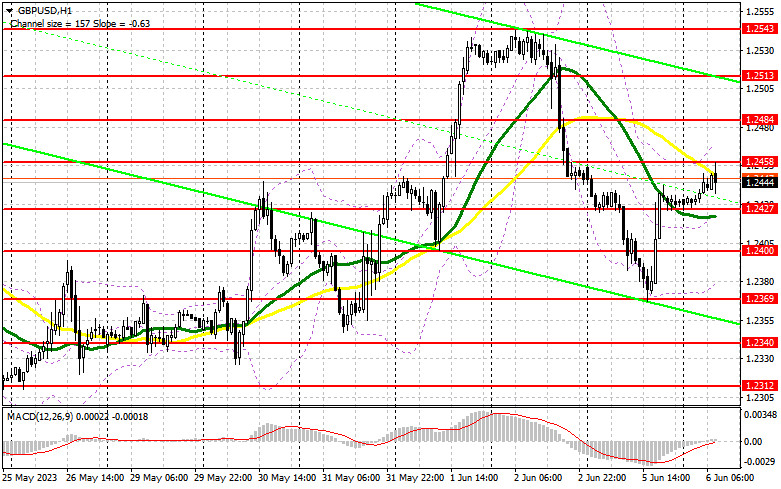

Yesterday, traders received just one signal to enter the market. Let us take a look at the 5-minute chart to figure out what happened.

Earlier, I asked you to pay attention to the level of 1.2409 to decide when to enter the market. A breakout of this area and a downward test allowed traders to open long positions, resulting in a pair's growth of over 30 pips.

Conditions for opening long positions on GBP/USD:

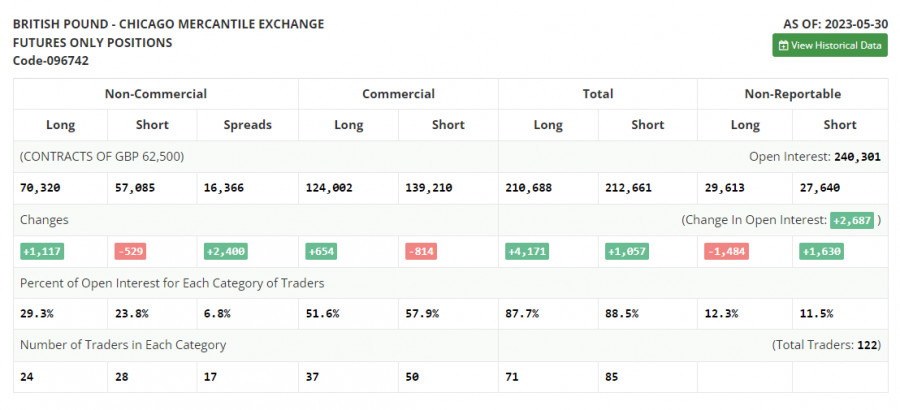

Before analyzing the technical picture of the pound, let's see what happened in the futures market. The COT report (Commitment of Traders) for May 30 showed a drop in short positions and an increase in long positions. The pound experienced a significant decline, but decent statistics released last week helped to halt the decline and partially recoup losses suffered in May. However, expectations that the Federal Reserve will continue to raise interest rates are capping the pair's upside potential. Despite the central bank's pause in June, an overheated labor market will not allow the committee to halt the cycle of tightening monetary policy for long. Further uncertainty about the BoE's ing monetary policy will exert pressure on the British pound. According to the last COT report, short non-commercial positions decreased by 529 to 57,085, while long non-commercial positions increased by 1,117 to 70,320. This led to an increase in the non-commercial net position to 13,235 from 11,059 a week earlier. The weekly price decreased to 1.2398 from 1.2425.

