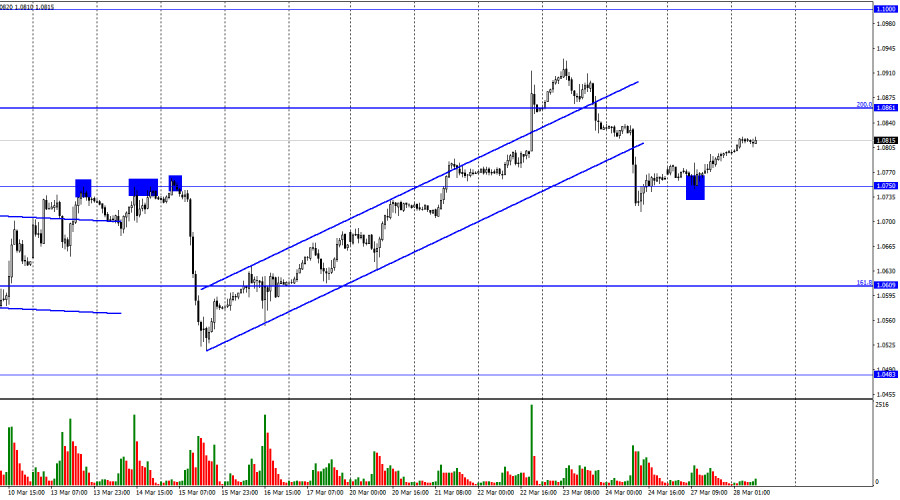

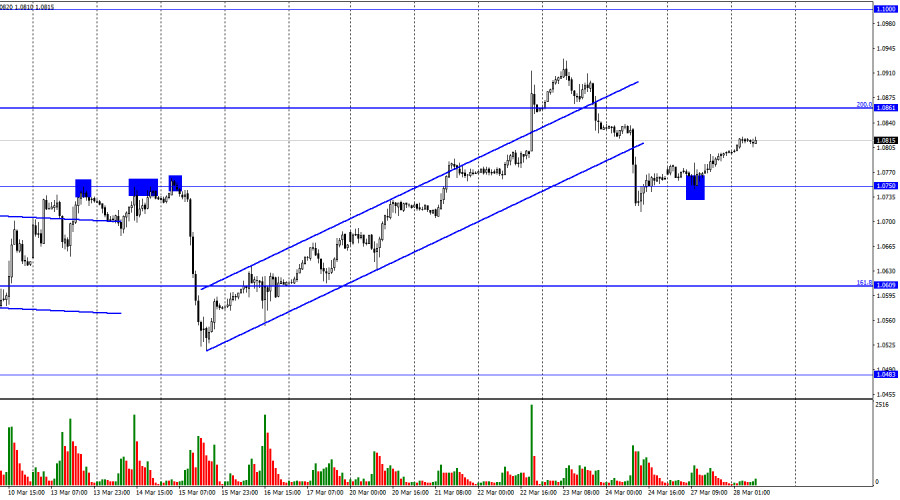

On Monday, the EUR/USD pair rebounded from the 1.0750 level and carried on its upward trend toward the corrective level of 200% (1.0861). The US dollar will benefit from the rebound in prices from this level and the continuation of the decline toward 1.0750. The likelihood of continued development toward the level of 1.1000 will increase if the pair's rate is fixed above 1.0861.

There was no background information on Monday. The fact that bull traders are resuming their offensive strategy is all the more startling. Although it is still too early to predict whether the European currency will increase further, Monday's performance showed that the bulls did not abandon the market but rather merely took a brief break. Additionally, the bears are not in a rush to seize this chance. Pablo de Cos, a member of the ECB, stated yesterday that core inflation, economic and financial statistics, and future interest rate decisions will all be based on these three variables. According to him, the current state of the banking industry poses hazards to the financial system and cannot be disregarded. The likelihood of inflation and economic activity is nevertheless impacted by the tightening of monetary policy. If market tensions continue, the process of deflation can quicken. To keep the financial system operating steadily, the ECB is prepared to take action, according to de Cos.

I believe that the ECB is getting ready to finish its program of tightening monetary policy, similar to other central banks. It will be exceedingly challenging to increase the rate at the same rate if all incoming data is considered, rather than just the inflation that is always rising. Forecasts for the Eurozone's GDP in 2023 range from 0% to 0.3%. Although not a recession, this is a situation that is extremely near to one. It is challenging to predict that the value of the euro will rise more at this time.

