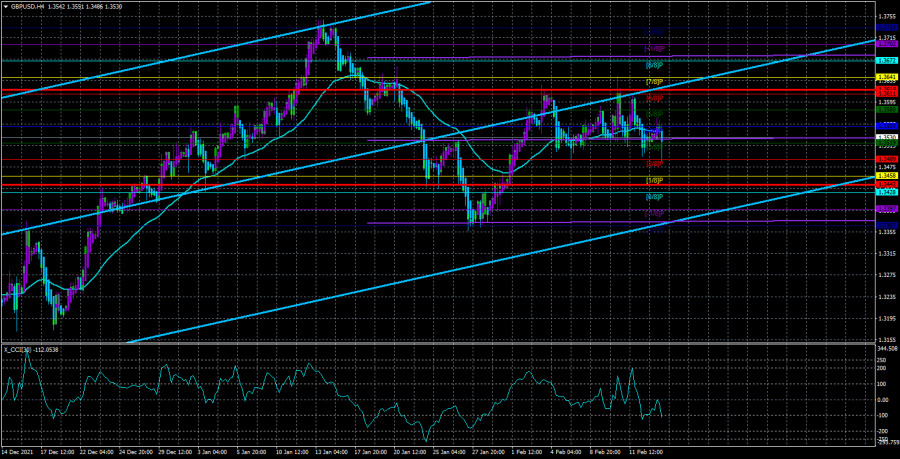

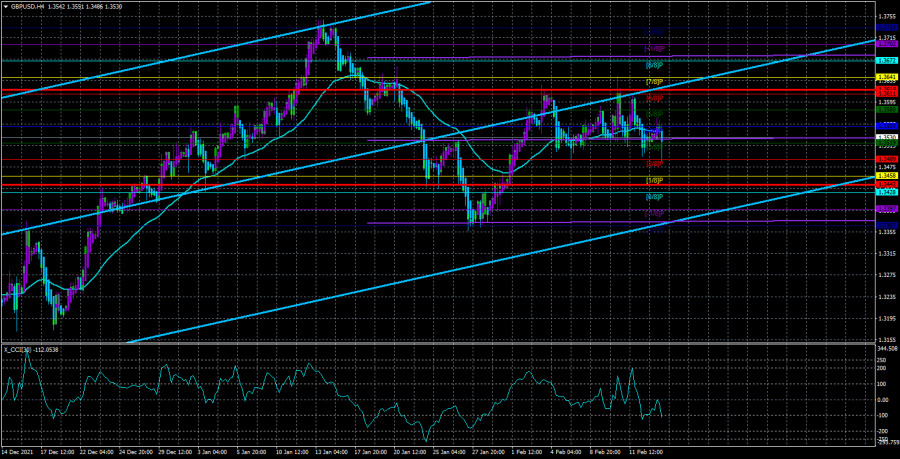

The GBP/USD currency pair continued to trade on Tuesday, it is unclear how. On absolutely all timeframes, an unreadable technical picture has now developed. It is impossible to even conclude what the trend is now, whether it exists at all, and whether there is a flat now. The pair moves in a "swing" mode. Sometimes volatile, sometimes not so much. There is no side-channel now either. Absolute random. For example, in the UK yesterday morning, pretty good statistics on wages, unemployment, and applications for unemployment benefits were released. Although these are not the most significant reports, they could still provoke a strengthening of the British currency. The pound rose by 40 points within one hour. And over the next few hours, it fell by the same 40 points. And with the opening of the American trading session, it began to fall again. In general, absolutely nothing is unclear. The same situation has developed on the 24-hour TF, where the price continues to trade simply along the critical line, without paying any attention to it. On the hourly TF, we have been watching a "roller coaster" for a couple of weeks. Therefore, now it is impossible to draw any conclusions at all about the future movement of the pound/dollar pair. The pair did not even react to the morning news about the withdrawal of Russian troops from the borders with Ukraine. We don't know if this is true or not, but still, most assets and instruments reacted to this information. But not the pound. Thus, if we take into account the entire fundamental background, we can conclude that there are no good reasons for a new fall in the British currency now. However, this does not mean that it cannot resume falling. There will be a few important macroeconomic events this week, and the markets have focused all their attention on the topic of the Ukrainian-Russian conflict. Therefore, anything can happen.

The Fed did not announce any results of the emergency meeting.

At the same time, when the whole world is watching "geopolitics", the Fed held an emergency meeting "under the guise". It was to begin on Monday evening, and its results were to be known during Tuesday. However, no information on this matter was received and several world media said that the meeting was closed and its results would not be published. Honestly, it's a disappointment. First, the market was hoping for a rate hike in February (otherwise why call an emergency meeting?). Second, then the question arises: why was it necessary to convene the Fed ahead of schedule? What issues were resolved? Are these issues related to the same geopolitics? However, we have not received any answers to these questions and probably will not receive any. Already, almost all FOMC members declare with one voice that the regulator is ready to raise the rate, so we can only wait for the next meeting, which is scheduled for mid-March. However, there is still 1 month until mid-March. It's hard to imagine where inflation will fly in the States during this time.