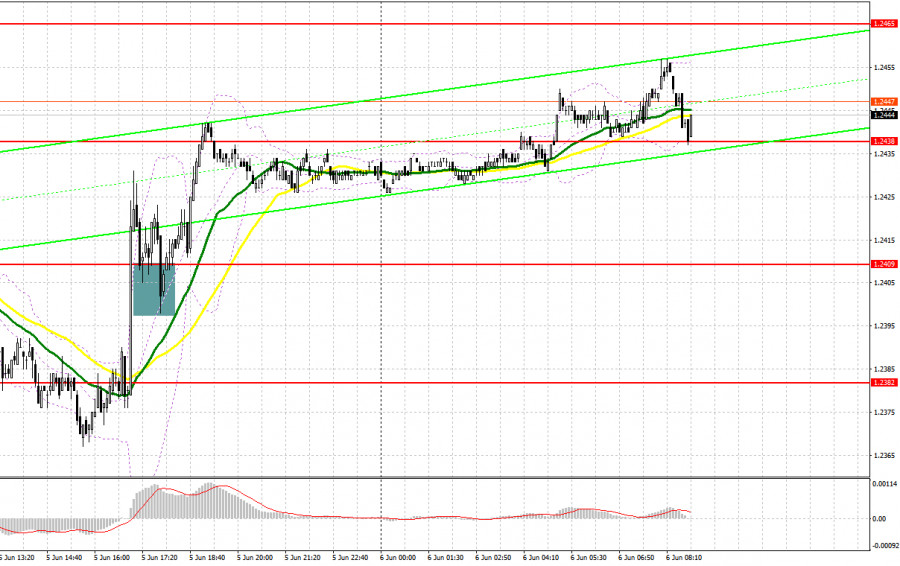

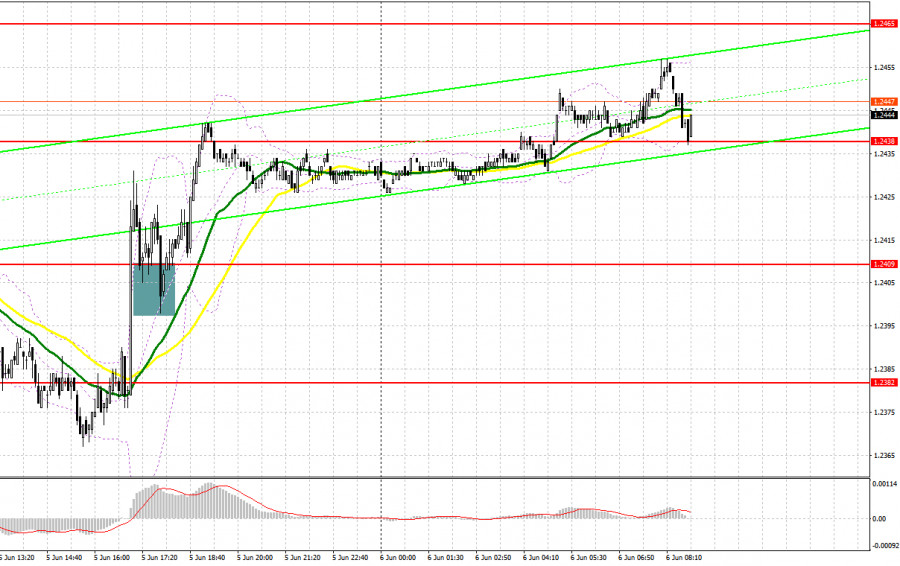

Today, there is no important data on the UK. That is why the pound sterling will have a chance to continue yesterday's upward correction and fully recover after Friday's losses. Poor data on the UK business activity in the construction sector will exert slight pressure on the pair, leading to its decline. The pair may also test the nearest support at 1.2427. Traders should pay close attention to this level. Defending this level, along with the formation of a false breakout, will confirm the presence of buyers in the market, providing an excellent entry point with the target at 1.2458. A breakout and downward retest of this range will form an additional buy signal, returning strength to the pound and leading to an update of 1.2484. Without this level, GBP/USD buyers will find it difficult to count on further growth. In the case of a breakout above this range, we can talk about a surge towards 1.2513, where I will take profits.

In the event of a decline in GBP/USD and the absence of buyers at 1.2427, pressure on the pound will increase. If that happens, I recommend postponing long positions until 1.2400. Traders may open buy positions there after a false breakout. Traders may also go long just after a rebound from 1.2369, expecting a correction of 30-35 pips within the day.

Conditions for opening short positions on GBP/USD:

Bears lost control of the market yesterday, and there is currently some equilibrium. However, the absence of statistics may help buyers hold onto the nearest resistance at 1.2458, which is very important. Only a false breakout will provide a sell signal with a downward target towards support at 1.2427, where the moving averages are located. A breakout and an upward retest of this range will serve as an entry point for selling, with the target at 1.2400. This will allow sellers to regain the bearish trend. The further target will be the weekly low of 1.2369, where I will take profit.

If GBP/USD grows and bears fail to protect 1.2458 amid favorable data on the UK business activity in the construction sector, the situation may come under the control of buyers. In such a case, only a false breakout in the area of the next resistance at 1.2484 will form an entry point for short positions, anticipating a downward movement of the pound. In the absence of activity there, I recommend selling GBP/USD from 1.2513, expecting a bounce of 30-35 pips within the day.

Signals of indicators:

Moving Averages

Trading is performed near 30- and 50-day moving averages, which points to the sideways movement.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair rises, the upper limit of the indicator located at 1.2475 will act as resistacne. If the pair drops, the support level will be seen at the lower limit of the indicator – at 1.2385.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total number of long positions opened by non-commercial traders.

- Short non-commercial positions is a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.