The EUR/USD currency pair managed to hold above the moving average line on Thursday. Last but not least, the ECB's decision to hike the key rate by 0.5 percent contributed to this. However, we shall discuss this a little bit below. So far, a fragile upward trend remains. The euro, like the pound, has shown an increase of 300 points in the last few days, but this is not enough to infer that the decline is finished. Most of the fundamental and geopolitical variables remain not on the side of the euro. Therefore, it is still difficult to bet on significant growth against the dollar. Moreover, traders "took" the psychological mark of 1.0000 and "took" 20-year lows. What can prevent them from continuing to sell the euro currency on a severe downward trend?

Of course, the decline of the euro will not persist forever. Sooner or later, the armed confrontation in Ukraine will stop, or there will be no additional implications for the European economy due to the sanctions imposed against Russia. Sooner or later, the Fed will cease raising the rate, which may spark a major upward correction or a new upward trend. But thus far, even considering the hike in the Fed's key rate by 0.5 percent, the balance of power between the ECB and the Fed, the euro, and the dollar has not shifted drastically. The European Union will go through a terrible winter without Russian gas and oil. Of course, a full embargo on energy supplies from the Russian Federation has not yet been established, but the process is going slowly in this direction. If there is a total rejection of oil and gas from the Russian Federation, the European Union will have to rapidly hunt for new places of purchase, which it has already done. We agreed with Azerbaijan on enhanced gas supplies to the EU, while Joe Biden attended talks with Saudi Arabia on expanding oil supplies. However, would these countries be able to cover the volumes that were supplied from Russia entirely?

The ECB nonetheless offered a surprise.

In principle, most traders anticipated that the European Regulator would hike the rate by 0.25 percent. It is because Christine Lagarde and the firm have recently exhibited an incredibly inactive stance in the fight against inflation, so we had to assume that for the EU, the fight against inflation is not in the first place. However, now we may reach the same conclusion since one rate hike, even by 0.5 percent, does not imply anything. The ECB has taken a big step toward a long-term tightening of monetary policy, but recall that Christine Lagarde has frequently declared that in 2022 she suggests raising the rate twice by 0.25 percent. This strategy can already be regarded as overfulfilled. And at the beginning of the year, Lagarde even said that the ECB could not chase the Fed and that the rate would not rise in 2022. Either the ECB is trying to influence the markets uniquely, or it is continuously altering its opinion "in the course of the play."

One way or another, a 0.5 percent increase in the rate is still not enough even to slow down price inflation. The latest research showed that prices in the European Union are already expanding at 8.6 percent per annum. Using the example of the Fed and the Bank of England, we can see that even an increase in the rate to 1.25-1.75 percent is not adequate to bet on a decrease in inflation. Therefore, everything will depend on whether the European regulator is ready to continue tightening monetary policy and not limit itself to one or two increases. If so, the European currency may enjoy considerable market support. Even considering the reality of its slide in recent months and years, we believe this currency is already rather oversold. We have not witnessed regular corrections on the 24-hour TF for a long time. Consequently, if the ECB shows its readiness to hike the rate "until the bitter end," the market sentiment may be contrary. Maybe not right now, but it is extremely genuine after a month or two.

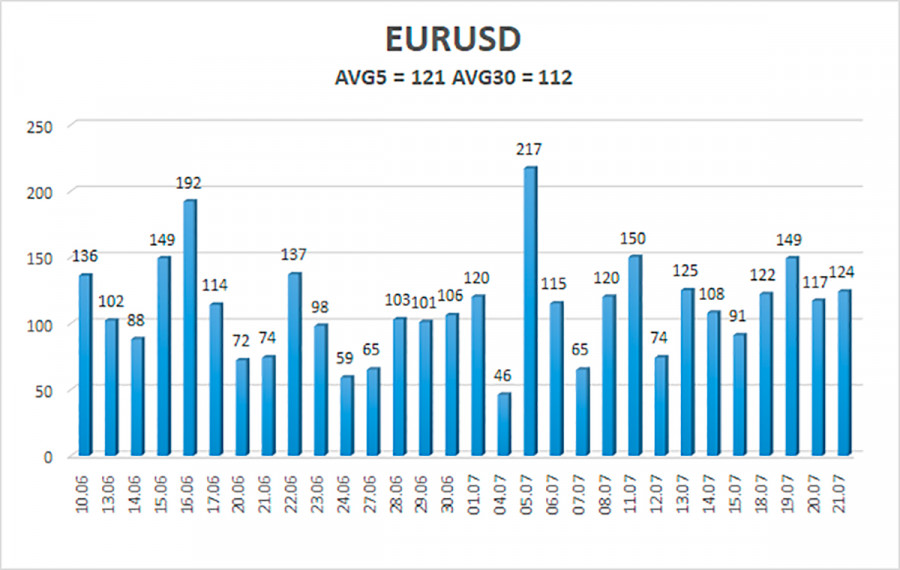

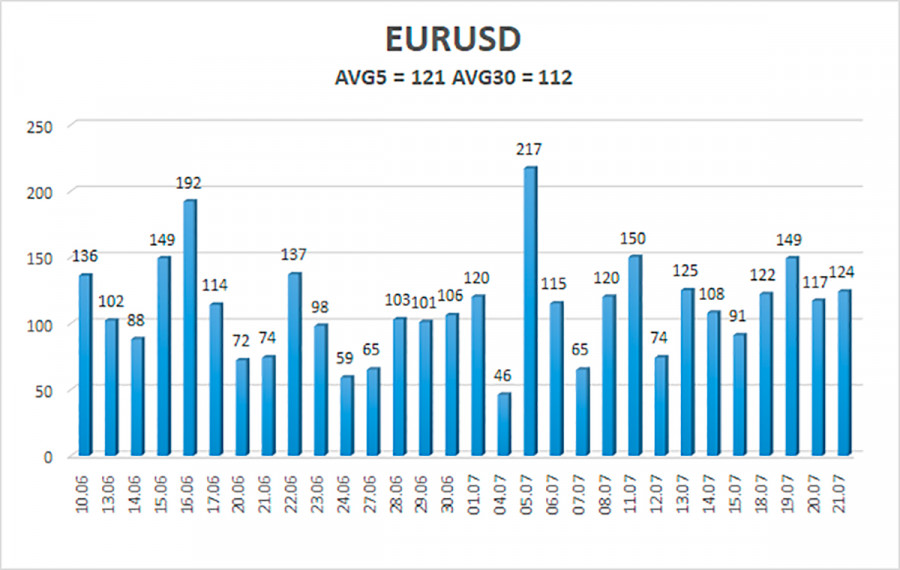

The average volatility of the euro/dollar currency pair over the last five trading days as of July 22 is 121 points and is described as "high." Thus, we expect the pair to trade today between 1.0064 and 1.0307. A reversal of the Heiken Ashi indicator back to the top will signify a likely continuation of the upward trend.

Nearest support levels:

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

Trading Recommendations:

The EUR/USD pair has started a new fall cycle but stays above the moving average. Thus, new long positions with goals of 1.0254 and 1.0307 should now be explored in the case of a price rebound from the moving average line. The pair's sales will become significant again when anchored below the moving average with targets of 1.0064 and 1.0010.

Explanations of the illustrations:

Linear regression channels – help determine the present trend. If both are directed in the same direction, then the trend is strong presently.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be undertaken currently.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) indicate the expected price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) implies that a trend reversal in the opposite direction is imminent.