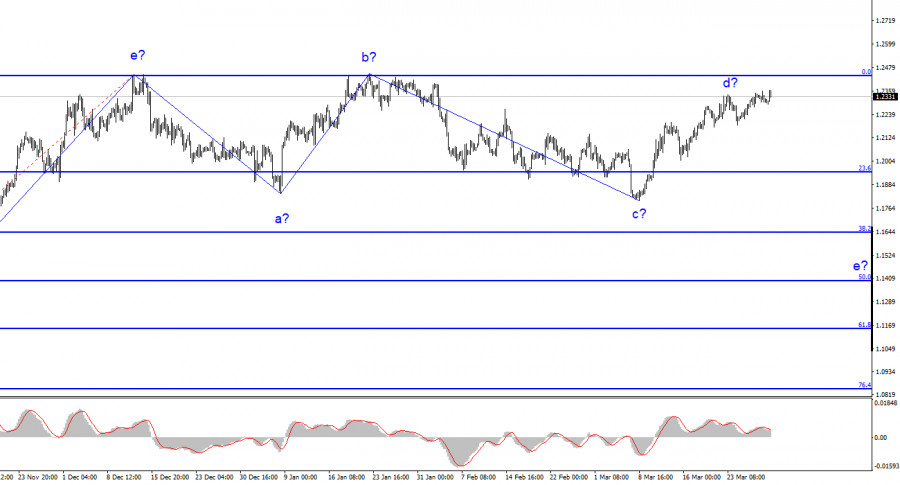

The wave analysis for the pound/dollar pair now appears challenging, but it does not call for any clarifications. There are some differences between the wave patterns of the euro and the pound, including the euro's current high likelihood of growth. I believe that the downward part of the trend is still being built at this time. Although wave c took on a prolonged form, it has already been finished because the pair descended below wave a's low, though by a small amount. Although it should be emphasized that forecasts do not often match reality, I predict a sharper decrease in the value of the pound sterling. If the euro's downward trend is complete, there is a greater than 50% chance that all ended on wave c for the British pound. Additionally, the movements that follow it are not wave d but rather the initial wave of a new upward trend segment. The pair may very well turn the December 13 originating downward segment of the trend into a five-wave corrective. The wave pattern would have looked more convincing in this scenario, but once again, there is an extremely low likelihood that the euro and the pound would develop completely separate trends. And to the euro, everything appears to be a rising series of waves that may include three waves and is already almost finished.

This trend has continued for four days in a row as the pound/dollar exchange rate rose by 30 basis points on Thursday. Although it cannot be said that the pair remains still, the movement has a very low amplitude. There is a certain rise, but the wave analysis is now so unclear that it is challenging to make a clear judgment about the pair's future. There are now several choices for wave analysis, as I've already mentioned. There were no news reports that were particularly intriguing for the market on Monday, Tuesday, Wednesday, or Thursday. The remarks given by Andrew Bailey were dull and uninspiring. The US GDP for the fourth quarter, the first more or less significant report, will be published today, but I don't anticipate it will have a significant effect on market sentiment. The entire current week has been extremely calm and even dull. We are currently unable to make any long-term predictions due to the wave analysis.

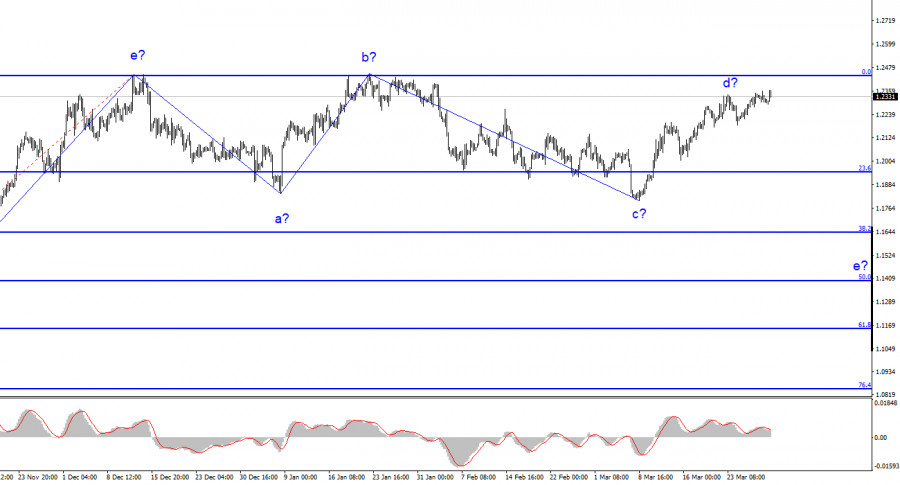

You simply need to wait for the market to wake up in the present scenario. You must wait for reliable and crucial information. Of course, you are welcome to attempt to contribute to the current movements, but in my view, this is not the best course of action. It is much more difficult to make decisions without a clear wave plan, without knowing what waves to anticipate right now, and without knowledge of the news context. The amplitude would be stronger if the pair were still moving faster. So even if you correctly predicted the direction, it's doubtful that you'll make a significant profit on your trading positions. It's unlikely that Friday will go any differently from the prior four days.

Conclusions in general.

The wave pattern of the pound/dollar pair presumably represents the end of a segment of a downward trend (due solely to the correlation of the euro and the pound). According to the "up" reversals of the MACD indicator, it is possible to take into account purchases with targets higher than the 25-figure range at this moment. The possibility of developing a downward wave e, the targets of which are situated 500–600 points below the current price, is something I do not entirely rule out, though. We can now take into account purchases as well.

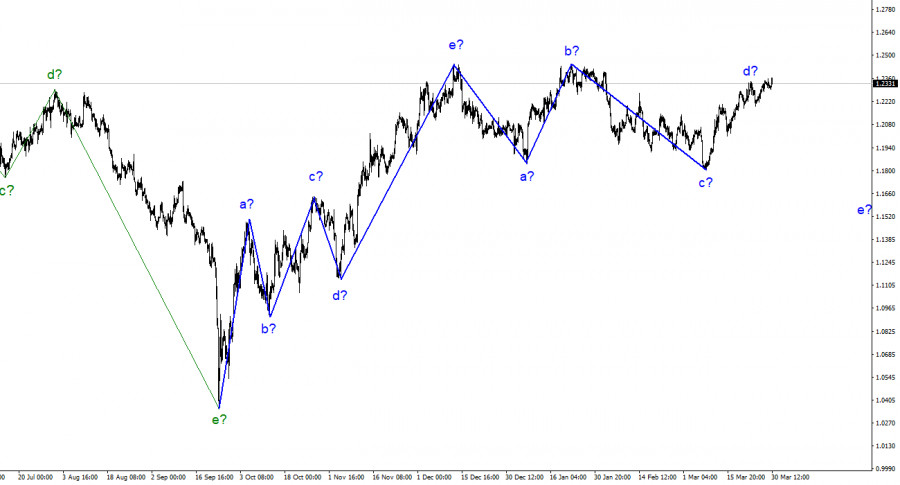

The picture resembles that of the euro/dollar pair at higher wave scales, but there are still minor differences. The upward correction part of the trend has now been completed. If this presumption is true, we should be expecting the development of a downward section to last for five waves, with a potential fall in the range of 14–16 figures.