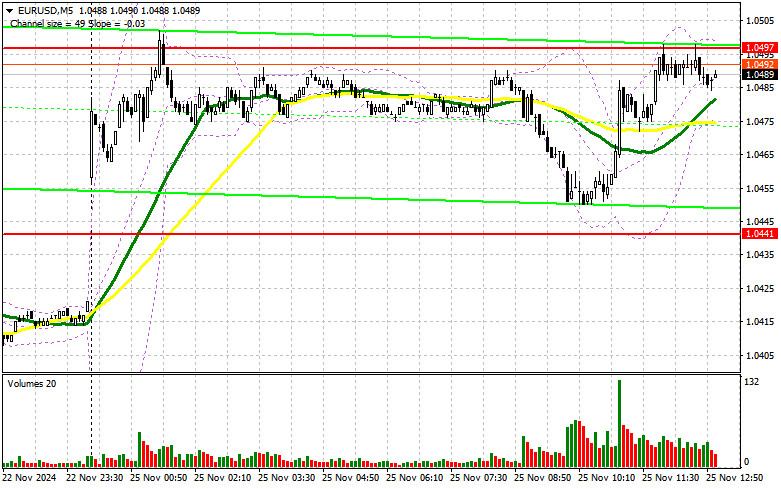

In my morning forecast, I highlighted the level of 1.0441 and planned to base my market entry decisions on its behavior. Let's review the 5-minute chart and analyze the developments. Although the pair declined, it missed testing and formed a failed breakout at that level by just a few points, leaving me without any trades. The technical outlook for the second half of the day remains unchanged.

To Open Long Positions on EUR/USD:

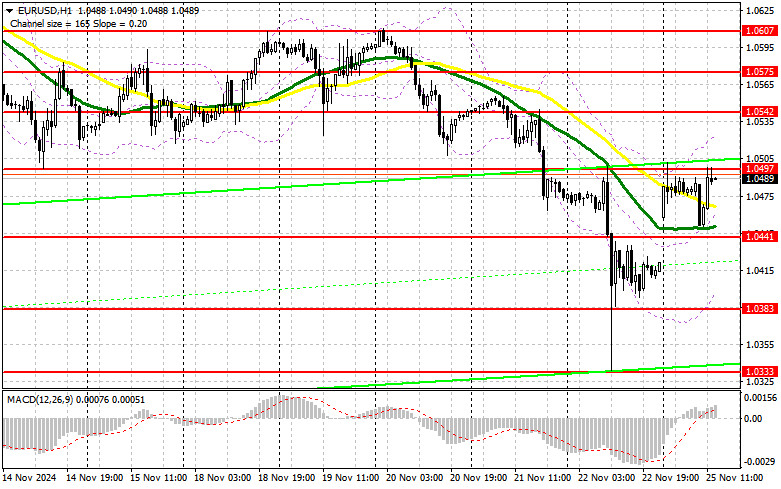

The lack of economic data from the U.S. may affect the strategy of euro sellers in the second half of the day, potentially allowing EUR/USD to extend the upward correction seen during the Asian session. However, I am cautious about initiating purchases near the upper boundary of the sideways channel. Instead, I prefer to focus on the support level at 1.0441, where moving averages, favoring the bulls, are located. Only a failed breakout at this level will provide a signal to build long positions as part of a correction, potentially opening the path to the 1.0497 level, which has proven difficult to surpass.

A breakout above this range, followed by a successful retest, will confirm a potential buying opportunity with the target of 1.0542. The ultimate goal will be the high at 1.0575, where I plan to take profits. If EUR/USD declines and there is no significant activity around 1.0441 in the second half of the day, selling pressure on the euro may return. In this case, I will look to act after a failed breakout near the lower boundary of the sideways channel at 1.0383. I also plan to open long positions on a rebound from 1.0333, targeting an intraday upward correction of 30–35 points.

To Open Short Positions on EUR/USD:

If the pair rises, defending the resistance level at 1.0497 will be the primary goal for sellers in the second half of the day. A failed breakout at this level will serve as an entry signal for short positions, with the aim of a decline toward the support level of 1.0441—a level that the pair failed to reach earlier today. A breakout and consolidation below this range, followed by a retest from below, will confirm another viable approach for selling, targeting a new low at 1.0383. This move could further reinforce the bearish trend for the pair. The ultimate target will be the 1.0333 level, where I plan to take profits.

