M5 chart of EUR/USD

EUR/USD started the bearish correction that I have been talking about for a long time. Of course, it is too early to conclude that the fall will be strong and could take long, but yesterday the pair made a big step towards this scenario. I have been mentioning a strong correction since 3 weeks ago, but there were no sell signals on the higher charts, and the market continued to buy the pair even when there were no reasons to do so. The only macro data from yesterday that I could mention are the data on German inflation and U.S. manufacturing activity. German inflation went down from 10% to 8.6% while CPI has fallen from 47.7 to 46.2. It is unlikely that the euro fell because of these reports.

But yesterday's technical picture was quite pleasant. In the very beginning of the European session, there was a sell signal near the Ichimoku indicator, later the price crossed 1.0581 and went down about 50 pips. Unfortunately, the price failed to reach the next target level of 1.0485, but there was no buy signal during the day. Therefore, the deal had to be closed manually closer to the evening with profit around 80 pips.

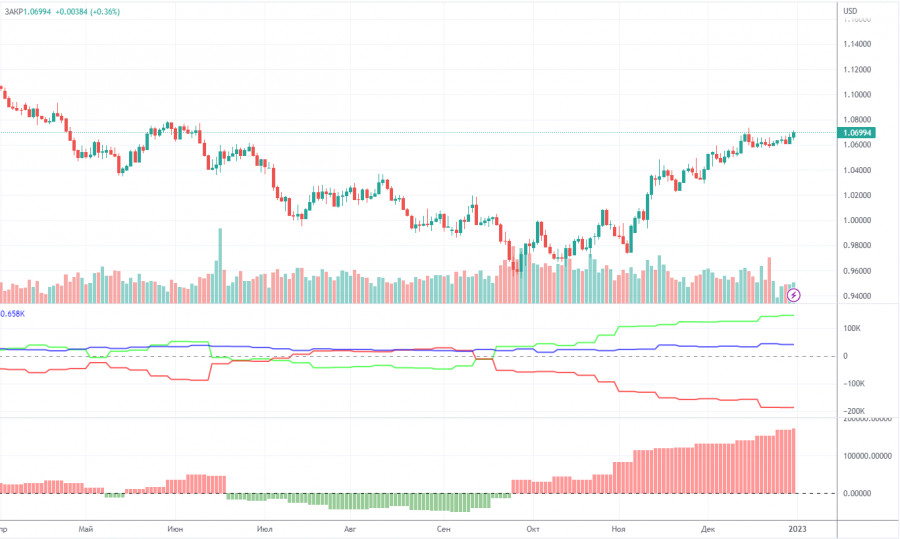

COT report

The COT reports for the euro in the last few months have been fully consistent with what is happening in the market. You can clearly see on the chart that the net position of big players (the second indicator) has been growing since early September. Around the same time, the euro started to grow. At this time, the net position of the non-commercial traders has been bullish and strengthens almost every week, but it is a rather high value that allows us to assume that the upward movement will end soon. Notably, the green and red lines of the first indicator have moved far apart from each other, which often means the end of the trend. During the given period, non-commercial traders opened 2,700 long positions, whereas the number of short positions fell by 1,100. Thus, the net positions rose by 3,800. The number of long positions is 146,000 higher than the number of short positions opened by non-commercial traders. So the question now is how long will the big players increase their longs? Moreover, from a technical perspective, a bearish correction should have started a long time ago. In my opinion, this process can not continue for another 2 or 3 months. Even the net position indicator shows that we need to "unload" a bit, that is, to correct. The overall number of short orders exceeds the number of long orders by 41,000 (685,000 vs. 644,000).

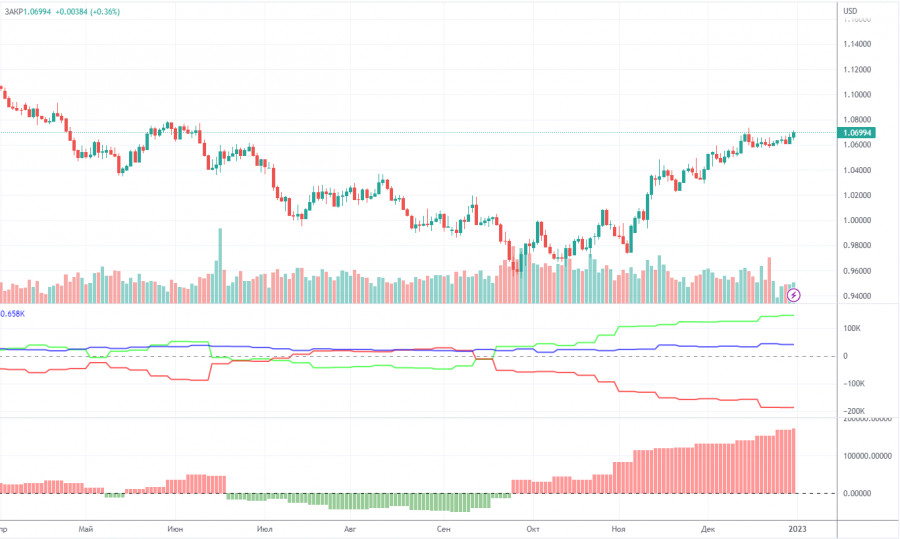

H1 chart of EUR/USD

EUR/USD resumed the downward movement on the one-hour chart, and settled below the horizontal channel, in which it spent several weeks. I expect the euro to fall further, which can only be prevented by Friday's US data. However, I believe that even if they turn out to be weak, in the mid term the US dollar will still show growth. The euro has risen too much and for no reason at all over the last months, a correction is necessary. On Wednesday, the pair may trade at the following levels: 1.0269, 1.0340-1.0366, 1.0485, 1.0581, 1.0658-1.0669, and also Senkou Span B lines (1.0623) and Kijun Sen (1.0616). Lines of the Ichimoku indicator may move during the day, which should be taken into account when determining trading signals. There are also support and resistance levels, but signals are not formed near these levels. Bounces and breakouts of the extreme levels and lines could act as signals. Don't forget about stop-loss orders, if the price covers 15 pips in the right direction. This will prevent you from losses in case of a false signal. On January 4, the ISM manufacturing activity index for December will be released in the US, followed by the Federal Reserve minutes later in the evening. I don't expect the market to show a significant reaction to the minutes, but the ISM index might provoke one in case its value is much different from the forecasts.

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.