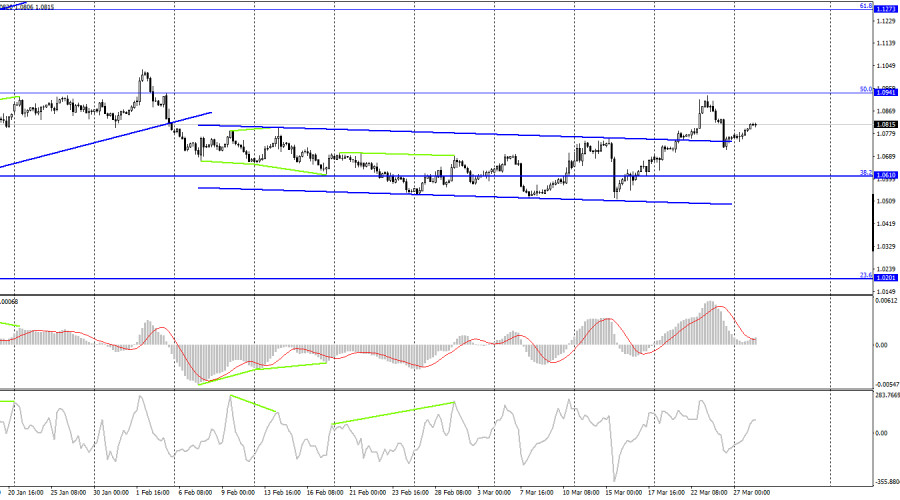

The 4-hour chart shows that the pair has stabilized above the side corridor, allowing us to predict further growth. However, consolidation was not possible above the corrective level of 50% (1.0941). (however, there was no rebound from it). As a result, the decline in quotes can always be resumed in the direction of the corrective level of 38.2% (1.0610). Emerging divergences are currently undetectable in any indication.

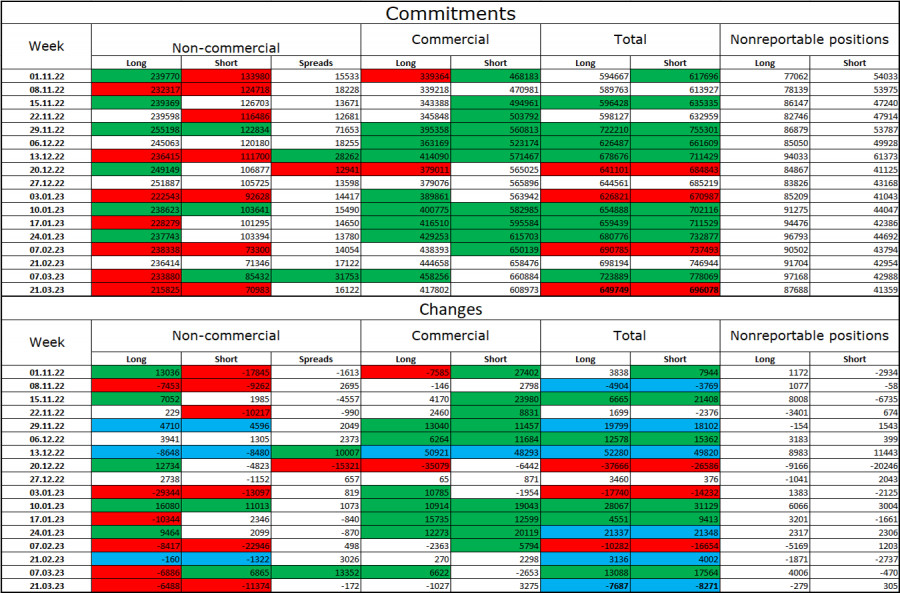

Report on Commitments of Traders (COT):

Speculators closed 6488 long contracts and 11374 short contracts during the most recent reporting week. Major traders' overall attitude is still "bullish" and getting better. Speculators now have 215 thousand of long contracts, while just 71 thousand short contracts are concentrated in their hands. Although the value of the euro has been rising for several months in a row, professional traders have not raised the number of long contracts in recent weeks. After a protracted "black period," the situation is still in the euro's favor, and its prospects are strong. Until the ECB gradually raises the interest rate by increments of 0.50%, at least. I would like to point out that the market could become "bearish" shortly since the ECB won't be able to keep raising interest rates by half a percent.

Calendar of events for the United States and the European Union:

The United States and the European Union both have no economic events scheduled for March 28. The information background will not affect the mood of traders today.

Forecast for EUR/USD and trading advice:

On the hourly chart, the pair's sales can be initiated when they rebound from the 1.0861 level with a target of 1.0750. On the hourly chart, buying the pair with a target of 1.1000 will be possible if it closes above the level of 1.0861.