If EUR/USD rises in the second half of the day and there is no significant bearish activity near 1.0497, I will postpone sales until the pair tests the next resistance level at 1.0542. I will also consider selling there, but only after an unsuccessful consolidation. Additionally, I plan to open short positions on a rebound from 1.0575, targeting a downward correction of 30–35 points.

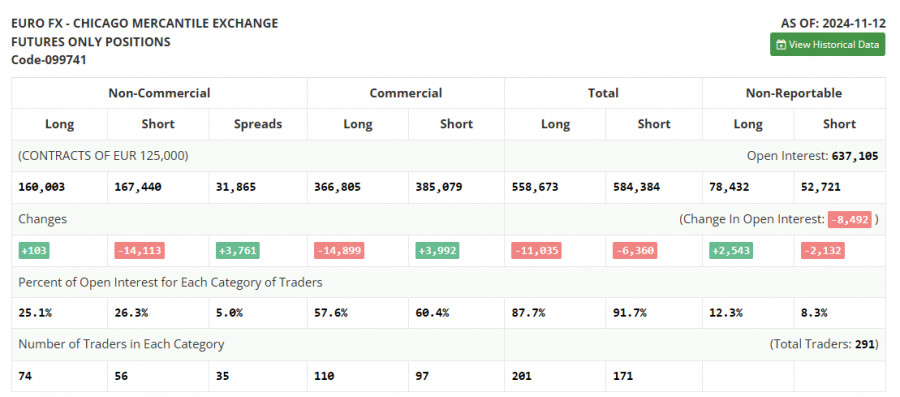

The Commitment of Traders (COT) report for November 12 showed a slight increase in long positions and a sharp decrease in short positions. This data reflects the Federal Reserve's decision to cut interest rates and Donald Trump's presidency. It appears that fewer traders are willing to sell the euro at current lows, which may signal a potential bottom for EUR/USD and the start of a medium-term bullish reversal. However, there is currently insufficient data to confirm this scenario. The lack of active euro buyers remains more significant than the reduction in sellers. According to the COT report, non-commercial long positions increased by 103 to reach 160,003, while short non-commercial positions decreased by 14,113 to 167,113. As a result, the gap between long and short positions widened by 3,761.

Indicator Signals:

Moving Averages:

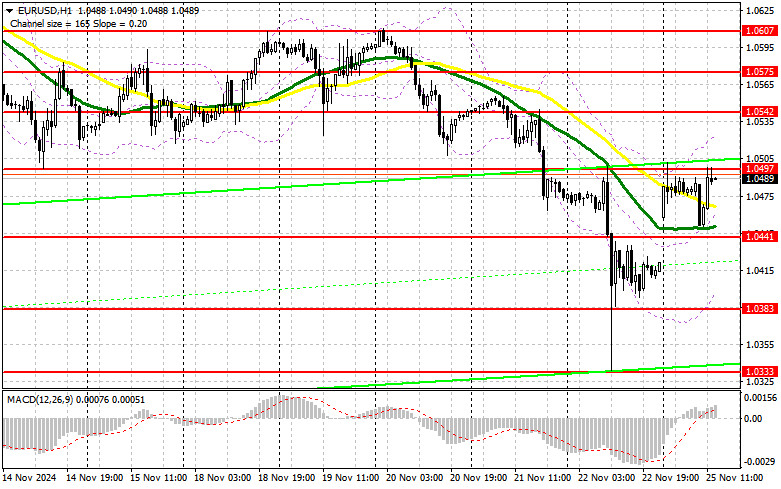

Trading is occurring slightly above the 30- and 50-day moving averages, which supports the potential for further correction in the pair.

Note: The moving average periods and prices are based on the hourly H1 chart, which differs from the classical daily moving averages observed on the D1 chart.

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator near 1.0383 will act as support.

Indicator Descriptions:

- Moving Average (MA): Defines the current trend by smoothing out volatility and noise.

- Period: 50. Marked in yellow on the chart.

- Period: 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence):

- Fast EMA: Period 12.

- Slow EMA: Period 26.

- SMA: Period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes while meeting specific requirements.

- Long non-commercial positions: Represent the total long positions held by non-commercial traders.

- Short non-commercial positions: Represent the total short positions held by non-commercial traders.

- Total non-commercial net position: The difference between long and short positions held by non-commercial traders.