Analyzing trades on Wednesday

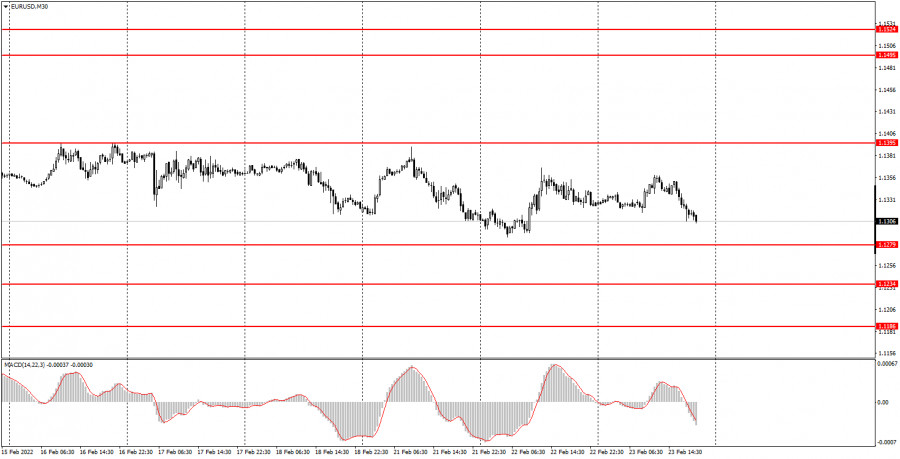

EUR/USD on 30M chart

On Wednesday, the EUR/USD pair continued to trade within the sideways channel of 1.1279-1.1395. So, the technical picture has not changed much in the past 24 hours. The pair did not even approach the channel boundaries today, so there were no signals on the 30-minute time frame. In addition, there was neither macroeconomic news nor fundamental background. The only key report of the day was the second estimate of the inflation rate for January. The reading did not differ much from the first estimate and amounted to 5.1%. Naturally, there was no market reaction to this report. Market participants are now fully focused on the geopolitical crisis. Although the EUR/USD and GBP/USD pairs seem to downplay any news about the Ukrainian-Russian conflict, the market may still be affected in the event of a full-fledged war. The risk of Russia's military invasion of Ukraine is now really high. Therefore, if this happens, global markets may get into a panic.

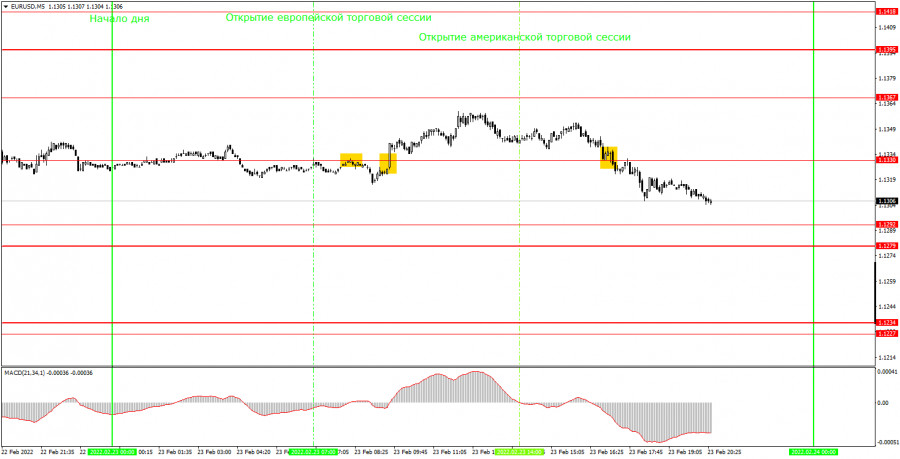

EUR/USD on 5M chart

On the 5-minute time frame, three trading signals were formed on Wednesday. The volatility was average as the pair advanced by just 55 pips. Just like yesterday, the pair first went up and then moved lower. However, such movements are natural when the pair is trading flat. Let us take a look at trading signals. It is not easy to trade when the price is moving sideways, and strong signals appear less often. The first sell signal today turned out to be false. The price rebounded from the level of 1.1330 and managed to go down by only 9 pips. Therefore, a sell trade should have been closed manually after consolidation above the level of 1.1330, which was already a buy signal. After the formation of a new signal, the price rose by about 20 pips, so novice traders could at least have time to set a Stop Loss to breakeven. However, the price failed to reach the target level and settled below the level of 1.1330 during the North American session, thus creating a sell signal. However, traders could have ignored this signal as two false signals had been formed near the same level of 1.1330. As a result, today's session was far from perfect but at least we managed to avoid serious losses. The market continues to trade mixed.

Trading tips on Thursday

On the 30-minute time frame, the latest upside cycle was canceled a long time ago. However, a new trend has not yet been formed. There is no trendline and no channel, which means there is no trend at the moment. For eight trading days, the pair has been stuck between the levels of 1.1279 and 1.1395, indicating a clear flat movement. The market is still waiting for the outcome of the conflict in Eastern Europe which is escalating every day. On the 5-minute time frame on Wednesday, it is recommended to trade at the levels of 1.1227-1.1234, 1.1279-1.1292, 1.1330, 1.1367, 1.1395, and 1.1418. You should set a Stop Loss to the breakeven point as soon as the price passes 15 pips in the right direction. There will be no important reports or events in the EU on Thursday. As for the US, it will release the second estimate for Q4 GDP which is expected to increase by 0.2%. A minor report on jobless claims will also be published. However, these reports are unlikely to influence the market as traders seem to be cautious now.

Basic rules of the trading system

1) The strength of the signal is determined by the time it took the signal to form (a rebound or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on a false signal (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually.

5) You can trade using signals from the MACD indicator on the 30-minute time frame only amid strong volatility and a clear trend that should be confirmed by a trendline or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines).

Important announcements and economic reports that can be found on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.