The euro firmed after the ECB had announced its decision but failed to leave the wider sideways channel that started on November 30. The pound sterling skyrocketed as the Bank of England unexpectedly raised interest rates.

The ECB is not going to stand aside.

The European Central Bank said it would temporarily increase the regular bond purchase scheme to smooth out the impact of an economic shock after the emergency stimulus program ends in March.

ECB policymakers confirmed that the €1.85 trillion emergency program, known as the PEPP, would be curtailed in March as they had planned. The regulator's decision came amid risks of an inflationary surge in the eurozone. To cushion the economy's return to pre-crisis levels, the central bank said it would temporarily raise the regular bond purchase scheme, which had worked fairly well even before the coronavirus pandemic. ECB President Christine Lagarde had long been warning markets about possible changes, but no one expected the regulator to abandon the current PEPP program so quickly.

So, the Governing Council will buy €40 billion of bonds under the APP in the second quarter and €30 billion in the third quarter. Then, purchases will be maintained at €20 billion, for as long as necessary to support the economy.

ECB policymakers also changed the reinvestment rules for the PEPP, making it easier to deploy support in the event of market jitters. Only Greece was left behind. The country was excluded from the regular bond purchase program because of its low credit rating. However, it might receive extra support, the ECB noted.

Lagarde also emphasized that the bank could reactivate the program if needed to combat any possible crisis caused by a new wave of coronavirus. "Flexibility will remain an element of monetary policy whenever threats to monetary-policy transmission jeopardize the attainment of price stability," Lagarde said. "Net purchases under the PEPP could also be resumed, if necessary, to counter negative shocks related to the pandemic."

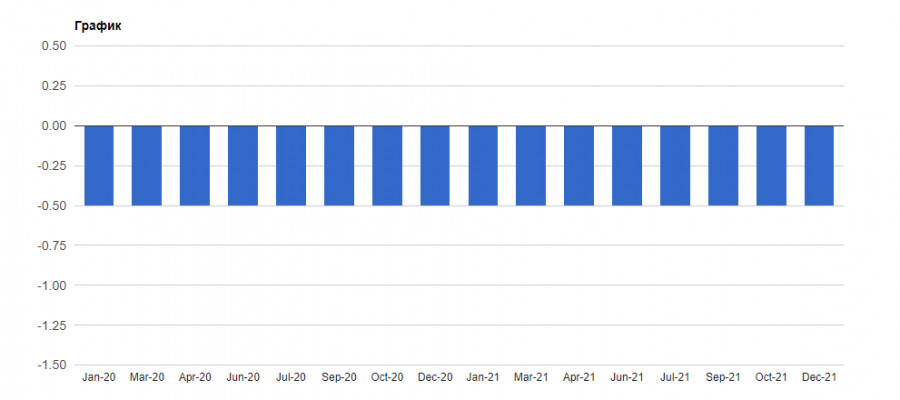

As a result, the 10-year bond yield in Italy rose by 8 basis points to 1%. Likewise, the 30-year bond yield in Germany increased above 0% for the first time since November. The futures market now expects the first rate hike by 10 basis points by the end of next year.

The euro firmed as ECB officials made it clear that the emergency purchase program should end. At the same time, the regulator takes into account increased uncertainty caused by a surge in new coronavirus cases, which is now exerting pressure on the recovery in the euro area and has stalled economic growth in Germany.

However, unlike the US Federal Reserve, the ECB still claims that high inflation caused by supply chain disruptions and a sharp increase in energy prices is transitory. "Monetary accommodation is still needed for inflation to stabilize at our 2% inflation target over the medium term. In view of the current uncertainty, we need to maintain flexibility and optionality," Lagarde said.

