EUR/USD 5M

The EUR/USD pair was once again trading in a flat on Tuesday, as it was on Monday. The 30-minute TF clearly shows the character and direction of the pair's movement over the past few days. As we have said in other articles, what is most surprising now is the fact that the price cannot start a tangible upward correction after a fairly strong fall, which is also perfectly visible in the chart above. Thus, the market is either frankly waiting for the results of the Federal Reserve meeting, or is preparing for new short positions on the pair, because when the trend ends, a rather sharp rebound from the lows follows, which is not observed now. A report was published in the European Union on Tuesday. The unemployment rate fell from 6.9% to 6.8% in March and did not affect the mood of traders. European Central Bank President Christine Lagarde delivered a speech yesterday, but it did not have much influence on the pair's movement. At the moment, there is not even any information in the media about Lagarde's statements.

There were only two trading signals during the past day. After the only segment of the trend movement during the day, the pair reached the critical Kijun-sen line and rebounded from it. However, this rebound was very inaccurate and at first it could be mistaken for a breakthrough. Thus, at this moment, traders could mistakenly open long positions, although they should not have done this, since at the time the signal was formed, the pair had already gone up 75 points. When the price settled below the critical line and then rebounded from it, it was absolutely necessary to open short positions, which made it possible to earn 20-30 points.

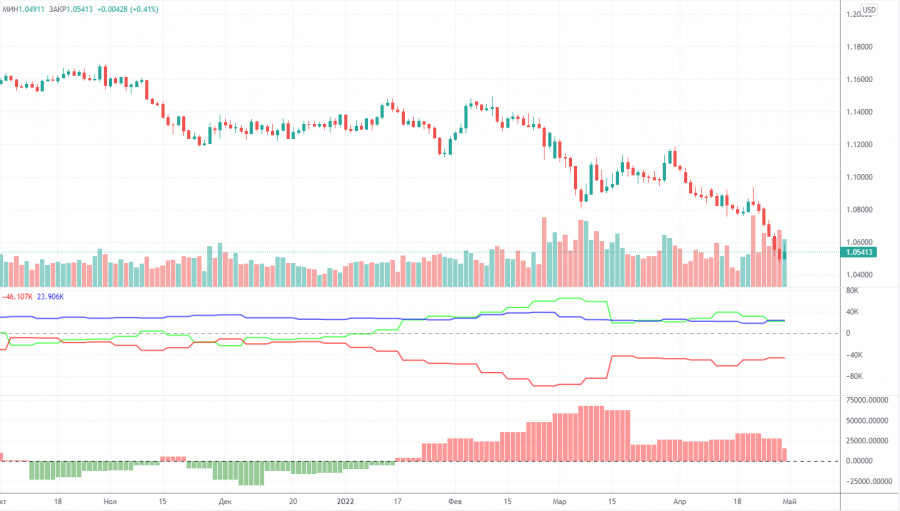

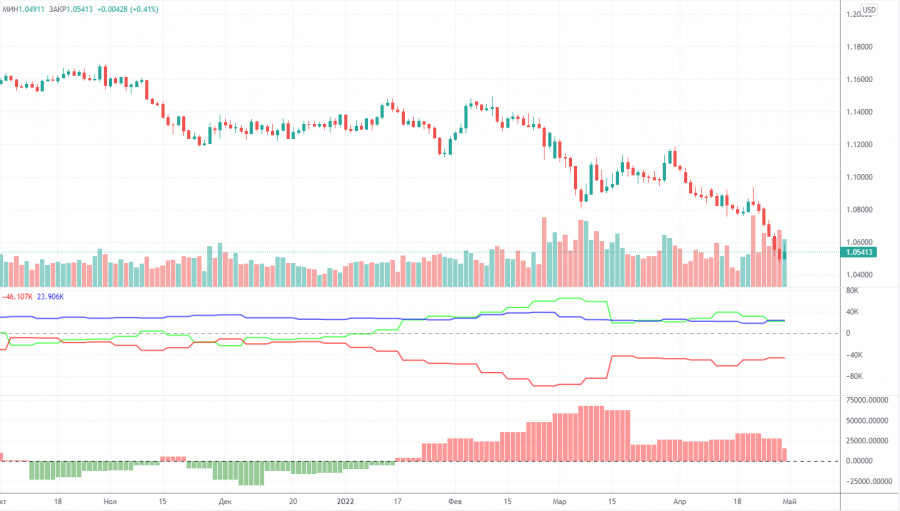

COT report:

