is becoming very similar to the beginning of the end." As you can see, Boris seriously undermined his credibility with his parties amid "lockdowns". Britain may face a new political crisis this year.

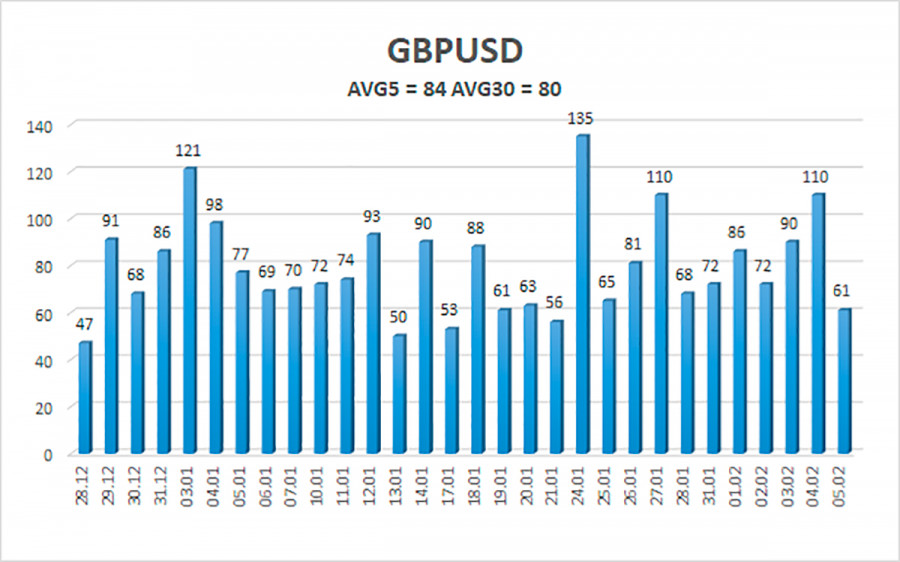

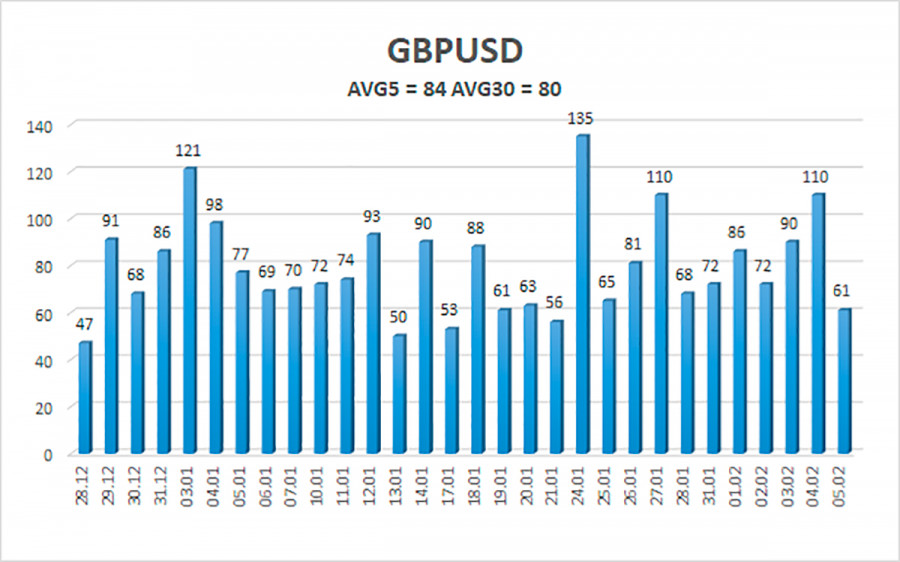

The average volatility of the GBP/USD pair is currently 84 points per day. For the pound/dollar pair, this value is "average". On Tuesday, February 8, thus, we expect movement inside the channel, limited by the levels of 1.3439 and 1.3609. The downward reversal of the Heiken Ashi indicator signals the beginning and continuation of a downward correction.

Nearest support levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading recommendations:

The GBP/USD pair continues to adjust on the 4-hour timeframe. Thus, at this time it is recommended to consider options for new long positions with targets of 1.3611 and 1.3672 if the price is fixed back above the moving average. It is recommended to consider short positions if the pair is fixed below the moving average, with targets of 1.3439 and 1.3428, and keep them open until the Heiken Ashi indicator turns up.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.