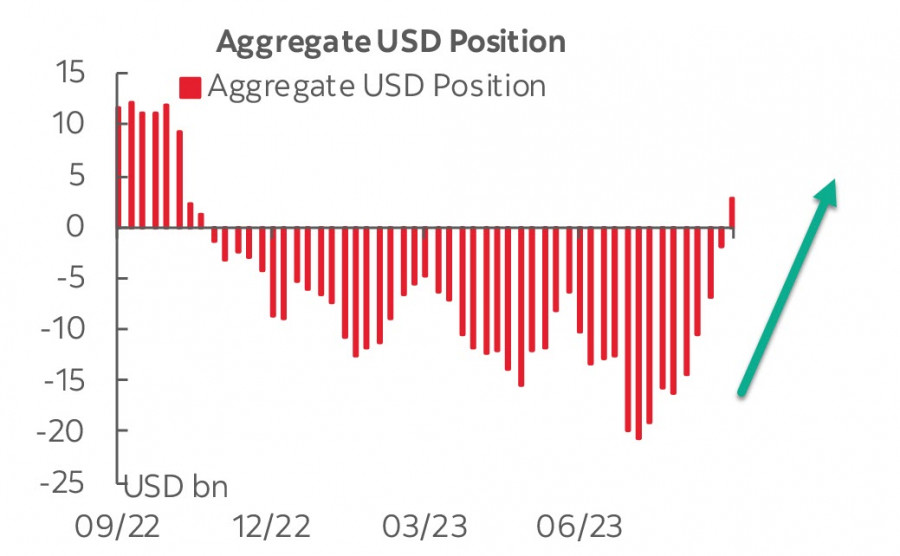

For the first time since November 2022, a net positioning has turned net long, with the value of the net dollar position amounting to 2.7 billion, with a weekly change of +4.685 billion. Traders have roughly increased their short positions in all major currencies, except for the Swiss franc, against the US dollar.

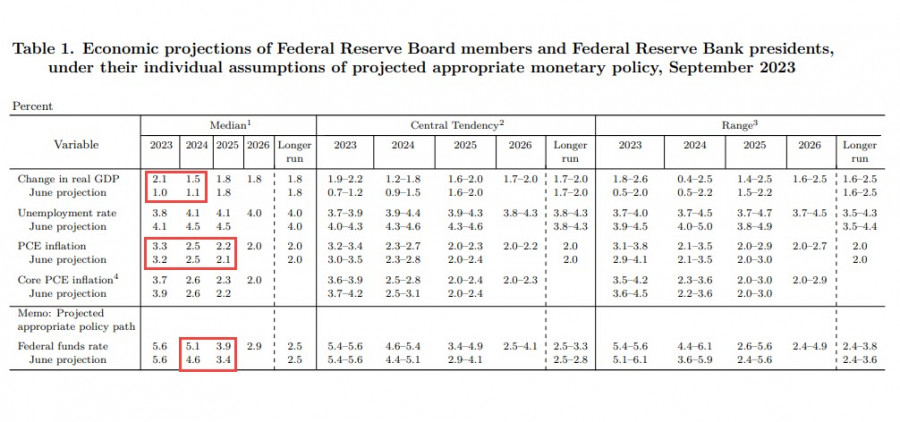

The outcome of the recent Federal Reserve meeting is seen as a bullish factor for the US dollar. The median rate forecast was raised from 4.6% to 5.1% for 2024 and 3.4% to 3.9% for 2025. This means that the Fed will start reducing rates significantly later than previously expected, extending the period of high interest rates. The futures market anticipates the Fed will start the first rate cut in the July 2024 meeting, while just a couple of months ago, the first rate cut was expected in May.

Why is this happening? It's all about the persistent excess demand that shows no signs of abating. The inflation forecast for the current year has been revised higher from 3.2% to 3.3%, and the GDP forecast from 1% to 2.1%. Furthermore, the GDP forecast for 2024 has increased from 1.1% to 1.5%, indicating that the Fed does not see the threat of a recession even in the face of tight financial conditions.

Accordingly, the Fed's logic is as follows - demand remains high, the economy is growing, so it is necessary to extend the period of high-interest rates because inflation will slow down gradually.

Needless to say, such an assessment of the US economy is a bullish factor for the dollar, as it maintains high yields amidst economic growth.

The currency market reacted to the outcomes of the "central bank policy parade" with a strong performance from the US dollar. The pound continues its downward trajectory after the dovish surprise from the Bank of England. The yen remains under pressure after the Bank of Japan left its ultra-easy monetary policy unchanged and gave no hints of any changes in monetary policy in the foreseeable future.

The main event of the week will be the European and US CPI numbers on Friday. A slowdown in inflation will create a good environment for the bond markets as the prospect of an end to key interest rate hikes will allow markets to speculate on faster rate cuts.

