4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - sideways.

Moving average (20; smoothed) - sideways.

On Monday, the EUR/USD currency pair continued trading inside the side channel between the Murray levels "0/8" - 1.1230 and "2/8" - 1.1353. As we said in our previous articles, at this time, the markets simply do not find any grounds for active trading. The pair rose to the upper limit of the channel at the end of last week but did not work out to the level of 1.1353. Nevertheless, at the moment, it can still be concluded that there has been a downward reversal. Thus, if this is the case, then the decline in the pair's quotes will continue to the lower border of the side channel. No other conclusions can be drawn now, no matter how much I would like to. Let's draw the attention of traders to the fact that now the market does not react to any fundamental events. Just because there aren't any. There are also no statistics. Therefore, even if the markets wanted to do this, they still could not. However, they are responding, for example, to the omicron pandemic, which continues to gain momentum around the world. However, even doctors already say that the strain "omicron" extremely rarely causes hospitalization, and also leads to the death of the patient. Therefore, the markets do not worry at all about the fact that in many countries of the world, morbidity levels are now higher than in any other "wave". And if so, then there is no reason to panic. And there is simply no other news and topics right now. Thus, we are waiting for the end of the year, waiting for traders to return to the market, waiting for the "foundation", waiting for "macroeconomics".

What will be the inflation rate in the States at the beginning of next year?

By and large, all the hot topics have not gone away, they are simply put on pause in honor of the New Year holidays. Recall that members of the government of any country also have periods of holidays and vacations. Thus, now, in principle, few people are working or working at full capacity. However, this does not mean that all current problems have been solved or forgotten. It's just that they will be remembered again next year when traders return to the market. One of the key topics was and remains the topic of American inflation, which jumped to 6.8% by the end of November. Since January 2021, it has grown from 1.4% to 6.8%. Although the QE program is being cut by the Federal Reserve for the second month in a row, this does not mean that inflation will immediately begin to fall. The US economy is a huge thing, so it's best to compare it with the Titanic, which has accelerated and is moving towards an iceberg at full speed. The Fed has now realized that a collision is inevitable, but it is trying with all its might to change the course of monetary policy. Meanwhile, the Titanic has already run its nose into inflation and now just continues to steam through its side, continuing to move forward. Thus, before inflation begins to decline in the States under the influence of the Fed's measures, it may continue to grow for several more months. What does this mean for the US currency? In general, the fact that it will continue to depreciate. However, the foreign exchange market has its mechanisms. The depreciation of the currency with which the dollar is currently being compared should also be taken into account. That is euro currencies. And it is also necessary to take into account the supply and demand of both currencies, which depend largely on the expectations of the markets regarding the future monetary policy. And based on all this, it can be concluded that an increase in inflation can support demand for the dollar, as it will increase the likelihood of tightening the Fed's monetary policy in 2022. But when the Fed starts raising the rate, we can observe exactly the illogical behavior of the market in the form of dollar sales, since the US currency grew on expectations of this decision during the second half of 2021. In general, if we talk about the long-term prospects of the US currency, we still do not believe that it will continue to grow.

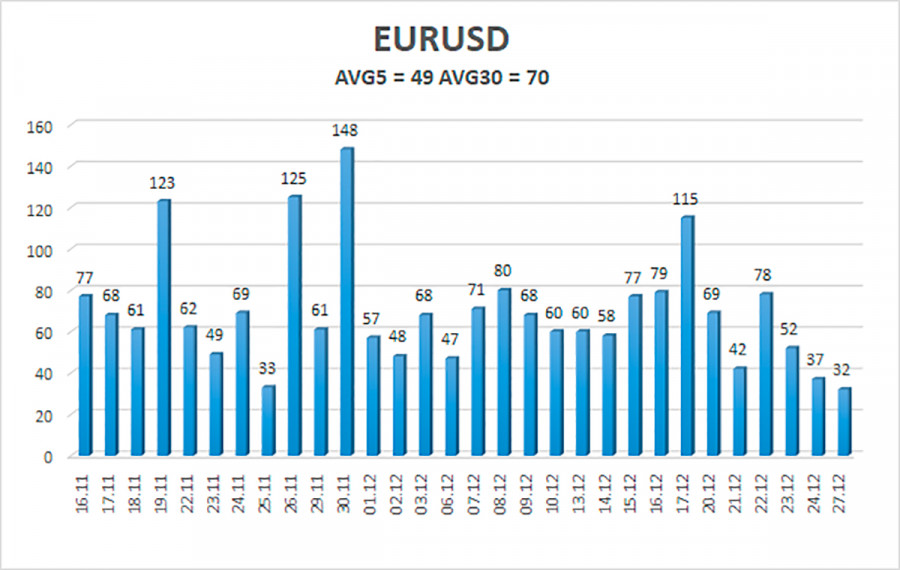

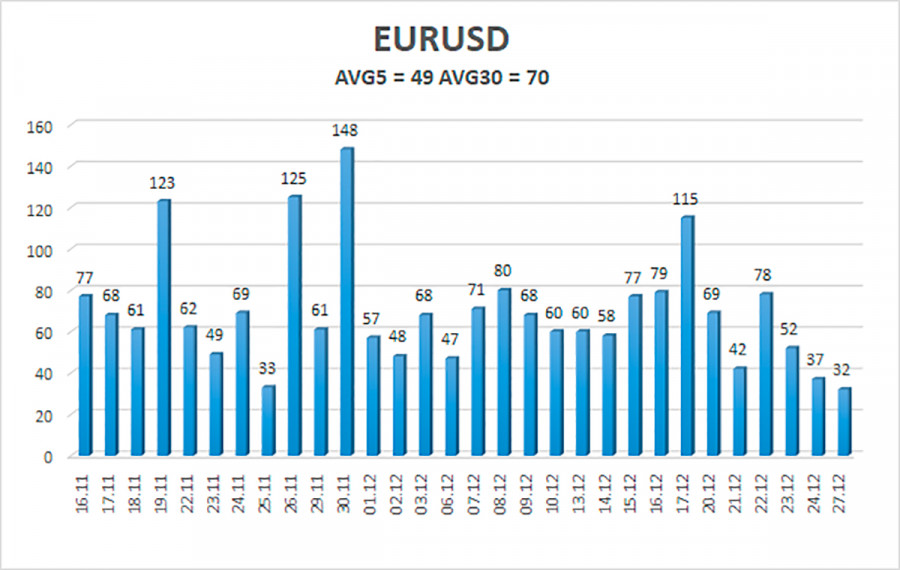

The volatility of the euro/dollar currency pair as of December 28 is 49 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1274 and 1.1372. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement in the side channel 1.1230 - 1.1353.

Nearest support levels:

S1 – 1.1292

S2 – 1.1230

S3 – 1.1169

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1414

R3 – 1.1475

Trading recommendations:

The EUR/USD pair continues to be located inside the 1.1230-1.1353 side channel. Thus, you can continue to trade for a rebound from the upper or lower border of this channel. However, it should be remembered that we are talking about a flat, and volatility remains low during the holidays.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.