To open long positions on GBP/USD you need:

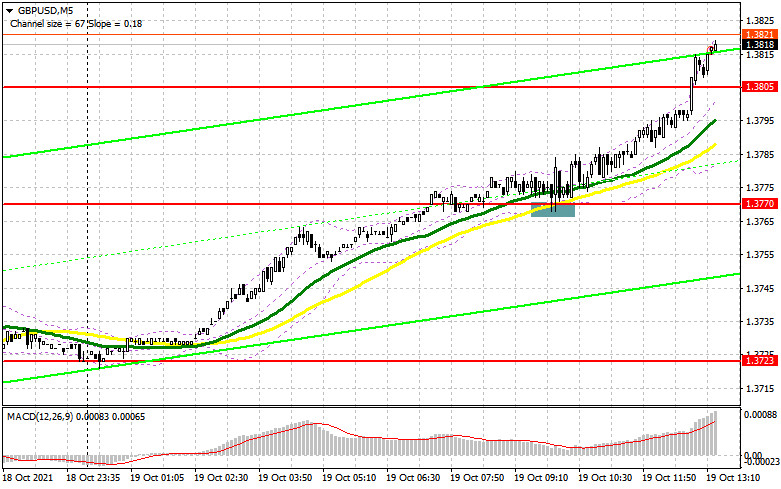

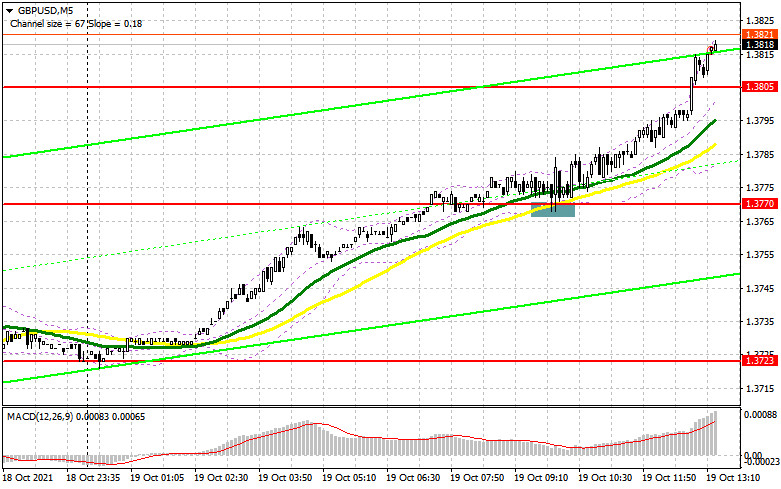

A considerably clear signal to buy the pound according to further trend was formed in the first half of the day. Let's observe the 5-minute chart and figure out the entry point. A smooth break and fixation above the resistance at 1.3770, followed by its renewal from the top down, led to the formation of a proper entry point into long positions. It resulted in the further growth of GBP/USD and the update of the high at 1.3805. The entry brought about 30 pips profit. In the second half of the day the technical picture has completely changed.