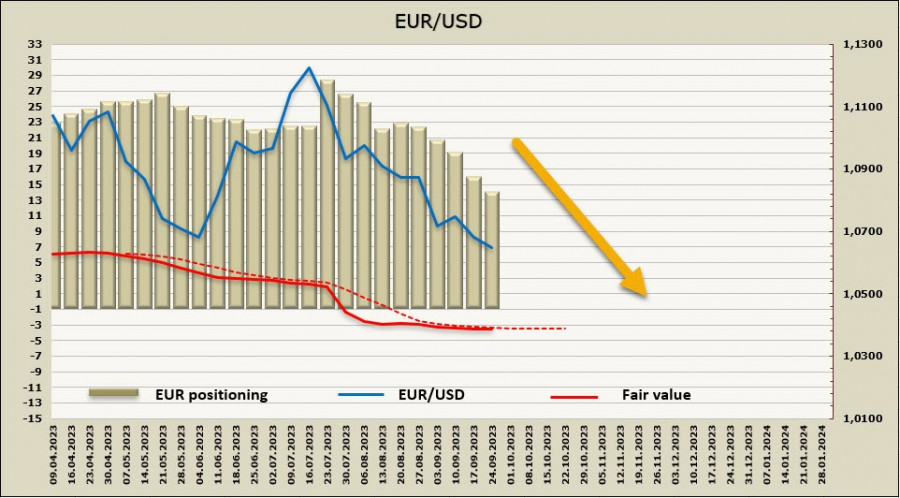

EUR/USD

The IFO indicator for Germany in September will be in focus, and traders may also look forward to the speeches from European Central Bank representatives Lagarde, Schnabel, and Villeroy.

The forecast for the IFO index suggests further decline in business optimism. The Eurozone Composite PMI Output Index posted 47.1 in September, up marginally from 46.7 in August. However, the latest reading still represents a contraction. Forecasts suggest that Eurozone GDP will decrease by 0.4% in the third quarter, with the main threat coming from the ongoing decline in production output.

Sooner or later, the reduction of inventories will make a positive contribution to growth as it may lead to an increase in production activity. Still, this is not expected in the coming months, and therefore the threat of the eurozone economy entering a recession with higher inflation compared to the US will prevent the euro from rallying against the dollar.

The net long EUR position fell by 1.588 billion to 13.613 billion over the reporting week, marking the lowest point since November 2022. The price is below the long-term average, and is exhibiting weak dynamics.

The euro fell to the support area of 1.0605/35, thereby updating the May low. There's a high probability of falling further, with the next target being the local low at 1.0514. There are no grounds for an upward reversal, and euro bulls can only count on consolidating in the range with the upper band at 1.0735 before the next downward wave.

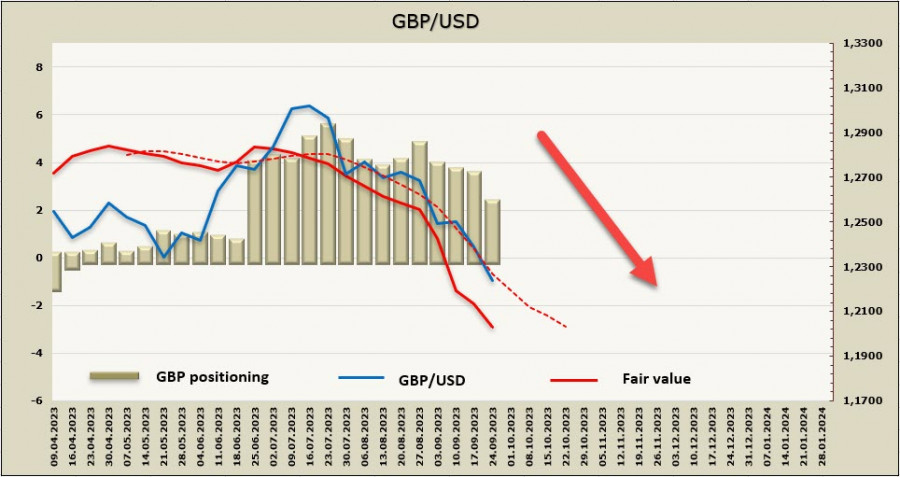

GBP/USD

The BoE's Monetary Policy Committee voted by the narrowest margin of 5-4 to keep the Bank Rate at 5.25%. Instead of raising the rate, the BoE said its balance sheet of government debt will shrink by £100 billion in the second year of so-called quantitative tightening to facilitate a broader bond maturity schedule for the next year.

The BoE left room for further rate hikes, reiterating the thesis that "further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures." The market sees roughly a 70% probability of a new rate hike by the beginning of 2024.

As for economic growth, the BoE expects modest growth this year, which could exert more pressure on GBP/USD. Inflation in the UK is higher, and GDP growth rates are lower than in the US, with comparable interest rates, meaning that real yields in the US are currently higher. Regarding the start of the rate-cutting cycle, forecasts for both the Fed and the BOE indicate the first rate cuts in the second half of 2024, so there is no advantage for the pound here either.

The net long GBP position fell by 996 million to 2.609 billion over the reporting week, and the price continues to decline rapidly.

The pound has updated its local low, and there are no grounds for a reversal. An attempt at a bullish correction is limited by resistance at 1.2307, with the nearest target being the technical level of 1.2074, and the long-term target being the support area at 1.1740/90.