The GBP/USD pair shifted to the moving average line on Tuesday. Consequently, a rebound from the movement will produce a fresh wave of downward movement, and overcoming it will result in a more robust corrective. Unfortunately, it is currently unnecessary to discuss the pound's upward tendency. Although from a technological point of view, it would make sense. The 4-hour TF reveals that the pound has lost almost 800 points over the past few weeks.

Consequently, it is entirely plausible to anticipate 400 points of correction. However, this is only achievable if the moving is overcome. Even if the moving average is surpassed, we believe the pound will continue to depreciate in the medium run. It is hard to assume that bears will refuse to sell the British pound before it reaches 50-point lows not seen in 37 years. In addition, the fundamental and geopolitical contexts remain unchanged. Thus, the main conclusion is that the pound has been significantly undervalued for an extended period. One may even say it is excessively inexpensive, but it may continue to fall.

How long will the British pound's decline continue? We expect the fall will continue as long as the Fed continues to raise its key interest rate. The markets are "dancing" in response to Fed decisions, as the dollar is the world's reserve currency. Dollars are available in all nations, whereas the pound is a more regional currency. Therefore, the actions of the Bank of England do not have the same effect on the markets as those of the Federal Reserve. In addition, the United Kingdom could face an energy crisis due to rising gas and oil costs. The British government will pay homeowners for a portion of their bills, which have already grown by a factor of two. However, the question is not how awful the British winter will be or how badly the economy will be affected. The issue is the market sentiment. We do not receive reports from the United States of gas shortages or particularly high, unaffordable energy costs (although oil and gas prices are rising in the United States as well). Therefore, the market erroneously assumes everything is okay in the United States. At the same time, the United Kingdom will either freeze to death or starve this winter because all of its money will be spent on energy and heating expenses.

Liz Truss is not an economic panacea.

As is common knowledge, Liz Truss is the new Prime Minister of the United Kingdom. Remember that we projected her triumph despite Rishi Sunak's victories in all the preliminary rounds. Liz Truss is already being referred to as the "Iron Lady," and she is the third female prime minister following Margaret Thatcher and Theresa May. Truss's pre-election claims made her significantly more memorable than Sunak's. She vowed to help Ukraine whatever the outcome and to reduce VAT and compensation for British electricity prices. And this is crucial on the eve of the next parliamentary elections, in which the Conservatives wish to gain another triumph and deny Labor the upper hand. Therefore, Truss was the most qualified and persuasive candidate for high office.

Instantaneously, nothing. Specific economic adjustments will be required to improve or deteriorate the situation. This requires time. Truss's ascension to the position of prime minister has prevented the pound from appreciating in the last several days. Normal corrective growth was observed. Much more crucial will be the duration and magnitude of the Bank of England's rate hike and the severity of peak inflation and recession. As the estimates for these indices are extremely pessimistic, these reasons may continue to weigh on the pound/dollar pair. We do not yet see any positives for the British economy, as tax cuts are a financial burden. The budget is burdened by the allocation of subsidies and compensations to energy firms so that they do not raise energy costs. In general, the economic climate remains fairly challenging.

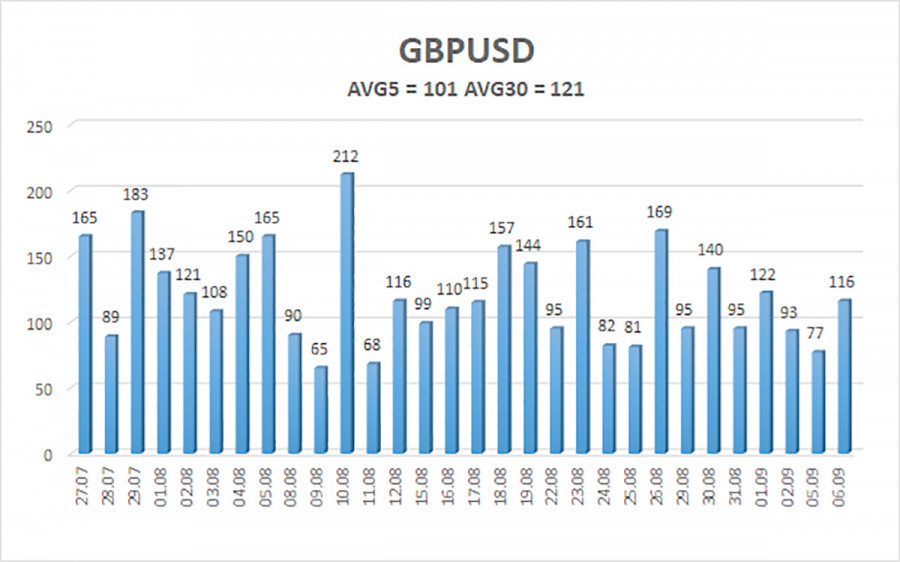

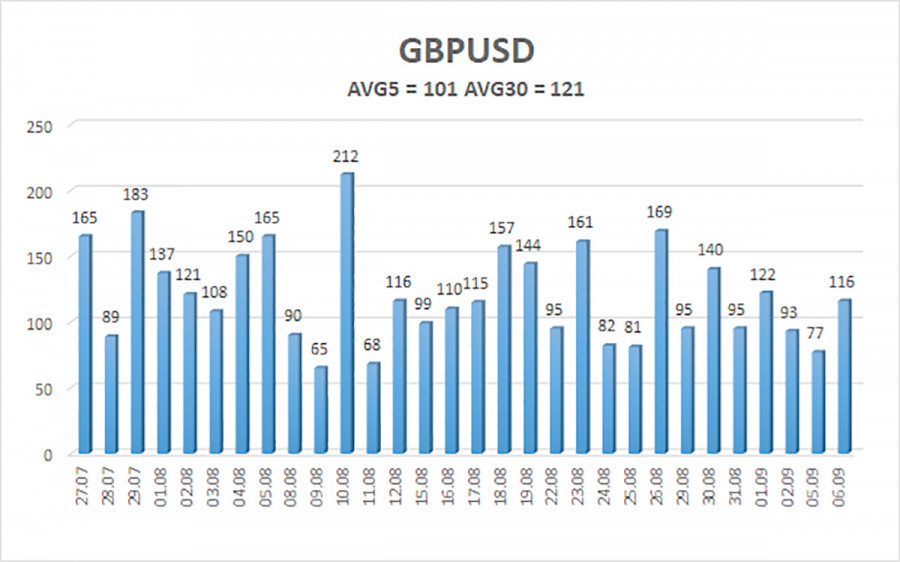

During the last five trading days, the average volatility of the GBP/USD pair was 101 points. This figure is the average for the pound/dollar pair. Therefore, on Wednesday, September 7, we anticipate price action within the channel, with support and resistance at 1.1435 and 1.1637. The downward reversion of the Heiken Ashi indicator signifies the continuation of the downward trend.

Nearest support levels:

S1 – 1.1536;

S2 – 1.1475;

S3 – 1.1414.

Nearest resistance levels:

R1 – 1.1597;

R2 – 1.1658;

R3 – 1.1719.

Trading Recommendations:

The GBP/USD pair has adjusted to the 4-hour moving average and is poised to resume its downward trend. Therefore, new sell orders with targets of 1.1475 and 1.1435 should be opened and maintained until the Heiken Ashi signal goes up. Open buy orders when the price closes above the moving average line with goals between 1.1658 and 1.1719.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. The current trend is strong if both are moving in the same direction.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction;

Murray levels - movement and correction target levels;

Volatility levels (red lines) represent the price channel in which the pair is anticipated to trade tomorrow, based on current volatility indicators.

The CCI indicator — its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.