Long positions on EUR/USD:

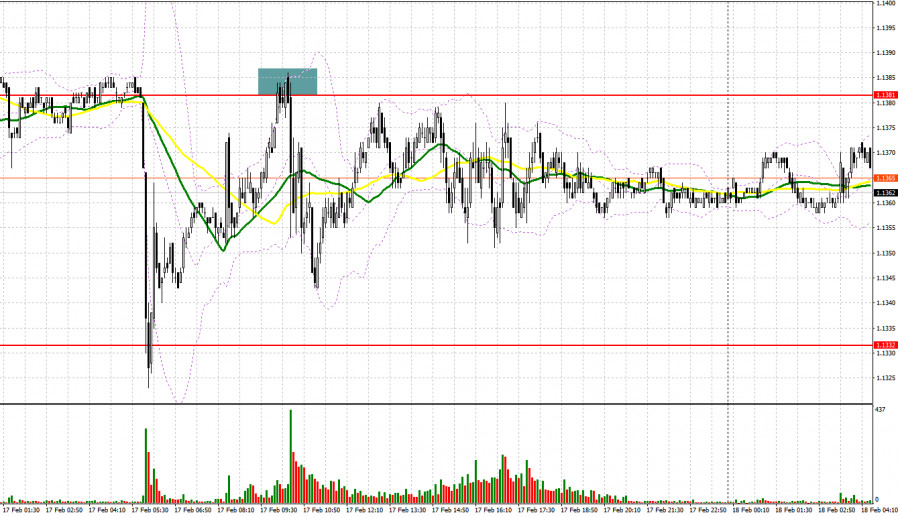

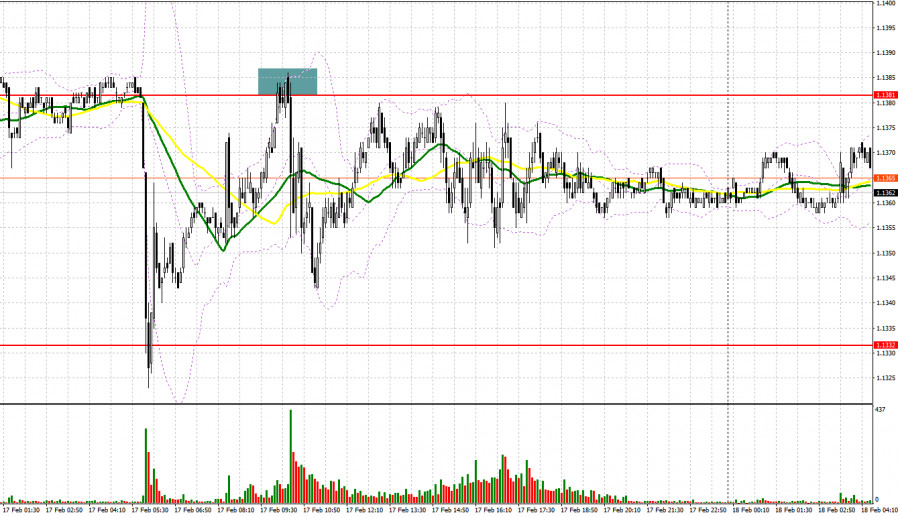

Yesterday, a single entry signal was produced in the first half of the trading day as volatility decreased sharply in the North American session. Let's switch to the M5 chart and analyze it. In my previous analysis, I said you should pay attention to the level of 1.1381 and consider entering the market from this point. After a mass sell-off in the Asian session, the euro showed considerable growth, so bullish sentiment increased and support of 1.1381 was updated. A false breakout there in the first half of the day generated a strong sell signal. The quote fell by around 40 pips as a result. Yet, the price failed to reach the target in the second half of the day due to average fundamentals that had no effect on the market whatsoever. Therefore, no entry signals were formed.

