A new trading week has begun. Due to the lack of publication in today's economic calendar of important macro statistics, the activity of investors will likely be low. During today's Asian trading session, a slight increase in volatility was observed against the backdrop of the publication of Japanese macro data. Also, volatility (primarily in the quotes of the New Zealand dollar) may increase today towards the end of the trading day, when fresh consumer price indices in New Zealand will be published.

However, volatility in the financial markets may rise to high levels already during tomorrow's Asian trading session. At 00:30 and 02:00 (GMT), the minutes from the October meeting of the RBA and a block of the most important macro statistics on China will be published.

Both publications should directly affect the quotes of the currencies of the Asia-Pacific region, particularly, the quotes of the Australian dollar.

China is Australia's largest trade and economic partner and buyer of its commodities. Therefore, positive macro statistics from China may also have a positive impact on AUD quotes, although recent data from China indicate a slowdown in the world's largest economy, and this is a negative factor for stock markets and commodity currencies. This time, positive macro data is expected from China. If they are confirmed, then the AUD will only benefit from this.

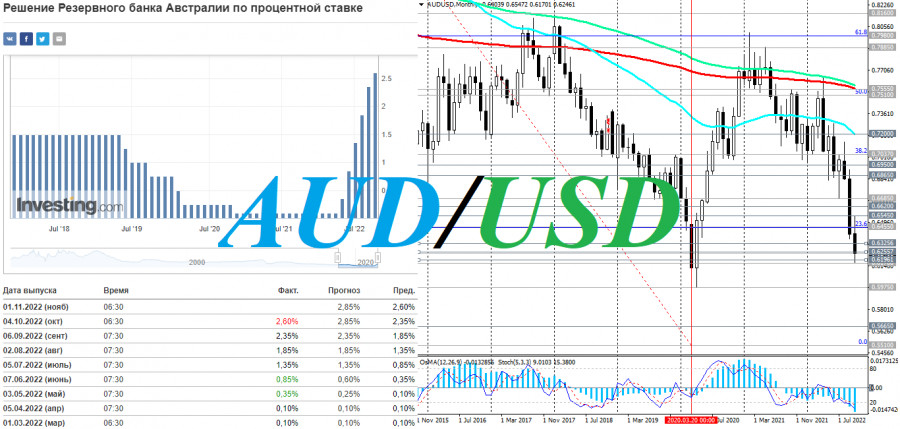

At 00:30, as we noted above, the minutes of the October meeting of the RBA will be published. As you know, during this meeting, the Reserve Bank of Australia raised the interest rate by 0.25%, disappointing buyers of the Australian dollar. The RBA cited weakening growth prospects for the global economy as the main reason for this decision.

The decision to raise the rate by 0.25% came as a surprise to market participants who had expected a 0.50% increase. While the RBA's accompanying statement said that "the central bank remains strongly committed to bringing inflation back to its target" and "expects further interest rate hikes in the coming period," market participants viewed the decision as a mild one to further strengthen the Australian dollar. It fell sharply immediately after the publication of the RBA decision.

Probably, tomorrow's publication of the protocol from this meeting will not bring any surprises. But if it still contains unexpected information, then the volatility in the AUD quotes may rise sharply. Market participants, who follow the dynamics of the AUD, will primarily be concerned about the mood of the RBA leadership regarding the prospects for the bank's monetary policy.

If the RBA is positive about the state of the labor market in the country, GDP growth rates, and also shows a "hawkish" attitude towards the inflation forecast in the economy, the markets regard this as a higher probability of a rate hike at the next meeting, which is a positive factor for the AUD. The soft rhetoric of statements by the bank's leaders regarding, first of all, inflation will put pressure on the AUD.

As of writing, AUD/USD is trading near 0.6250, having managed to recover slightly during the Asian trading session after Friday's big fall. Since April, AUD/USD has been actively declining, which, however, coincides with the beginning of the Fed's monetary policy tightening cycle.

A strong bearish momentum prevails, pushing AUD/USD to new local lows.

The next meeting of the RBA, dedicated to the issues of monetary policy, is scheduled for November 1. According to the forecast, the interest rate is expected to increase by 0.25% to 2.85%. Thus, the RBA is one of the first major world central banks that decided to move towards taming high inflation in smaller steps. This is hardly a strong bullish factor for the AUD.