To open long positions on EURUSD, you need:

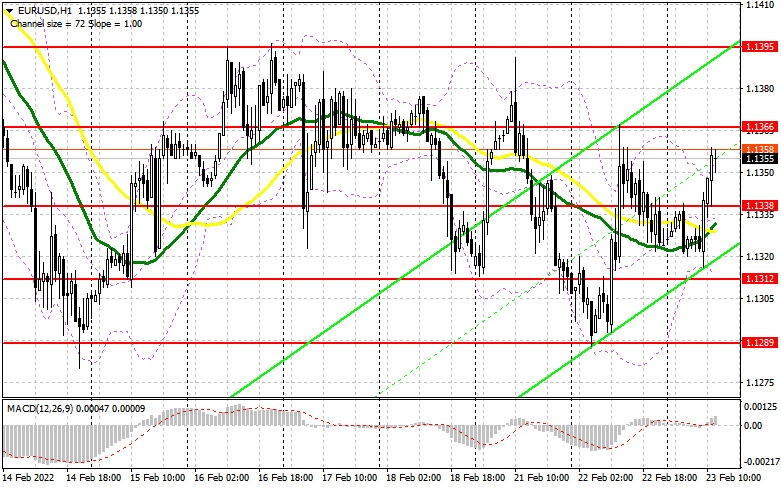

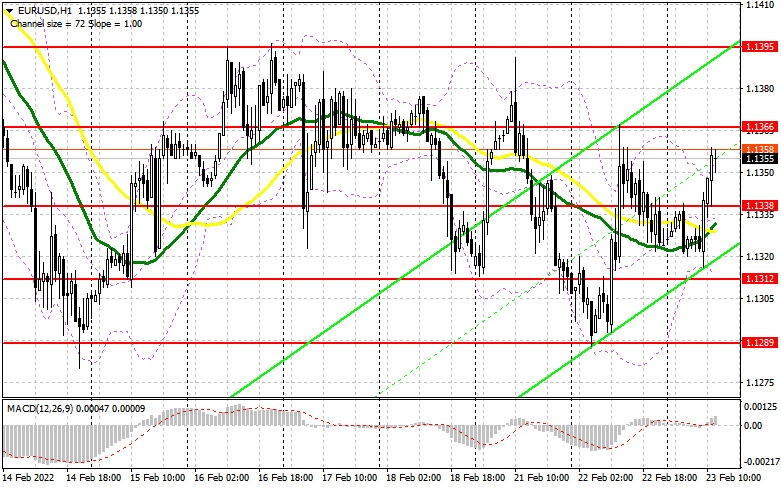

In my morning forecast, I paid attention to the 1.1338 level and recommended making decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened. The negative report on Germany led to the formation of a false breakdown in the resistance area of 1.1338, but there was no downward movement from this level. A breakout and consolidation above this range, and then a reverse test from top to bottom gave an excellent entry point already into long positions. At the time of writing, the pair has gone up more than 20 points, and the demand for the euro remains. For the second half of the day, the technical picture has not changed, as has the strategy. And what were the entry points for the pound this morning?

Today, there are no statistics on the United States, so the market will react only to geopolitical changes and news related to Russia and Ukraine. If there is no negative, we can count on the continued growth of the euro and the renewal of yesterday's highs. However, it should be understood that a serious conflict between Russia and Ukraine, which may even develop into an armed one, creates a certain pressure on the class of risky assets, to which the euro belongs. An important task of the bulls for the second half of the day will be to protect the nearest support of 1.1338, which served as resistance in the morning. Only the formation of a false breakdown will give the first entry point into long positions in the continuation of the upward correction of the pair. It is possible to count on a larger recovery of EUR/USD and go beyond the side channel only after active actions of buyers in the area of 1.1366. A breakout and a test of this range from top to bottom will lead to another buy signal and open up the possibility of recovery to the area of 1.1395, where I recommend fixing the profits. It is unlikely to get out of this range quickly since its breakdown will resume the bullish trend and open a direct road to the highs of 1.1427 and 1.1454, where I recommend fixing the profits. However, as I noted above, geopolitical tensions will affect the growth prospects of the euro. With the aggravation of the Russia-Ukraine conflict, the demand for the US dollar will return. If the pair declines during the US session and there is no activity at 1.1338, traders will begin to close long positions, which will return pressure on the euro. Therefore, it is best to postpone purchases until a false breakdown at 1.1312, but it is possible to gain long positions on the euro immediately for a rebound from the level of 1.1289, or even lower - around 1.1262 with the aim of an upward correction of 20-25 points inside the day.

To open short positions on EURUSD, you need:

Sellers have not yet shown themselves in any way and decided to postpone their activity until yesterday's highs are updated, or even higher - to a weekly maximum. Until the moment when trading is conducted above 1.1338, we can expect the pair to continue growing, so it is so important for the bears to focus on the return of this range during the American session. Given that we don't have any data on the US in the afternoon, volatility may be quite limited. An important task of the bears will be to protect the resistance of 1.1366. The formation of a false breakdown at this level, similar to what I discussed above, as well as negative news related to Russia and Ukraine, will all be a signal to open short positions to reduce EUR/USD to the 1.1338 area, just below which the moving averages are playing on the buyers' side. A breakdown of this area and a reverse test from the bottom up will give an additional signal to open short positions already with the prospect of falling to a minimum of 1.1312, and there you can reach a more distant goal of 1.1289, where I recommend fixing the profits. If the euro rises during the American session and there are no bears at 1.1366, it is best not to rush with sales. The optimal scenario will be short positions when a false breakdown is formed in the area of the weekly maximum of 1.1395. You can sell EUR/USD immediately on a rebound from 1.1427, or even higher - around 1.1454 with the aim of a downward correction of 15-20 points.

The COT report (Commitment of Traders) for February 15 recorded a reduction in both long and short positions, which led to an increase in the positive delta, as there were much fewer short positions. The uncertain policy of the European Central Bank, together with its president Christine Lagarde, who recently said that it was necessary to act more aggressively in the event of an acceleration of inflationary pressure, and last week completely changed her position, leads traders to a dead end. But, even despite the growth of the positive delta, the euro sank very much at the end of the reporting period. This is happening against the background of the risk of a military conflict between Russia and Ukraine. More recently, the Russian authorities recognized the independence of the LDPR, which only exacerbated geopolitical tensions around the world. Another weighty argument for the observed downward movement of the EUR/USD pair is the actions of the Federal Reserve System in relation to interest rates. According to the Fed minutes from the February meeting, it is expected that the Central Bank may resort to more aggressive actions and raise rates immediately by 0.5% in March this year, and not by 0.25%, as originally planned. This is a kind of bullish signal for the US dollar. The COT report indicates that long non-commercial positions decreased very slightly - from the level of 218,973 to the level of 217,899, while short non-commercial positions decreased from the level of 180,131 to the level of 170,318. This suggests that although fewer people are willing to sell euros, there are no more buyers from this. It seems that traders prefer to sit on the sidelines of those events that are now rapidly gaining momentum. At the end of the week, the total non-commercial net position increased slightly and amounted to 47,581 against 38,842. The weekly closing price collapsed and amounted to 1.1305 against 1.1441 a week earlier.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates the bulls' attempts to continue the upward correction.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A breakthrough of the upper limit of the indicator in the area of 1.1352 will lead to new growth of the euro. In the case of a decline, the lower limit of the indicator in the area of 1.1312 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.