The latest Commitment of Traders (COT) reports on the euro raised more questions than they answered! Major players, starting from January 2022, maintain a bullish mood, and the euro currency, starting from January 2022, maintains a downward trend. During this time, it has already fallen in price by almost 10 cents, however, all this time the mood remained bullish. During the reporting week, the number of long positions increased by 2,000, while the number of shorts in the non-commercial group increased by 11,000. Thus, the net position decreased by 9,000 contracts. This means that the bullish sentiment has eased, but it is still bullish, as the number of long positions now exceeds the number of short positions held by non-commercial traders by 22,000. Accordingly, the paradox remains and it lies in the fact that professional players generally buy more euros than they sell, while the euro continues to fall almost non-stop, which is clearly seen in the chart above. We explained earlier that this effect is achieved by higher demand for the US dollar (there are simply no other options). The demand for the dollar is higher than the demand for the euro, so the dollar is growing in tandem with the euro. Therefore, the data of COT reports on the euro now does not make it possible to predict the further movement of the pair. The longer the phase of active hostilities in Ukraine lasts, the higher the likelihood of serious consequences of the food and energy crises for the European Union, and the dollar may continue to grow due to its status as a "reserve" currency and the stability of the American economy.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. May 4. Will there be anything before May 9th? How can the conflict between Ukraine and Russia develop?

Overview of the GBP/USD pair. May 4. The UK is heading for nuclear power.

Forecast and trading signals for GBP/USD on May 4. Detailed analysis of the movement of the pair and trading transactions.

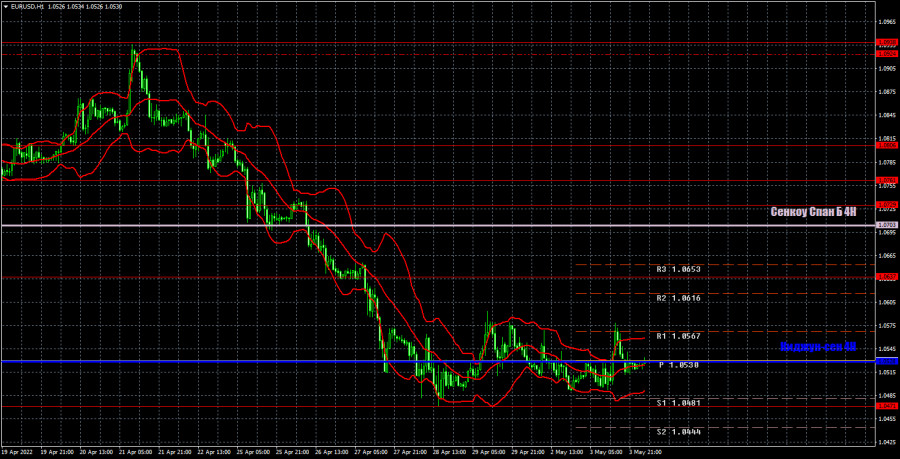

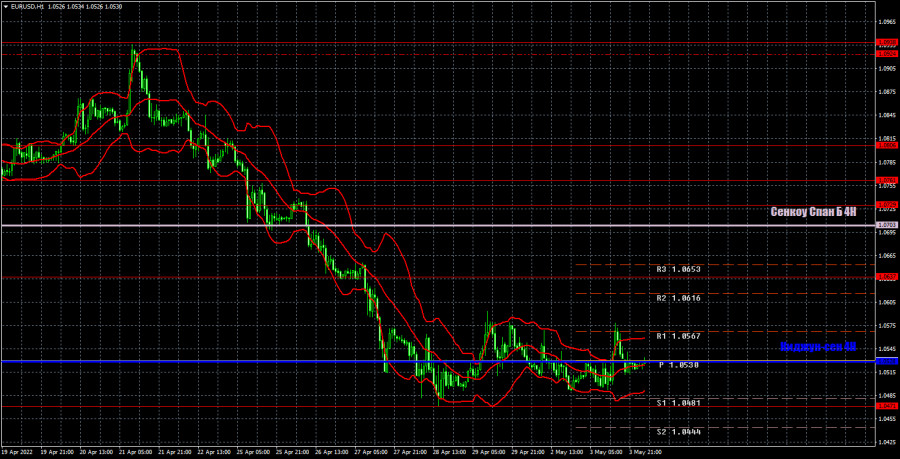

EUR/USD 1H

It is clearly seen that the pair maintains a downward trend on the hourly timeframe and is in close proximity to its 5-year lows. Even if there is no new negative for the euro, traders still do not want to start an upward correction. The situation for the euro may worsen today, as the Fed is almost guaranteed to raise the rate by 0.5%. We allocate the following levels for trading on Wednesday - 1.0340-1.0369, 1.0471, 1.0637, 1.0729, as well as Senkou Span B (1.0703) and Kijun-sen (1.0528). Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. There are also secondary support and resistance levels, but no signals are formed near them. Signals can be "rebounds" and "breakthrough" extreme levels and lines. Do not forget about placing a Stop Loss order at breakeven if the price has gone in the right direction for 15 points. This will protect you against possible losses if the signal turns out to be false. The European Union is set to publish an index of business activity in the services sector and a report on retail sales on Wednesday. We do not believe that they will have any impact on the pair's movement. More important ISM and ADP reports in the US, and in the evening, the announcement of the results of the Fed meeting and Jerome Powell's press conference. We remind you that the market reaction to the Fed meeting may be unpredictable, even if a decision is made to raise rates by 0.5%.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.