Fundamentals

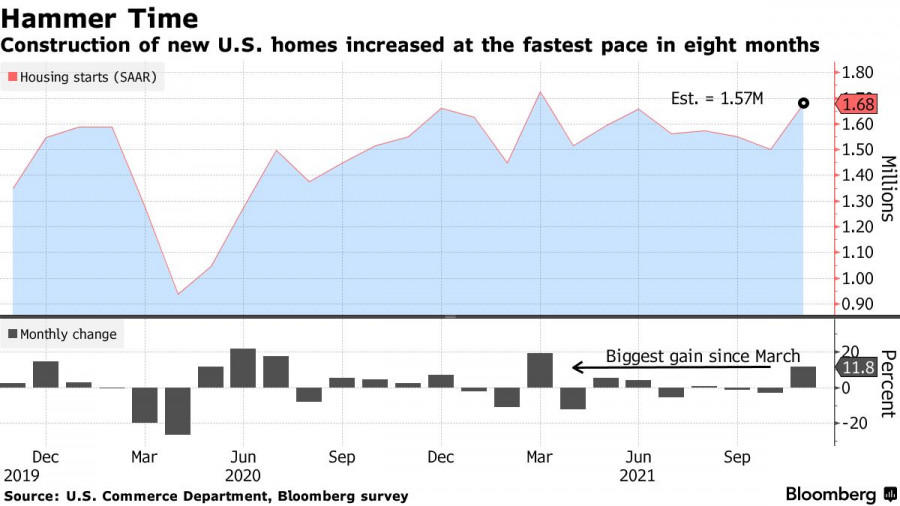

As for yesterday's macroeconomic data, housing starts in the US rose in November after two months of decline, according to the Commerce Department. The indicator surged by 11.8% to an annualized rate of 1.68 million in November. Economists had expected housing starts to rise by 2.6% y/y to 1.56 million. In October, housing starts were downwardly revised to 1.50 million from an earlier estimate of 1.52 million.

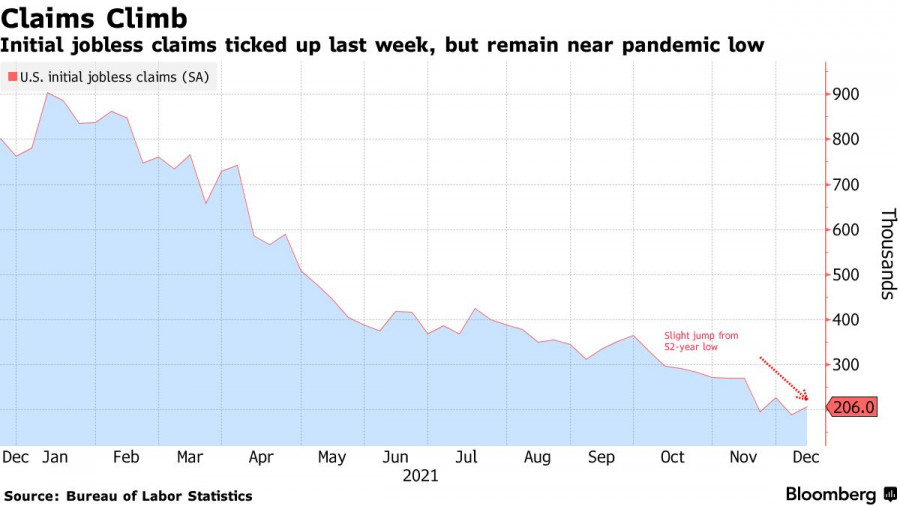

US jobless claims rose in the previous week but remained at their lowest level since the outbreak of the coronavirus pandemic. The Labor Department report logged an increase in initial jobless claims by 18,000 to 206,000 in the week ended December 11. Economists had expected the number of Americans filing new claims for unemployment benefits to rise to 200,000. The number of continuing jobless claims fell to 1.85 million.

It was also reported that companies are now reluctant to lay off employees as they struggle to meet sustained demand for goods and services amid widespread labor shortages. A surge in Covid-19 hospitalizations in many states and continuing uncertainty surrounding the latest Omicron variant are still weighing on the jobs market.

Technical analysis of EUR/USD

Buyers should protect support at 1.1321 because if the pair returns below this level, pressure on the euro will increase and the quote may fall to 1.1300 or even to 1.1265. In case the price breaks through resistance at 1.1355, the euro may extend gains within the wider sideways channel and head towards its upper boundary at 1.1380. If the price breaks through this level, a strong uptrend may start with targets at 1.1420 and 1.1480.