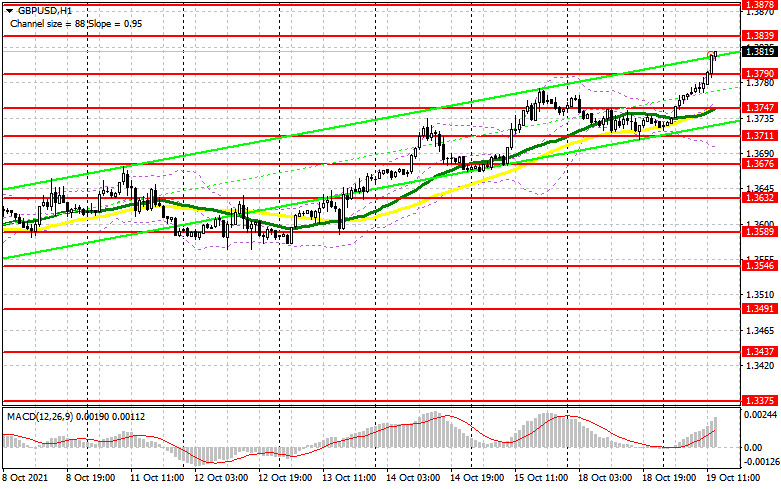

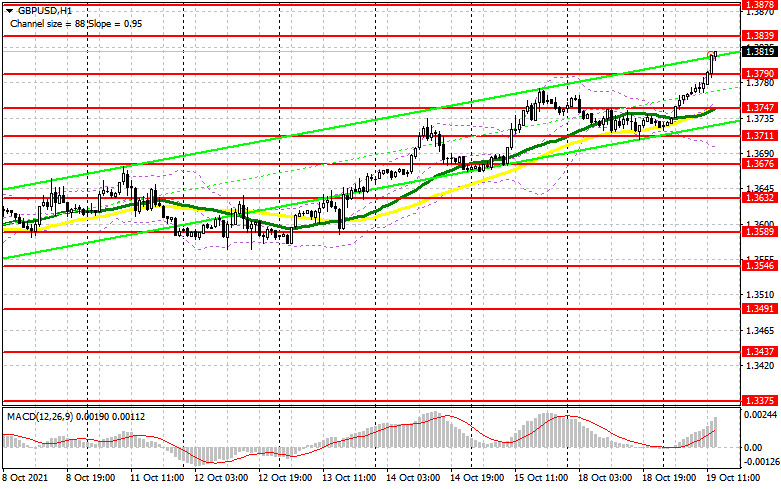

Buyers of the pound will more likely try to reach 1.3839. Moreover, it may occur both while Bank of England Governor Andrew Bailey will be delivering his speech, and after the US real estate market data will be released. Despite the readings, forex traders may start taking profit after the rally observed in the morning. Besides, it is better to be cautious about buying above 1.3839. Only break and fixation above this range with the reverse test from the top down will form a new entry point to long positions. The British pound will have a chance to climb to new local levels of 1.3878 and 1.3910, where I recommend to take profit. The area of 1.3955 is considered a more distant target. In case of the pound decline amid profit taking in the second half of the day, the best scenario is the defense of the support at 1.3790. A false break at this point forms a proper entry point to buy following a bull trend. In case bulls demonstrate low activity around 1.3790, the optimal scenario for long positions will be a test of the next support at 1.3747, where the moving averages pass, which favor bulls. I recommend monitoring long positions in the GBP/USD pair at the immediate rebound only from the low of 1.3711, counting on the upward intraday correction of 25-30 pips.

To open short positions on GBP/USD you need:

Sellers of the pound are not trying to enter the market even concerning such high prices. It makes the bullish trend quite prospective. Today, in the afternoon, the situation will most likely be focused on the defense of 1.3839 and the US strong economic data regarding the speeches of the Fed's officials. Only unsuccessful attempts to consolidate above this range, as well as a false break there, will form a signal to open short positions against the trend, counting on the pair's downward correction to the support at 1.3790. It will be extremely hard to reach this level as many bulls' stop-losses are concentrated below it. Therefore, a key task for sellers will be to break and regain control of 1.3790. Break of this area and its opposite test from the bottom up will generate a signal to open short positions with a decline to 1.3747, and then with the renewal of the low at 1.3711, where I recommend taking profit. With the pound's further recovery and lack of sellers at 1.3839, only formation of a false break around the next resistance at 1.3878 will be a signal to open short positions in GBP/USD. I recommend selling the pound immediately on the rebound from a larger resistance at 1.3910, counting on the pair's downward intraday rebound of 20-25 pips.

