The EUR/USD currency pair traded higher for most of the day on Thursday. "Again" because it was also inclined towards growth the day before, but strong news from across the ocean returned it to a downward trend. However, time passes, and the pair has fallen for almost a month without stops or corrections. Two months ago, we regularly mentioned that the pair could only constantly grow with significant corrections. The situation is the opposite now, which means a correction is needed!

Yesterday, an important event occurred from a technical standpoint. The CCI indicator entered the overbought zone. It is worth noting that this indicator rarely generates signals, so each one requires special attention. A buy signal indicates that growth will begin soon. It could be a simple correction since we still expect a decline in the euro and an increase in the dollar in the medium term. However, the pair should still move up a bit.

It is also worth noting that in the 24-hour timeframe, the pair came close to the 38.2% Fibonacci level, so a bounce from it could signal the start of a correction. Remember that the CCI signal may be delayed, so if the growth begins next week, it is also not a problem. We are warned about it, so any price consolidation above the moving average should be considered a trend reversal.

There was a lot of macroeconomic and fundamental data yesterday. Despite the volatility not being very high and the pair not jumping from side to side all day, it is still evident that many factors are influencing the pair, and market participants still need to fully understand what to react to and what is more important. Therefore, it is very important to "separate the wheat from the chaff" now.

Inflation in the EU is decreasing faster than forecasts.

So, yesterday, the inflation report for May in the European Union was published, showing a faster decline than expected. We warned that the pan-European indicator could show a greater decline since inflation in Germany, Spain, France, and Italy had already been published this week. In all cases, the consumer price index slowed down more than forecast. In theory, the European currency should have come under pressure again because a faster decline in inflation means that the ECB may eventually raise rates less than the market expects. However, it should be noted that the interest rate factor and the correlation between rates and inflation have significantly weakened recently, so they no longer have the same impact on market sentiment as before. In other words, how quickly and strongly inflation is falling no longer matters. No matter what Christine Lagarde and the company say, the ECB does not have the same power as the Federal Reserve. Moreover, the ECB needs to take care of 27 countries at once. In some places, inflation is already approaching the target level, so a high key rate would mean an unnecessary contraction of the economy and a more significant future decline in inflation.

Thus, the ECB will likely raise rates at most 1-2 times. Commerzbank experts also supported this idea, saying they expected another increase of 0.25% yesterday. However, Christine Lagarde stated yesterday that the rate should be raised until inflation approaches the target level, implying 3–4 more increases. The minutes of the May meeting showed that several members of the ECB's monetary committee voted for a 0.5% tightening. One of the representatives of the European regulator, Klaas Knot, stated that a rate cut should not be expected in early 2024. As a result, the market received a whole set of contradictory information, which explains the not entirely logical movement of the pair on Thursday. The euro may continue to decline for some time, but a correction is inevitable. Today, important statistics will be released in the United States, so anything can happen, including a new rise in the American currency.

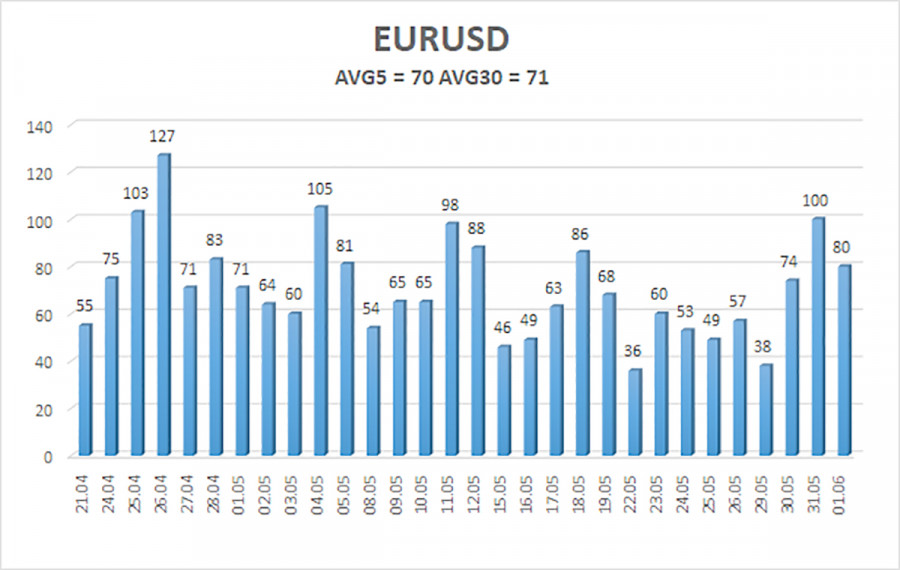

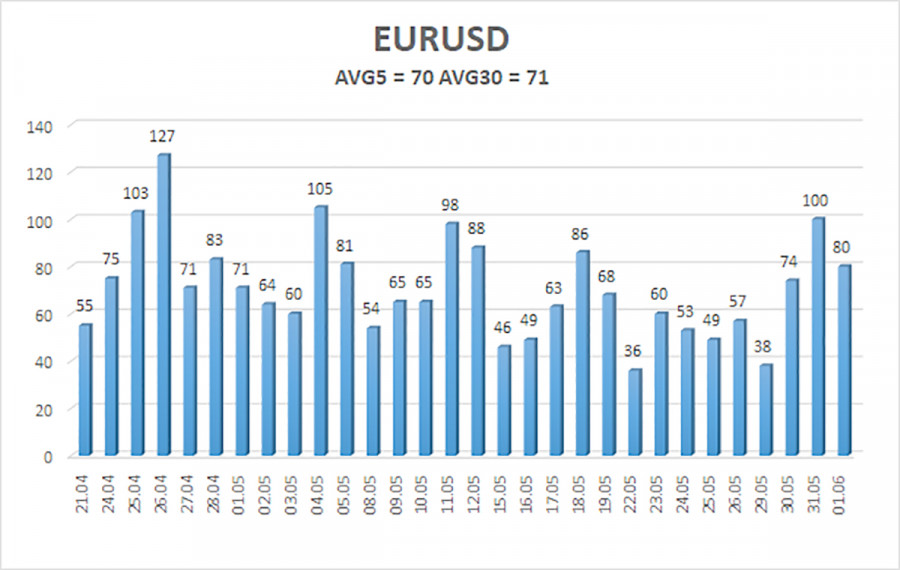

The average volatility of the euro/dollar currency pair for the last five trading days as of June 2nd is 70 pips, characterized as "average." Therefore, we expect the pair to move between the levels of 1.0664 and 1.0804 on Friday. A reversal of the Heiken Ashi indicator downward will indicate a possible resumption of the downtrend.

Nearest support levels:

S1 - 1.0681

S2 - 1.0620

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0803

R3 - 1.0864

Trading recommendations:

The EUR/USD pair has started a new phase of correction. New short positions should be considered with targets at 1.0664 and 1.0620 in case the price bounces off the moving average. Long positions will become relevant only after the price consolidates above the moving average line with a target of 1.0803.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will move the next day based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an upcoming trend reversal in the opposite direction.