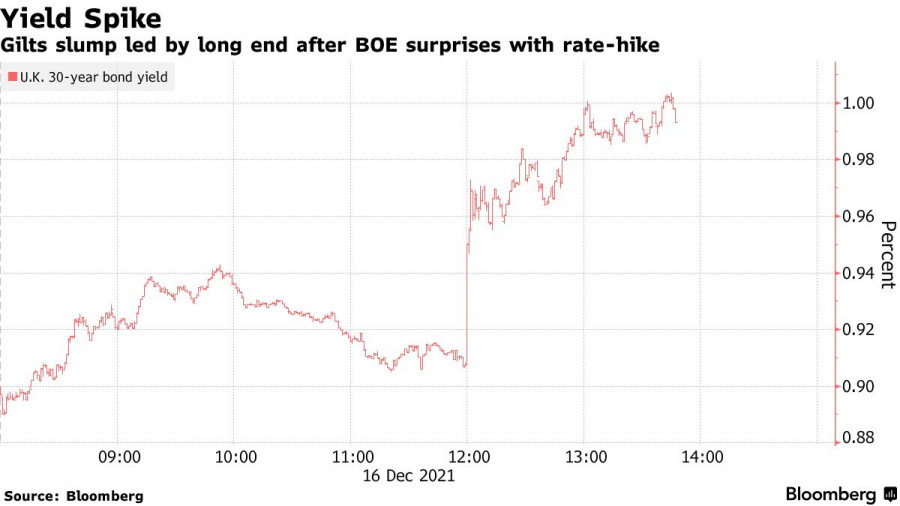

The Bank of England unexpectedly raised interest rates.

Yesterday, the Bank of England unexpectedly raised interest rates for the first time in three years, discarding fears of an increase in infection cases due to the spread of the Omicron variant. The decision came all of a sudden, although it was universally justified. Extremely high inflation unseen more than a decade urged the regulator to act.

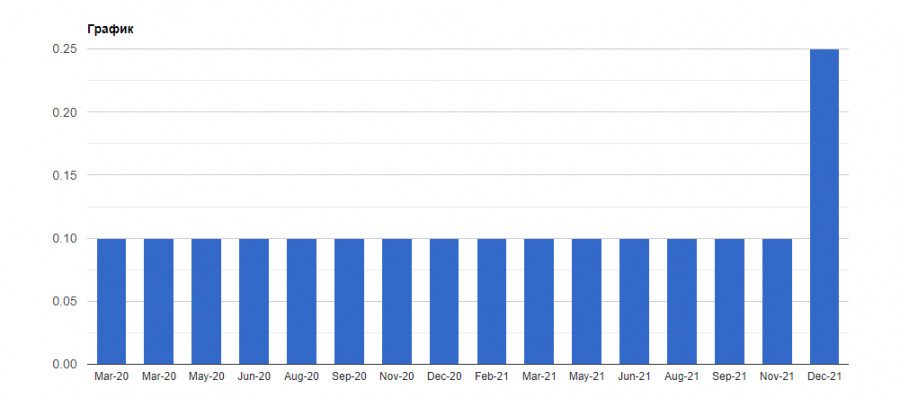

The Bank of England said it would raise interest rates by 15 basis points to 0.25%, thereby becoming the first Group of Seven central bank to raise interest rates since the pandemic struck.

Consequently, the pound sterling soared by 1.0% and the 10-year bond yield increased by 5 basis points. Traders now expect the BoE to raise the benchmark rate to 1% by September.

Experts say after another 25 basis point rate hike, the regulator may begin to reduce its balance sheet. At the same time, the maturity of bonds in its portfolio starts in early March. There is now an 80% chance that the bank will raise the benchmark rate by another 20 basis points in February. This will allow the BoE to write off up to GBP 37 billion of public debt from its balance sheet by the end of 2022.

The Monetary Policy Committee, led by Governor Andrew Bailey, voted 8-1 for the rate hike. Silvana Tenreyro was the only member of the committee to vote against the rate increase. Policymakers said some modest tightening is likely to be needed as inflation may peak at around 6% by April 2022.

Meanwhile, investors were selling UK government bonds, boosting bond yields as the Bank of England unexpectedly raised interest rates for the first time in three years. The yield on the 30-year bonds jumped 10 basis points on Thursday to 1%, its highest level since November.

Technical analysis of GBP/USD

The pound sterling touched the high of 1.3370 and pulled back below 1.3336. This range is now considered the primary target for buyers because, after a breakout there, the price may return to 1.3372. If so, the pair may continue to retrace upward. In case GBP/USD faces pressure, it will be important to keep trading the pair above 1.3300. Otherwise, the quote may fall to 1.3270.