On Wednesday, the GBP/USD currency pair lost about 200 points. Surely, such a movement could not happen by chance. A study on US inflation that was released the day before indicated a modest decrease in January. The following day, a report on British inflation was made public, and it revealed a 0.4% fall to 10.1% y/y. The devaluation of the British pound is still the most likely scenario, as we stated in the previous article. Although the decline in the consumer price index in January cannot be characterized as "fast," it also cannot be characterized as "weak." Most crucially, it has not yet had any impact on the Bank of England's monetary policy.

The British regulator has already increased the key rate ten times, yet in just three months, inflation has only decreased by 1%. It becomes clear that BA's struggle with inflation is shifting in favor of the latter because the rate cannot increase continuously but has been doing so in recent months in 0.5% increments. Hence, declining inflation does not necessarily indicate that the regulator will refrain from raising the rate in the future, and rising "hawkish" sentiment does not necessarily indicate a lack of declining inflation. In general, the correlation between inflation and the BA rate is currently insignificant. No matter how much the consumer price index declines, the regulator must keep raising the rate at the highest rate. Hence, rather than the rate at which inflation is decreasing, the question is whether BA is willing to keep tightening monetary policy. Yesterday, the market responded to the question of whether it has confidence in BA's capacity to control price growth. As the pound has decreased, traders do not anticipate the regulator taking any new aggressive actions. As a result, the British pound may continue to fall as the Fed is only sending hints of a stricter monetary policy.

Even when the Fed tries to keep markets calm, things don't go well.

Jerome Powell stated two weeks ago that the regulator may opt to tighten monetary policy more firmly if the strength of the American labor market and low unemployment persist. Here, there are two crucial points at once. The labor market is strong, but a high rate may "cool" it by raising the unemployment rate, which would stop wage growth and bring down inflation. High rates will also result in a fall in inflation since less money will be invested and borrowed. And given how well the labor market is doing right now, the Fed is free to raise interest rates in virtually any way until 2023.

Patrick Harker, the chairman of the Philadelphia Federal Reserve, stated yesterday that the Fed should increase the rate by over 5%, which has long been widely accepted. He did, however, emphasize that the specific amount above 5% would depend on the situation. In other words, Harker permits the rate to increase to 6% if the inflation rate stops decreasing. Of course, every Fed meeting will now decide on all of this. The rate may have been increased by 0.75% or 0.5% while inflation was still uncharacteristically high, but now that it is required to address inflation, the choice will be made from meeting to meeting. Yet, the Fed's ability to permit a stronger tightening is what matters most because it gives the US currency more opportunities for future growth.

Harker believes that food prices are still too high and that the process of cutting inflation is moving too slowly, although some of his colleagues are encouraged by the progress. By the end of the year, core inflation will decrease to 3.5%, which will still be much higher than 2%, according to his prediction. Harker also ruled out the possibility of a recession, predicting that the economy will expand by 1% this year and 2% the following. As you can see, the dollar is doing well overall. Rates will continue to rise since the economy is strong, the labor market is solid, and rates are rising. Nothing stands in the way of the British pound. Due to the significant likelihood of tightening the ECB's monetary policy, the euro currency can still balance, but the pound once again runs the risk of hitting the bottom.

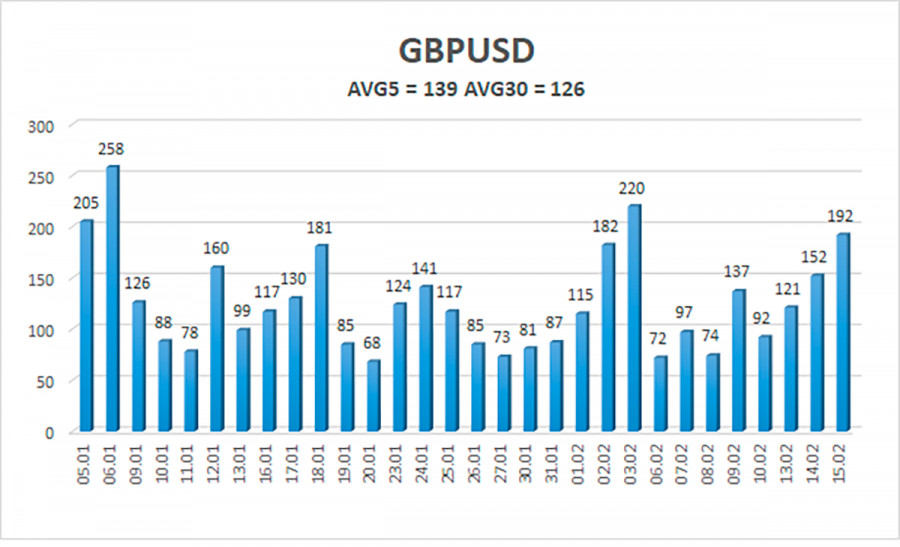

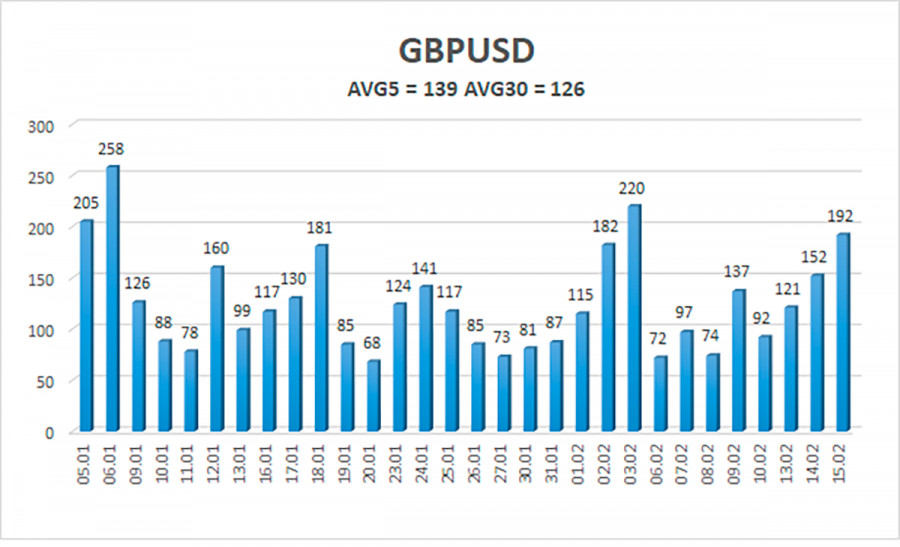

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 139 points. This figure is "high" for the dollar/pound exchange rate. As a result, we anticipate movement on Thursday, February 16, inside the channel, limited by the levels of 1.1861 and 1.2181. A round of corrective movement begins when the Heiken Ashi indicator reverses upward.

Nearest levels of support

S1 – 1.2024

S2 – 1.1963

S3 – 1.1902

Nearest levels of resistance

R1 – 1.2085

R2 – 1.2146

R3 – 1.2207

Trade Suggestions:

Over the 4-hour timeframe, the GBP/USD pair resumed its downward trend. So, until the Heiken Ashi indicator turns up, it is possible to hold short positions with targets of 1.1963 and 1.1902. In the event of consolidation above the moving average, long positions might be initiated with targets of 1.2181 and 1.2268.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.