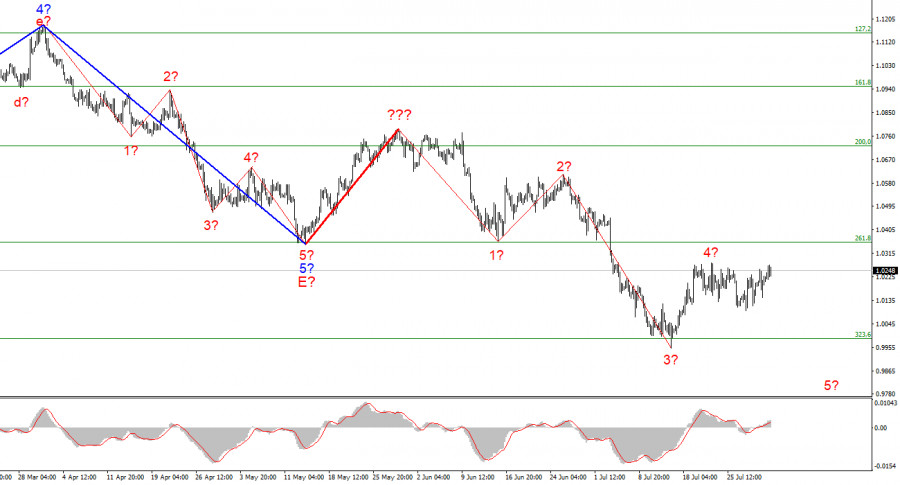

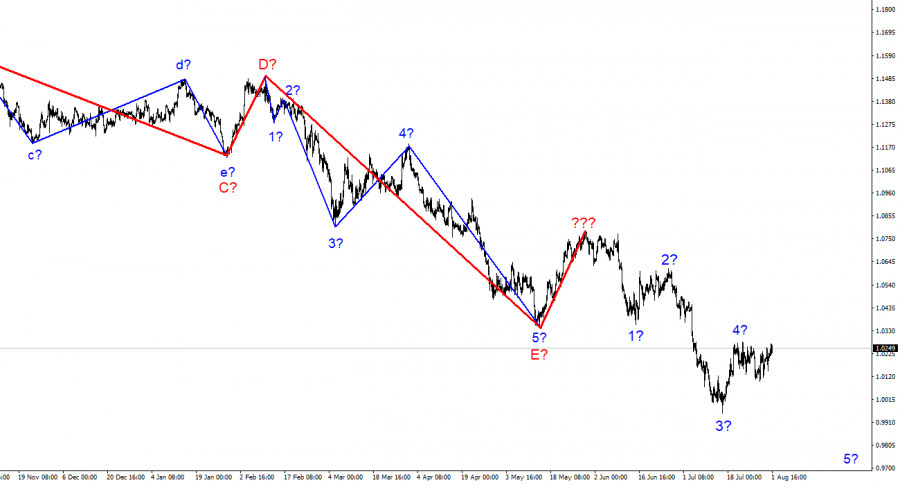

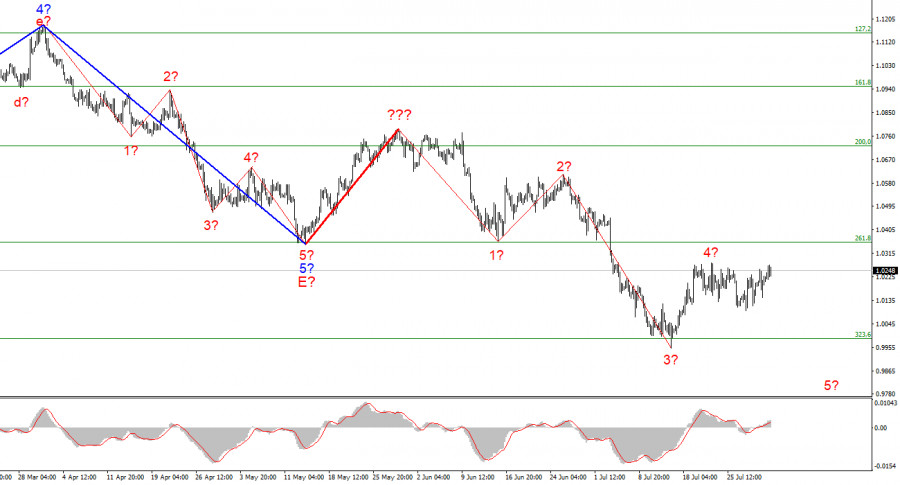

The wave marking of the 4-hour chart for the euro/dollar instrument became more complicated a few weeks ago, but at the moment, does not require new adjustments. A successful attempt was made to break through the 261.8% Fibonacci level, which was also the low of the waves E and b, so these waves are not E and b anymore. I have built a new wave layout, which does not yet take into account the rising wave marked with a bold red line. The whole wave structure can be complicated an unlimited number of times, and this is the disadvantage of wave analysis since any structure can always take a more complex and extended form. Therefore, now I propose to work on simpler wave structures that contain waves of a lower scale. As you can see, now the construction of a descending wave has presumably begun, which may be wave 5 of a new downward trend section. If this assumption is correct, then the instrument will resume its decline with targets located below 1.0000. However, the lack of decline in recent weeks within this wave suggests to me that wave 4 may take a more complex form. Now I would like to avoid this since, in this case, the whole wave pattern may take a more complex form. At the moment, it has an impulse character.

Geopolitics can help the dollar

The euro/dollar instrument was confusing on Monday. At first glance, the news background was not so strong. In the first half of the day, only the index of business activity in the production sector of the European Union was released, which predictably fell below the key mark of 50.0. However, the market did not show any concern about this, and the euro remained near its local peaks. During the day, the instrument even increased by 30 basis points. But it is not economic news that occupies the minds of analysts right now. Two conflicts may form at once in the coming days. Out of the blue, last night, it became known about clashes on the Serbian-Kosovo border due to the desire of the Kosovo authorities to invalidate any documents on their territory, except those issued by them. This is a stone in the garden of Serbian people who remained living on the territory of Kosovo after the end of a long military conflict. Belgrade warned that any encroachment on the Serbian residents would result in a military defeat for the "semi-recognized" Kosovo. There were shooting and sirens on the border, but the conflict seemed to be extinguished very quickly, and at the moment, everything is relatively calm.

An even more interesting situation has arisen around Taiwan. According to US intelligence, China may soon attack this also "semi-recognized" republic. In light of this, under the pretext of an "Asian tour", the speaker of the US Congress Nancy Pelosi went to Taiwan. Her board even disappeared from the radar for a while, so that it was impossible to track its location. This is all done so that China does not attempt to prevent Pelosi's visit to Taiwan, where it will be about defense in case of a possible Chinese attack. Beijing has already stated that any attempt by Pelosi to land in Taiwan could result in "catastrophic consequences" and even the phrase "shooting down her plane" was heard. Geopolitical tensions may lead to an increase in demand for the dollar.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section continues. If so, then now it is possible to sell the instrument with targets located near the estimated 0.9397 mark, which is equivalent to 423.6% Fibonacci, for each MACD signal "down" in the calculation of the construction of wave 5. Wave 4 can already be completed.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any kind of length, so I think it's best now to isolate three and five-wave standard wave structures and work on them.