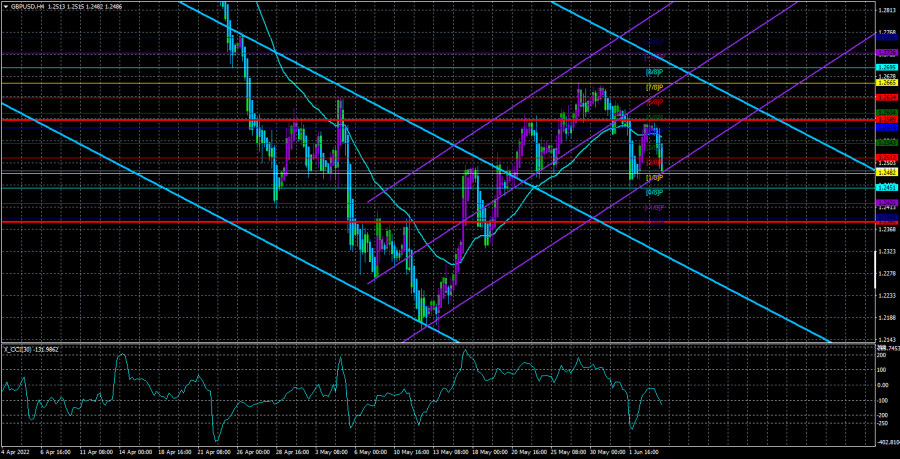

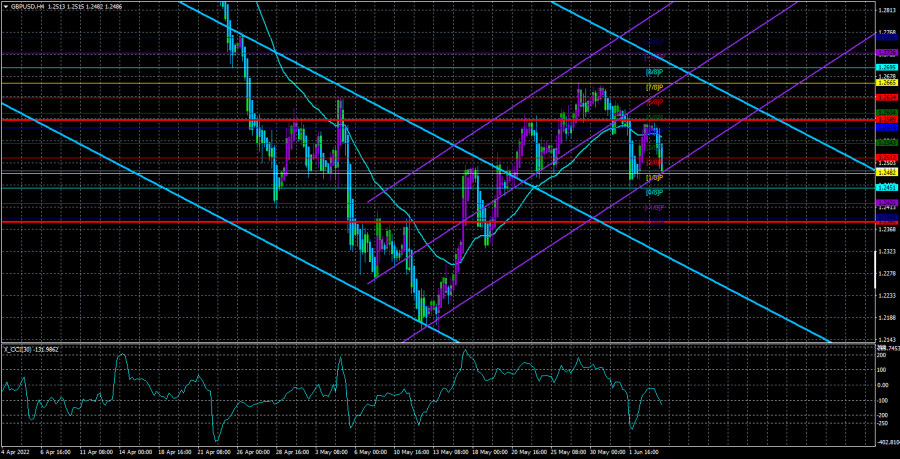

The GBP/USD currency pair on Friday, after briefly being above the moving average, collapsed down again. Thus, at the moment, the short-term upward trend has been canceled, and the pair may rush down to its 2-year lows again, which is not so bad. After all, the euro currency at the same time may again take a course to its 20-year lows. As in the case of the euro currency, there are no special reasons for the British pound to become more expensive. In the last few weeks, it has risen in price by 500 points, but if someone thinks that this is a lot, then we recommend looking at the 24-hour TF - over the past year and a half, the pound has fallen in price by 2000 points. Thus, the current upward correction (which may already be completed) is a normal, "intra–trend" correction. If you look at the same 24-hour TF, you can see that all the corrections over the past year and a half did not exceed 500 points. Therefore, the pound has fulfilled its duty, now with a clear conscience, it is possible to fall again.

Unfortunately, the pound is getting more and more new reasons to start depreciating against the US currency again every day. Even Andrew Bailey is already talking about a possible shortage of food, the same head of the BA suggests an increase in inflation to 10.25% (which means that the CPI may grow even stronger), and four increases in the key rate have not had any positive effect. In addition, London remembered that life is somehow boring without an external conflict. The kingdom has just moved away from Boris Johnson's "coronavirus" parties, and you should not relax. Now London and Brussels are again in conflict over the "Northern Ireland protocol" and it is unlikely that it will be just a "frozen conflict". The problem with the border and customs points between Ireland and Northern Ireland has been hanging over all the "sword of Damocles" for several years. We believe that if there was a solution to this problem, hundreds of politicians would have found it long ago, for whom it is a direct duty. So far, everything is heading towards a trade conflict between the Alliance and the Kingdom, as well as the rupture of the Brexit agreement.

Macroeconomics does not help the pound

In the new week, business activity indices (final values for May), GDP data for April, and industrial production for April will be published in the UK. Business activity indices are unlikely to arouse interest among traders since these are the second, final values. Market participants have already "digested" the drop in the service sector from 58.9 to 51.8. GDP data is not quarterly, the most important data, so it is also unlikely to cause a reaction. Well, industrial production has long been not the most important report. Things will be even more boring in the States. On Friday, a report on inflation for May will be published, which, according to experts, will not change compared to April and will amount to 8.3% y/y. If so, then we can assume that the Fed managed to stop at least the acceleration of the CPI by raising the rate to 1%. Now we need to reduce inflation, and this requires continuing to raise the rate. What is important is that in June, the QT program begins its work, which is the antipode of the QE program. We are talking about quantitative tightening, in other words, the withdrawal of excess money from the economy by selling government bonds from the balance sheet of the Fed. Paired with an increase in the rate, this may slow down inflation and return it to at least 6-7% in the coming months. But this is still not enough, since the target is 2%. But FOMC members mustn't abandon the plan to aggressively tighten monetary policy, so the dollar has the necessary grounds to resume growth. Of course, the market could have already worked out all future rate increases several times, since everyone has known about them for a long time. But there is no way to check whether the market has won back this factor or not yet.

The average volatility of the GBP/USD pair over the last 5 trading days is 104 points. For the pound/dollar pair, this value is "high". On Monday, June 6, therefore, we expect movement inside the channel, limited by the levels of 1.2382 and 1.2589. The upward reversal of the Heiken Ashi indicator signals an attempt to resume the upward trend.

Nearest support levels:

S1 – 1.2482

S2 – 1.2451

S3 – 1.2421

Nearest resistance levels:

R1 – 1.2512

R2 – 1.2543

R3 – 1.2573

Trading recommendations:

The GBP/USD pair continues to be located below the moving average line on the 4-hour timeframe. Thus, at this time, you should stay in sell orders with targets of 1.2421 and 1.2382 until the Heiken Ashi indicator turns up. It will be possible to consider long positions again if the price is fixed above the moving average line with targets of 1.2604 and 1.2634.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.