In early February, the crypto market saw light at the end of the tunnel. The 2-month long downward correction seemed to be coming to an end. BTC quickly regained $45,000 and settled at this level. However, bitcoin began to slide down afterwards, reaching a low of $36,300. The crypto community is debating whether the market is turning bearish or BTC is going down due to recent events worldwide.

Here are 5 arguments in favor of a bear market shift, ranging from fundamental factors to local, interconnected ones.

Geopolitical situation

Vladimir Putin's decision to recognize the self-proclaimed rebel regions of DPR and LPR as sovereign states has brought the world close to the point of no return. The next day, wide-ranging sanctions were imposed on Russia by many European countries, as well as the US and Canada. Rising tensions are weighing down on the stock market. Investors abandon high risk assets, trying to protect their capital. As a result, the crypto market has nothing that could give it support and reverse the main cryptocurrencies upwards.

Fed policy

Amid rising war risks in Europe, the Federal Reserve's influence on the cryptocurrency market has been overlooked. However, its impact on crypto assets has been significant. The Fed's monetary tightening and interest rate hike is likely to push down digital assets. The market cap of $2 trillion could be unreachable for crypto in 2022. As investment flows dwindle, major market players would seek more lucrative and less risky profit opportunities. The Fed policy is likely to hit the DeFi and NFT markets particularly hard, bringing liquidity down to swing lows and all-time lows, depending on the platform. The Federal Reserve could become the main obstacle for the crypto market's growth in the long term.

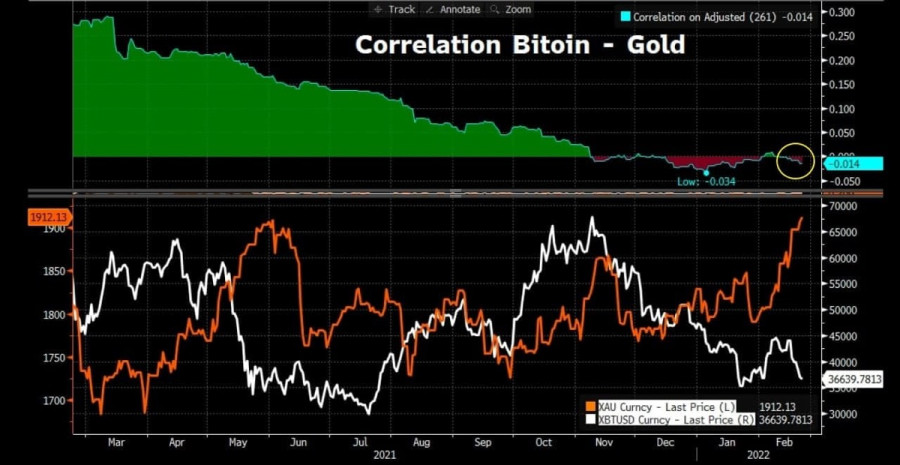

Bitcoin vs. gold

Gold entered a new uptrend during a spike of BTC's dominance in the crypto market. It seemed that investors were hedging risks caused by Fed statements and growing tensions between Russia and Ukraine. However, the correlation between gold and BTC turned out to be negative – investors did not use bitcoin as a defensive asset. The precious metal climbed to an 8-month high, while the cryptocurrency plunged to swing lows. In the meantime, the market cap of stablecoins pegged to gold pushed new highs. Compared to gold, bitcoin has yet to gain trust of investors.

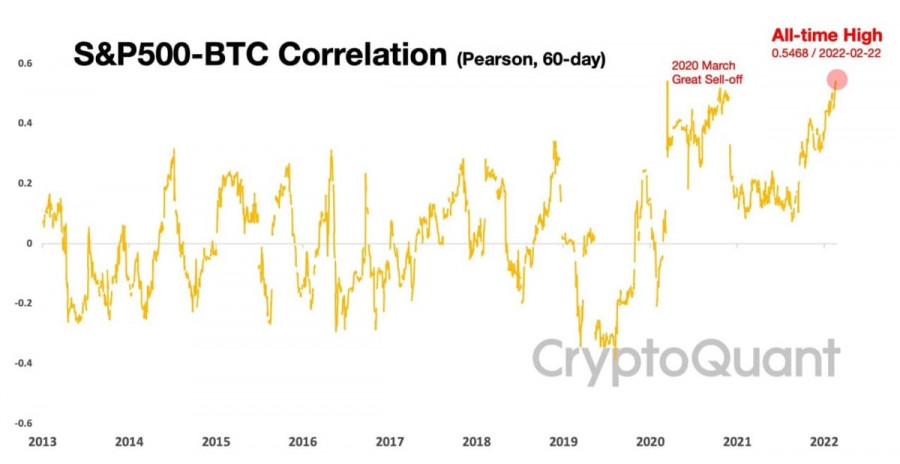

Record high correlation between BTC and US equities

The very high correlation between bitcoin and US stock indexes suggests the cryptocurrency is recognized as a high-risk asset. Although it indicates that regular financial institutions have accepted BTC, they still do not view it as a defensive asset. The high correlation between crypto and equities is another sign of an upcoming crypto winter.

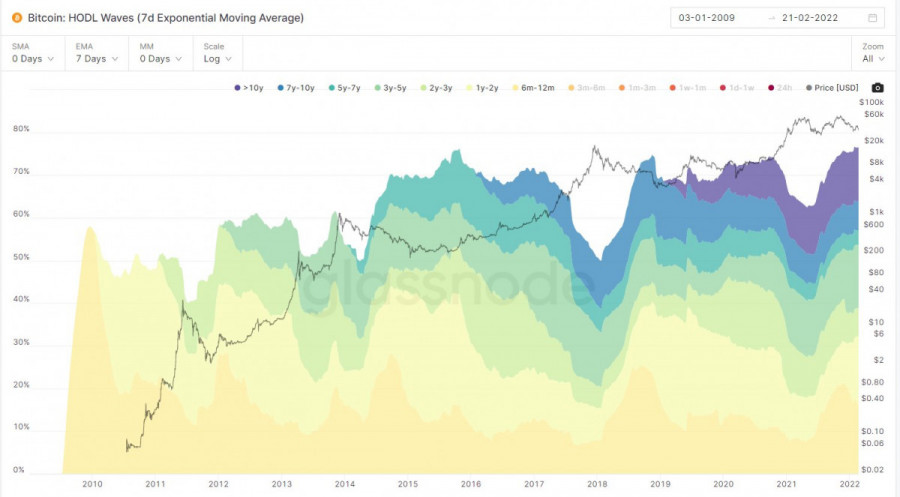

Share of mid-term holders reached all-time high – 76.5%

Major investors are abandoning crypto assets – Cardano has experienced a major outflow, while Ethereum's inflows are increasing. In the meantime, market players are holding onto their BTC investments – the number of wallets holding BTC for more than 6 months has reached a record high of 76.5%. Investors could possibly sell their assets to limit their losses. Alternatively, they are following the HODL trading strategy, which is widely used in the crypto market during a long downtrend.

Nevertheless, it is not completely certain that bitcoin and the crypto market are in a lengthy downtrend. Perhaps the market is digesting the current situation – eventually it will be priced in the value of the cryptocurrency. In the afternoon, the asset regained $39,000. However, the candlestick pattern suggests the position of bulls is weak – there is no potential for a long-term uptrend.

BTC has managed to hold on to $37,100, giving bullish traders some time to consolidate and push the asset upwards. However, this is unlikely under current conditions. BTC/USD could likely slump into the $35,000-$32,000 range by the end of February. Its future trajectory would be determined by the reaction of the market and market makers, the movement of stock indexes, and the geopolitical situation.