On Wednesday, the EUR/USD currency pair was trading higher, and, for the first time in a while, it broke through the moving average line. As a result, the trend is now formally upward. "Formally" – as overcoming the moving is not a significant signal by itself. This is merely a cautionary note that the trend might change. Signals confirming the trend change are now required. Furthermore, such signals might not exist. The pair may close tomorrow below the moving average due to strong statistics from the USA or weak figures from the European Union. Here, it's important to pay close attention to both the signs on the 24-hour TF and the fundamental background.

Additionally, I'd like to point out that we continue to anticipate a decline in the value of the euro. To be honest, it should be said that it is becoming increasingly difficult to think that the value of the euro would decline every day. We shall discuss the ECB's problems in more detail below, but for now, let's focus on the basic issue: no one knows how much a given central bank should raise interest rates to get inflation back to 2%. Most likely, there is no response to this query because the economy has a complicated structure that makes it difficult to foretell such occurrences. All central banks, therefore, attempt to operate "in the course of the play." And given this, it is quite challenging to predict which way the pair will move over the next two to three months. Tomorrow, Christine Lagarde will announce that the ECB will increase interest rates three more times by 0.5%. Of course, the euro will instantly experience strong growth. Jerome Powell will announce the Fed will speed up the tightening of monetary policy the day after tomorrow, and the dollar will already be more expensive. As a result, traders must now take action and be ready for any changes in the course of events. The pair's failure to overcome the Senkou Span B line on the 24-hour TF (so far) raises serious red flags regarding the potential end of a downward correction. On top, there is a Kijun-sen line that must be crossed for the upward trend to resume. As of now, a decline in prices is still something we may anticipate, but now strong factors are required for the devaluation of the euro.

One noteworthy incident from yesterday will be remembered. In a speech, Joachim Nagel, the head of the German central bank, warned that many more additional tightenings in monetary policy may be necessary following the ECB's 0.5% rate hike in March. Also, he pointed out that in Germany, inflation won't drop below 2% in 2023, 2024, or 2025. It's still unclear what Nagel meant. The reality that inflation will remain over target for a long time because the ECB is just not prepared to tighten monetary policy for an extended period? Or the fact that inflation will continue to be high regardless of how much the rate is raised? We think that Nagel's statements currently only reflect his perspective. Since the ECB is the central bank of a group of nations, the monetary committee of the ECB is not just present, and its other members may have different opinions. Also, it is necessary to consider each party's interests. In our opinion, the European regulator won't be prepared to increase the rate to 5 or 6%. In other words, it might take a while for the consumer price index to recover to the desired level, at least in the coming years.

By the way, Germany's inflation has already begun to increase once again. Not just in Germany, either. Today, a European inflation indicator will be issued, which may disappoint markets. But how will it disappoint them? In light of Nagel's statement, the euro appreciated significantly as the likelihood of a prolonged rate hike increased multiple times. The euro may continue to rise if inflation today shows only a slight slowdown or no decline at all since the probability will only increase. High inflation is therefore more beneficial than detrimental for the euro currency. The euro may well continue to be supported by this factor for a few more days, after which the Fed and US inflation will control everything. The Federal Reserve, a more active central bank, might also tighten its rhetoric if the consumer price index starts to increase in the US. Also, traders respond to speeches by Fed members far more enthusiastically than they do to similar statements by ECB members. As a result, such "swings" may very well be present on the market soon. But for the time being, we continue to think that the value of the euro will decline.

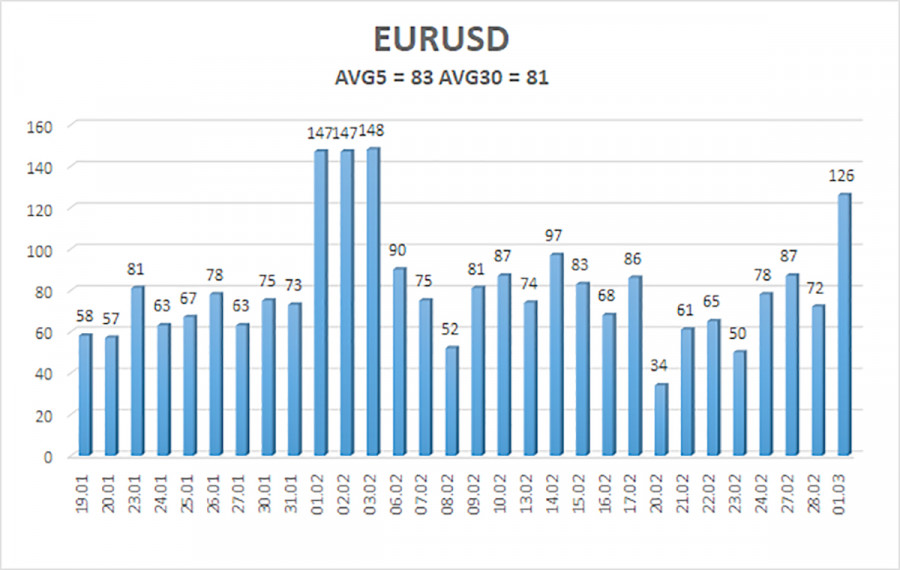

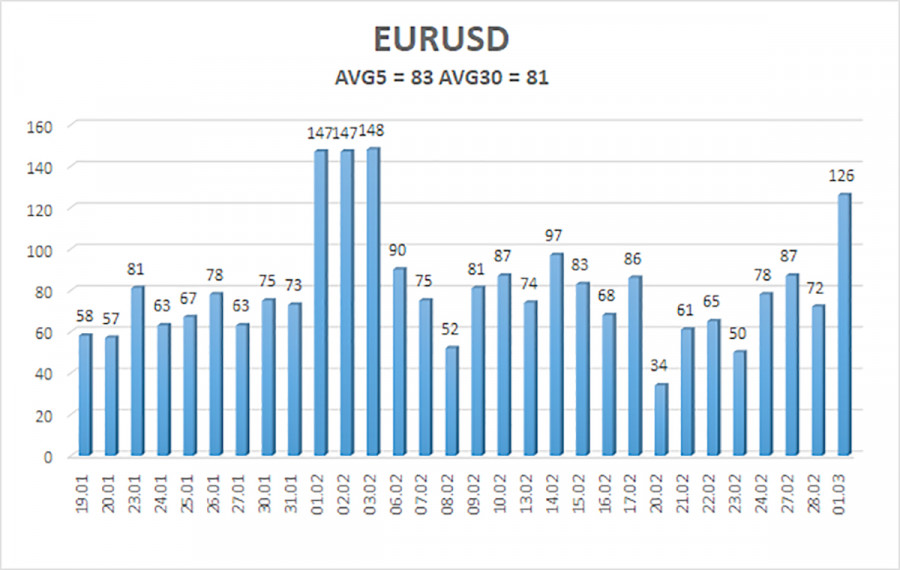

As of March 2, the euro/dollar currency pair has experienced 83 points of "average" volatility over the previous five trading days. Thus, on Thursday, we anticipate the pair to move between the 1.0566 and 1.0732 levels. The Heiken Ashi indicator's downward turn will signal a potential continuation of the downward movement.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 100986

Trade Suggestions:

The attempt to begin an upward trend by the EUR/USD pair can only be a technical corrective. Until the Heiken Ashi indicator turns down, you can continue holding long positions with targets of 1.0732 and 1.0742. After the price is fixed back below the moving average line, short positions can be initiated with targets of 1.0566 and 1.0498.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.