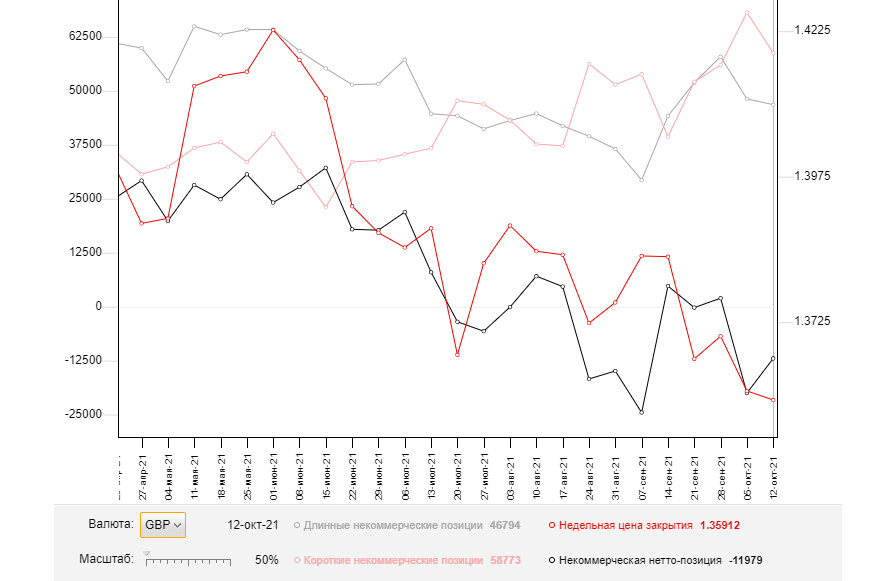

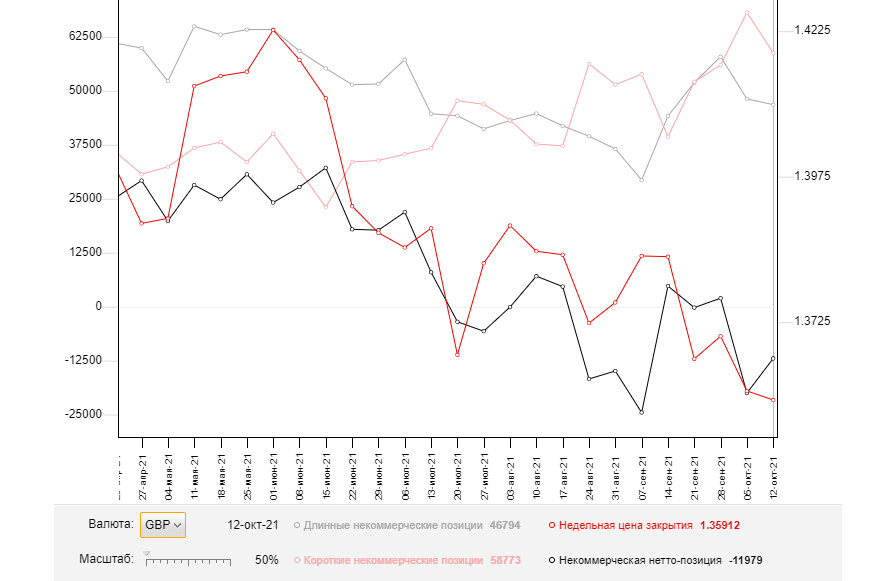

The COT report (Commitment of Traders) for October 12 recorded a decline of both short and long positions. However, the former were more numerous, which led to a slight recovery of the negative net position. Despite quite active attempts of bears to resist the bullish trend at the beginning of that week, buyers turned out to be stronger. This aspect resulted in further growth of the pound against the US dollar. Fewer problems with disruptions in supply chains, which weakened the pound at the beginning of this month, now gradually return to the market players who back further strengthening of risky assets. Constant speeches and statements by representatives of the Bank of England that it is necessary to take inflationary pressure more seriously also add confidence to buyers of the pound. The central bank minutes from last week's meeting confirmed the regulator's intentions to consider the option of raising interest rates already during its November meeting. Besides, it is a bullish signal for the GBP/USD pair . Therefore, the only concern for the pound buyers is the US Federal Reserve. Although it is not going to raise interest rates, it is also aimed at tightening monetary policy. However, the British pound in these circumstances is more favorable. The COT report showed that long non-commercial positions fell from 48,137 to 46,794, while short non-commercial positions declined from 68,155 to 58,773, partly reducing sellers' advantage over buyers. Consequently, the non-commercial net position totaled -11,979 versus -20,018. The closing price of GBP/USD little changed at the end of the week: 1.3591 versus 1.3606.

Indicator signals:

Moving averages.

Trading is conducted above the 30 and 50 daily moving averages, indicating further pound's pound in the short term.

Note. The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands.

In case the pair declines, the middle boundary of the indicator at 1.3747 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. On the chart, it is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. On the chart, it is marked in green.

- MACD (Moving Average Convergence/Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds and large institutions, which use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.