The EUR/USD currency pair continued to decline at the same unhurried pace on Thursday. In recent days, the European currency has been doing nothing but falling, while it cannot form even a minimal upward correction. And yet, despite the almost recoilless movement on the 4-hour TF, in general, the euro is not going down so fast. It loses an average of 20-30 points a day, but every day. There is absolutely nothing surprising in this. We have repeatedly listed a whole list of reasons why the euro currency has been falling in recent months and is likely to continue to fall during 2022. Even if we remove all the macroeconomic reasons, and leave only the geopolitical conflict between Ukraine and Russia, then it is enough for a powerful fall in the euro this year. In the meantime, we state the fact: the trend for the euro/dollar pair is descending again, but the quotes are with great difficulty held above the Murray level of "1/8" - 1.0864. It is this level that saves the euro currency from a new, more powerful fall. Recall that the pair is very close to its 15-month lows and is desperately looking for reasons to grow a little.

In the near future, however, a correction may still begin. It should be recognized that now the intensity of the military conflict between Ukraine and the Russian Federation has weakened. This, of course, does not mean that it is exhausted. According to the statements of many international experts, Moscow will relocate its troops to the Kherson, Donetsk, Luhansk, and Mykolaiv regions. If there are new fights, such news may become the basis for the fall of the euro currency.

Ukrainian-Russian negotiations: there is no way out.

Meanwhile, discussions of negotiations between Kyiv and Moscow, which gave a lot of reasons for optimism a week ago, have died down everywhere. Recall that after the next round in Turkey, both delegations stated that there was a breakthrough in the negotiations. And two days later it turned out that a breakthrough might have been outlined, but Kyiv and Moscow were not significantly closer to signing a peace agreement. We have repeatedly drawn attention to the fact that the parties can agree on 90% of the issues, but what about Crimea and Donbas? Kyiv's position: these territories are Ukrainian, and there can be no other way. Moscow's position: independence of Donbas, belonging of Crimea to Russia. And tell me, what can be the way out of this situation? A completely absurd opinion has already been voiced to suspend military operations and freeze issues with Crimea and Donbas for 15 years, during which to negotiate. However, what kind of negotiations can there be for 15 years, if the authorities in both Ukraine and Russia may change several times during this period. And what is the point of these negotiations if they are already underway, but there is no result? Thus, from our point of view, the negotiations are doomed to failure. Or, in general, they are an ordinary screen, so that if something happens, both sides can say: "we conducted peace talks, but we could not agree."

Yesterday, Russian Foreign Minister Sergey Lavrov said that Ukraine had provided a new version of the peace agreement, in which "security guarantees apply to Crimea," although there was no such wording following the Istanbul talks. Kyiv's position regarding the conduct of military exercises in Ukraine has also been changed. In the previous version of the agreement, it was stipulated that any exercises would be coordinated with all the guarantor countries. There is no such wording now. These statements once again confirm that Kyiv and Moscow will not be able to agree since their positions differ radically. Thus, the conflict is likely to drag on for many months or even years. This means that Europe will face stagflation, energy, and food crisis.

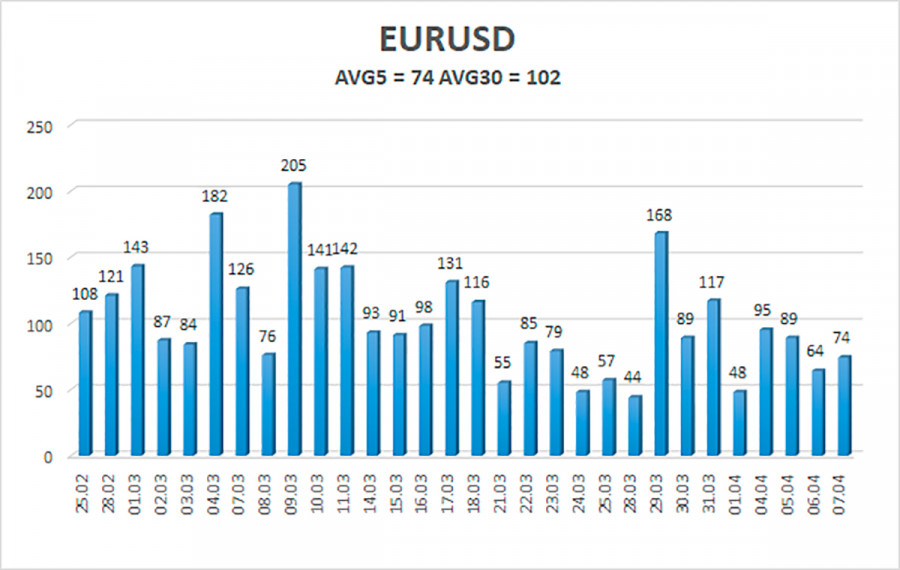

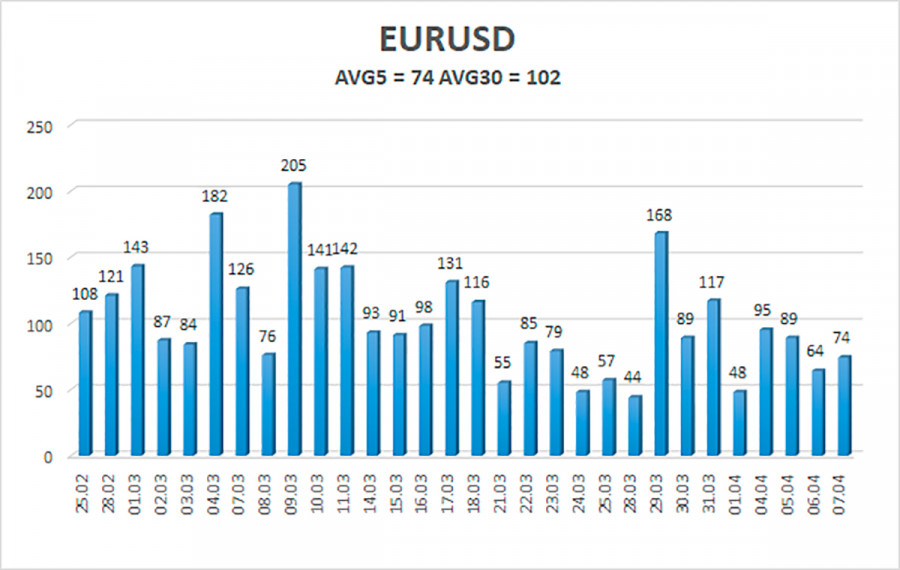

The volatility of the euro/dollar currency pair as of April 8 is 74 points and is characterized as average. Thus, we expect the pair to move today between the levels of 1.0830 and 1.0978. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 1.0864;

S2 – 1.0742;

S3 – 1.0620.

Nearest resistance levels:

R1 – 1.0986;

R2 – 1.1108;

R3 – 1.1230.

Trading recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, now you should stay in short positions with targets of 1.0830 and 1.0742 until the Heiken Ashi indicator turns up. Long positions should be opened with a target of 1.1108 if the pair is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.