This trend suggests a decrease in inflation, which, however, does not allow the Federal Reserve to accurately determine when the process of lowering interest rates will begin.

Previously, there were expectations that the Federal Reserve would begin the process of cutting rates as early as June. However, this week's robust economic indicators have sent government bond yields rising to levels not seen in months. This became the reason for market speculation regarding a possible deviation from the planned rate reduction schedule.

In this context, Federal Reserve Chairman Jerome Powell emphasized the consensus among policymakers that rate cuts will become necessary at some point this year. However, such a decision will only be made after there is credible evidence that inflation is reliably approaching the target level of 2%.

Stock prices fell after the release of the National Institute of ADP's report on employment, according to which the number of jobs in the private sector grew by 184 thousand in March. This indicates the dynamism of economic development. The report also shows a significant increase in the average salary of employees changing jobs - an increase of 10% in annual terms compared to 7.6% in February, which acts as a negative signal for inflation trends.

However, an analysis by the Institute for Supply Management (ISM) in services found input costs for businesses to fall to a four-year low, indicating a positive outlook for inflation.

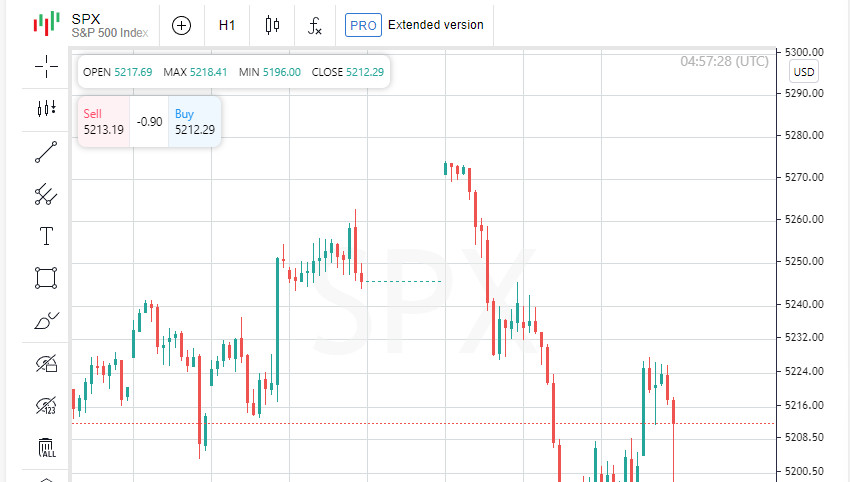

At the end of the day, the S&P 500 and Nasdaq indexes showed gains, supported by news of a slowdown in the US services sector in March. However, the rise was muted in light of statements by Jerome Powell, chairman of the Federal Reserve, that changes in interest rate policy were not expected in the near future.

The leading sectors of the S&P 500 index showed positive dynamics, with the most significant gains observed in the energy, materials and telecommunications services sectors.

Additional data from the Institute for Supply Management released Wednesday showed the services PMI fell to 51.4 in March from 52.6 in February. The result was below analysts' expectations, who had expected better results in a Reuters poll.

A score above 50 symbolizes expansion in the services sector, which accounts for a large portion of the American economy. It is reported that despite the slowdown, the US economy continues to grow, albeit at a more moderate pace.

The Dow Jones Industrial Average suffered minor losses, falling 43.1 points (0.11%) to close at 39,127.14. Meanwhile, the S&P 500 gained 5.68 points (0.11%) to finish at 5,211.49 and the Nasdaq Composite rose 37.01 points (0.23%) to close at 16,277.46.

The revision of forecasts for interest rate cuts by the US Federal Reserve from June became the subject of discussion in the market after the publication of the latest positive economic data.

Ulta Beauty shares fell 15.3% after the company gave a downward outlook at a cosmetics industry conference. Shares of other players in the sector such as e.l.f. Beauty and Coty also recorded declines.

Intel reported a $7 billion loss at its foundry division for 2023, topping the previous $5.2 billion loss reported a year earlier. This caused the company's shares to fall by 8.2%.

Total stock trading volume on U.S. exchanges reached 11.03 billion, slightly below the average of 11.76 billion over the past 20 trading days. On the New York Stock Exchange, advancers outnumbered decliners by a 1.66-to-1 ratio, and on the Nasdaq, advancers outnumbered gainers by a 1.25-to-1 ratio.

The MSCI global equity index recorded a slight rise of 0.1%, while government bond yields fell. The 10-year U.S. Treasury yield fell 1.6 basis points to 4.349%, after earlier setting a four-month record of 4.429%.

The pan-European STOXX 600 index rose 0.29%, reflecting positive reception of ISM data by European investors. In the US financial market, the S&P 500 index rose 0.11%, the Nasdaq Composite index rose 0.23%, while the Dow Jones Industrial Average suffered slight losses, decreasing by 0.11%.

Atlanta Federal Reserve Bank President Raphael Bostic, speaking to CNBC, stressed that the Federal Reserve should not cut its key interest rate until the end of this year. He repeated his position that the reduction in borrowing costs should only occur once in 2024.

The dollar index, which measures the value of the US dollar against a basket of six major currencies, stabilized near its highest in the past four and a half months, supporting the Japanese yen at lows not seen in many years. However, the risk of foreign exchange market intervention from the Japanese authorities limited the further fall of the yen.

The dollar index fell slightly by 0.50%, while the dollar strengthened against the yen by 0.11%, reaching 151.68 yen per dollar.

The price of US oil increased by 28 cents, reaching $85.43 per barrel. Meanwhile, Brent crude rose 43 cents to settle at $89.35 a barrel.

Gold also posted notable gains, reaching a new record high. US gold futures rose 1.5% to $2,315 an ounce.

Bitcoin rose marginally, adding 0.21% to reach $65,801.00.