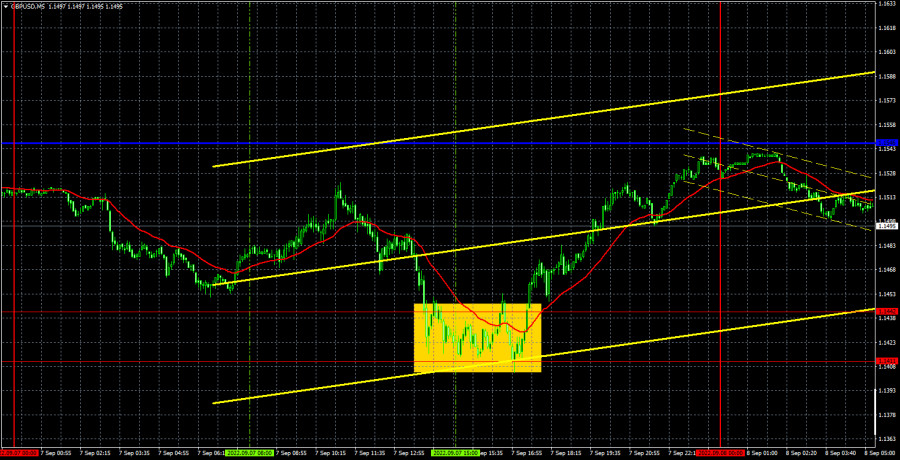

GBP/USD 5M

The GBP/USD currency pair traditionally resumed its downward movement on Wednesday and this time reached the level of 1.1411 and even went below it by a few points. Thus, it can be officially declared that the lows for 37 years have been updated! In principle, we have repeatedly said that this will happen. Now we expect that this level will be overcome, and the pound will set more than one anti-record in 2022. Immediately after the update of the lows, a rather strong upward movement began, which is very difficult to link with macroeconomics or the foundation. If in the case of the euro it can be assumed that the growth is associated with today's European Central Bank meeting and a very likely increase in rates by 0.75%, then in the case of the pound, the growth could only be technical. After all, the pound has also been falling for a very long time and very strongly - corrections should occur from time to time. However, the euro and pound went up almost identically and at the same time, which leads us to assume the technical status of this correction. If so, then both major pairs may resume falling in the coming days. There is absolutely nothing to take note of regarding the previous day's important events.

In regards to trading signals, the pound's situation was better than the euro's. In fact, only one signal to buy was formed in the area of 1.1411-1.1442. This area could also be considered as two separate levels, but when a signal was formed inside it, the price immediately turned out to be near another level, so it was better to consider them together. Thus, when the price settled above 1.1442, it was possible to open long positions. Subsequently, the pound rose almost to the critical line, but the deal should have been closed earlier, manually in the late afternoon. Profit amounted to about 50 points.

COT report

The latest Commitment of Traders (COT) report on the British pound turned out to be as neutral as possible. During the week, the non-commercial group closed 300 long positions and opened 900 short positions. Thus, the net position of non-commercial traders immediately increased by 1,200. The net position indicator has been growing for several months, but the mood of the big players still remains "pronounced bearish", which is clearly seen in the second indicator in the chart above (purple bars below zero = bearish mood). Therefore, the growth of the British pound still cannot count. How can you count on it if the market sells the pound more than it buys? And now its fall has resumed altogether, so the bearish mood of major players in the near future can only intensify. The non-commercial group now has a total of 87,000 shorts and 58,000 longs open. The difference is not as terrifying as it was a few months ago, but it is still noticeable. The net position will have to show growth for a long time to at least equalize these figures. Moreover, COT reports are a reflection of the mood of major players, and their mood is influenced by the "foundation" and geopolitics. If they remain as weak as they are now, then the pound may still be in a "downward peak" for some time. Also remember that it is not only the demand for the pound that matters, but also the demand for the dollar, which seems to remain very strong. Therefore, even if the demand for the British currency grows, if the demand for the dollar grows at a higher rate, then we will not see the strengthening of the pound.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. September 8. The market is beginning to shift its focus away from geopolitics and fundamentals to other factors.

Overview of the GBP/USD pair. September 8. Andrew Bailey pulled down the pound again.

Forecast and trading signals for EUR/USD on September 8. Detailed analysis of the movement of the pair and trading transactions.

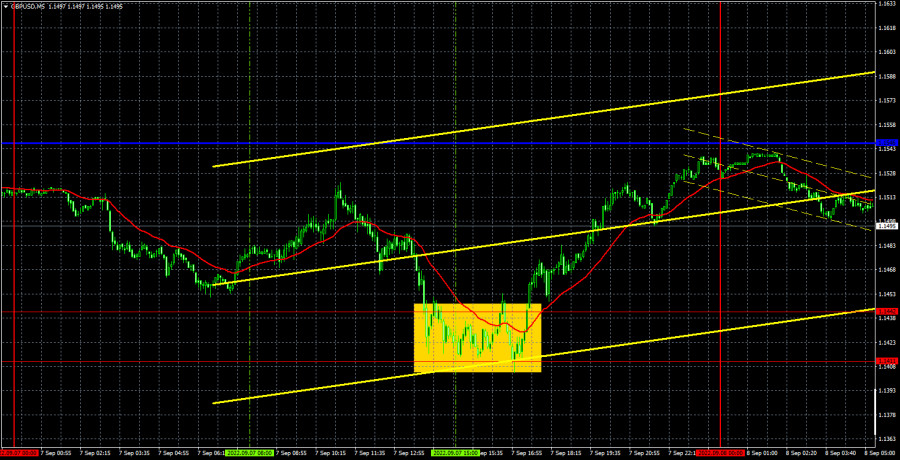

GBP/USD 1H

The pound/dollar pair maintains a downward trend on the hourly timeframe. Despite the rather strong growth from the previous day, the hourly timeframe clearly shows that the price has only moved away from its 37-year lows by 130 points. We highlight the following important levels on September 8: 1.1411-1.1442, 1.1649, 1.1874. Senkou Span B (1.1698) and Kijun-sen (1.1504) lines can also be sources of signals. Signals can be "rebounds" and "breakthroughs" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. There are no major events scheduled for Thursday in the UK, and Federal Reserve Chairman Jerome Powell, whom we haven't heard from in a while, will speak in the US. However, the market now clearly does not need important events and reports to trade actively. The downward trend continues, so after the completion of the current correction, the quotes will most likely resume falling without Powell's help.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.