The GBP/USD currency pair continued its decline on Wednesday, aligning with our expectations and predictions. Following Tuesday's drop, the British pound didn't make any efforts to recover. The price is steadily falling, even in the absence of significant fundamental or macroeconomic reasons. However, there are fundamental factors at play here. The Bank of England has raised interest rates significantly, making it increasingly challenging to anticipate further tightening. Huw Pill, the Chief Economist of the Bank of England, stated this week that it's more favorable to maintain high interest rates than to continue raising them. In the former scenario, the economic impact would be milder, and ensuring economic stability is one of the central bank's objectives.

Consequently, it's probable that the Bank of England is also approaching the peak interest rate. If this is the case, the pound lacks a basis to continue its overall upward trend. On the 24-hour timeframe, the price has finally breached the Ichimoku cloud, indicating the commencement of a robust and prolonged decline in the British currency. As previously mentioned, if the Federal Reserve begins providing clear signals about its readiness to initiate monetary policy easing, the dollar may fall out of favor with traders by year-end. Nonetheless, we are still a few months away from that juncture. Hence, the pound may have the opportunity to retrace to the 38.2% Fibonacci level at 1.1844.

The most critical reports in the United States have already been released, whereas they will only begin to surface in the UK next week. Anticipating robust statistics in the face of the Bank of England's consistent rate hikes doesn't seem logical. Each fresh weak report will exert added downward pressure on the pound. Consequently, we continue to anticipate its decline in the medium term.

Susan Collins: time to think about the economy

Yesterday, Susan Collins, the President of the Boston Federal Reserve, gave a speech. Previously, we rarely paid attention to her speeches, but she made several important statements this time. First, she noted that the risks associated with inflation now need to be weighed against the risks associated with the economy. In other words, it's time to think more about the possibility of a recession and a soft landing than just combating inflation. Collins pointed out that excessively raising interest rates will lead to a greater decline in economic activity than necessary.

Second, the Boston Federal Reserve head stated that a balanced and cautious approach to interest rates is necessary. According to her, it is still too early to talk about inflation returning to 2%, and demand still outpaces supply, driving up inflation. Nevertheless, the Federal Reserve can achieve its goals without serious consequences for the US economy.

It's worth remembering that the Fed is expecting another key rate hike. A lot will depend on the inflation report for August, which will be released next week. If inflation has accelerated for the second consecutive month, the Fed may opt for further tightening as early as September. Since the regulator has previously indicated that the pace of rate hikes has changed to once every two meetings, tightening in September would signify an enhanced "hawkish" approach. This, in turn, could trigger a new wave of buying American currency.

If inflation declines again, it won't mean anything special for the British currency because the factors driving the pound's growth have long been exhausted. In practically any case, we expect a further decline in the pair.

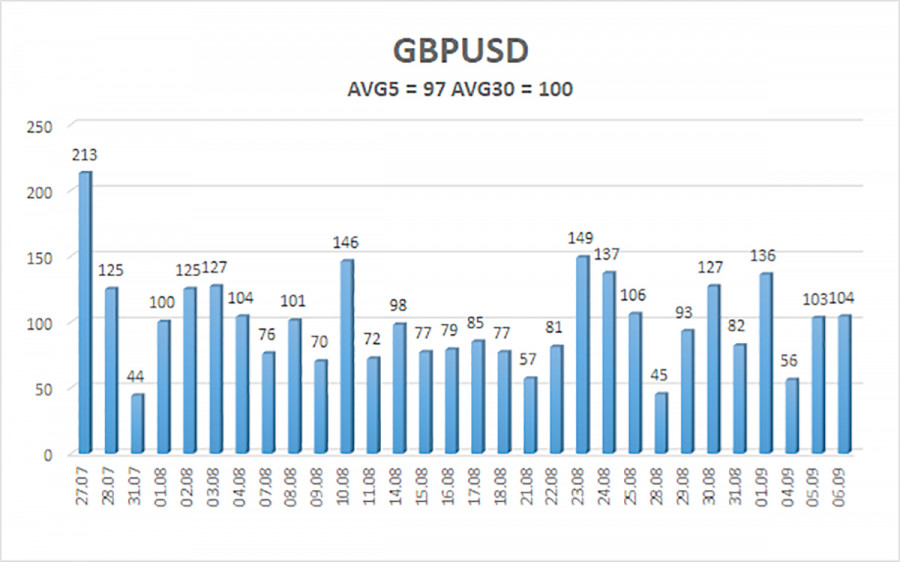

The average volatility of the GBP/USD pair over the last five trading days is 97 pips. For the GBP/USD pair, this value is considered "average." Therefore, on Thursday, September 7th, we expect movement within the range limited by the levels of 1.2399 and 1.2593. A reversal of the Heiken Ashi indicator upwards will signal a phase of upward correction.

Nearest support levels:

S1 – 1.2482

S2 – 1.2451

S3 – 1.2421

Nearest resistance levels:

R1 – 1.2512

R2 – 1.2543

R3 – 1.2573

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair has settled below the moving average and continues its downward movement. Therefore, at the moment, it is advisable to remain in short positions with targets at 1.2451 and 1.2388 until the Heiken Ashi indicator reverses upwards. Considering long positions will only be possible after the price consolidates above the moving average line, with targets at 1.2634 and 1.2665.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both point in the same direction, it indicates a strong trend.

Moving Average Line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray Levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price range the pair will trade in the next 24 hours based on current volatility indicators.

CCI Indicator - its entry into the overbought territory (above +250) or the oversold territory (below -250) indicates an approaching trend reversal in the opposite direction.