But one way or another, the dollar could have received additional support from the Fed in February but did not receive it. Tonight, by the way, the minutes of the last Fed meeting will be published, which in the current circumstances may affect the market. Recall that now we are not talking about one or two increases, but about the whole cycle of key rate increases, so the Fed protocol may clarify some points. In particular, to make it clear to the markets exactly how many FOMC members support a 0.5% rate hike in March. After all, now no one doubts that the rate will be raised, but how much? Given that inflation continues to rise, it is very likely to increase by 50 basis points at once. This is the question the markets will be waiting for an answer to. If the protocol is neutral, it can "pass by" traders and investors.

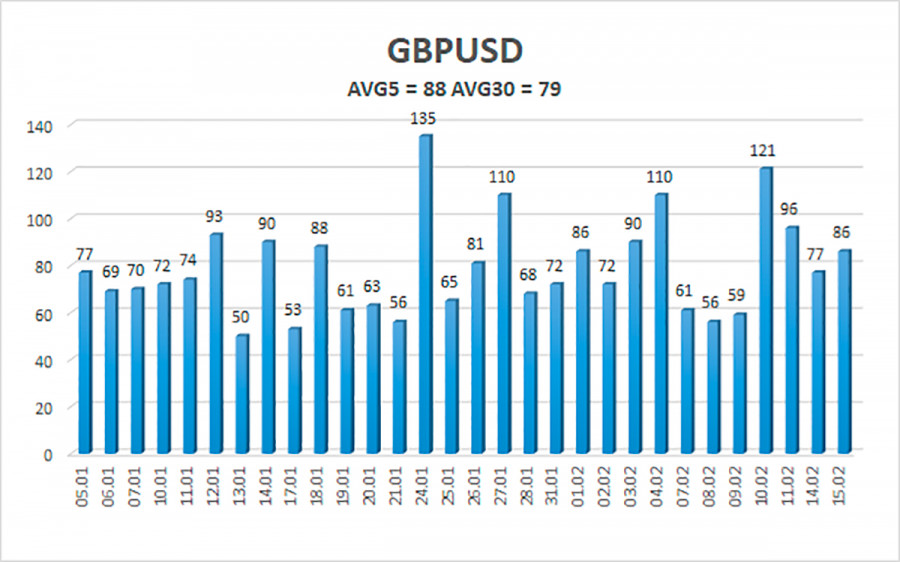

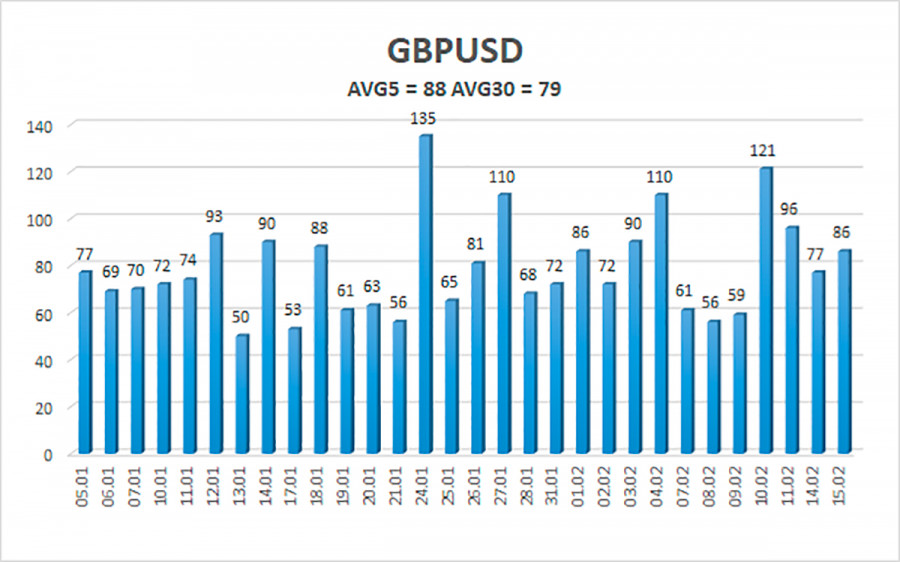

The average volatility of the GBP/USD pair is currently 88 points per day. For the pound/dollar pair, this value is "average". On Wednesday, February 16, thus, we expect movement inside the channel, limited by the levels of 1.3442 and 1.3618. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.3519

S2 – 1.3489

S3 – 1.3458

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3580

R3 – 1.3611

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues to trade near the moving in the "swing" mode. Thus, at this time, it is possible to consider short positions with targets of 1.3489 and 1.3458 before the Heiken Ashi indicator turns upwards, but the high probability of a flat should be taken into account. It is recommended to consider long positions if the pair gains a foothold above the moving average, with targets of 1.3580 and 1.3611, but you should also be wary of a flat.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.