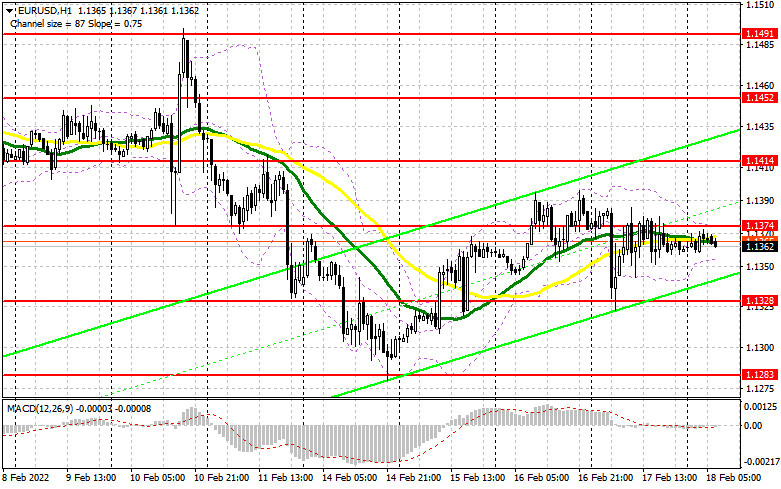

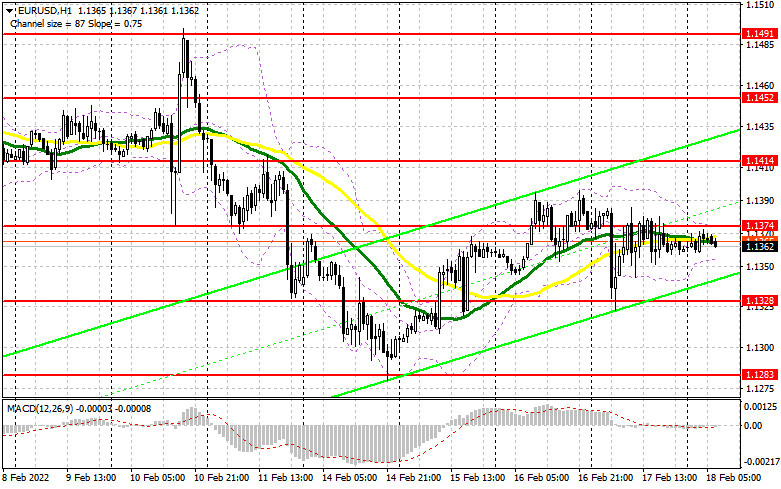

Today, traders will focus on the speeches of members of the ECB and the US Federal Reserve. Fundamentals in the eurozone, including February consumer confidence, are unlikely to somehow affect EUR/USD. The bulls' goal today will be to protect the support level of 1.1328 formed after the fall in the first half of the day. The bulls were actively buying the instrument there. Let's hope, they will also remain active there today. The pair's further movement is unclear as it trades in the area of the moving averages. A false breakout at 1.1328 could produce the first signal to buy the asset. However, the price may fall in the event of disappointing PPI results in France and the ECB's current account balance. If so, the current corrective move might end. Protection of this range will also allow buyers to preserve the lower limit. The EUR/USD pair will be able to recover after a breakout of resistance at 1.1374. Yesterday, the quote failed to consolidate above it. A breakout and a test of this level will generate another buy signal. In such a case, the quote may rise to 1.1414. The bullish trend will resume after a breakout of this range with targets at the highs of 1.1452 and 1.1491 where traders should lock in profits. If Russia-Ukraine tensions escalate, demand for the greenback will increase. Therefore, traders should be extremely cautious at the current highs. If the pair goes down in the European session and there is a lack of bullish activity at 1.1328, long positions could be opened only after a false breakout at 1.1283. Likewise, long positions could be entered after the price bounces off 1.1235 or around 1.1200, allowing a 20-25 pips correction intraday.

Short positions on EUR/USD:

The bears did not let the bulls touch new highs yesterday. Therefore, the euro/dollar pair may fall at the end of the week. Nevertheless, the greenback is getting stronger on expectations of a rate hike by the US regulator. The Fed's members are preparing to deliver speeches today, which could remind traders of the power of the American economy. So, the dollar may score gains as a result. To maintain control over the market, the bears should protect the resistance level of 1.1374. A false breakout there will send a signal to sell EUR/USD with the target at the support level of 1.1328. A breakout and a retest of this range will make an additional sell signal with targets at the lows of 1.1283 and 1.1235. Another target is seen at around 1.1200 where traders should lock in profits. A plunge will be possible in the event of strong macroeconomic results in the United States and the escalation of tensions between Russia and Ukraine. In such a case, demand for the safe haven will increase. If the pair goes up and there is a lack of bearish activity at 1.1374, short positions could be opened only after a false breakout at 1.1414. Likewise, short positions could be entered after the price bounces off 1.1452 or around 1.1491, allowing a 15-20 pips correction intraday.

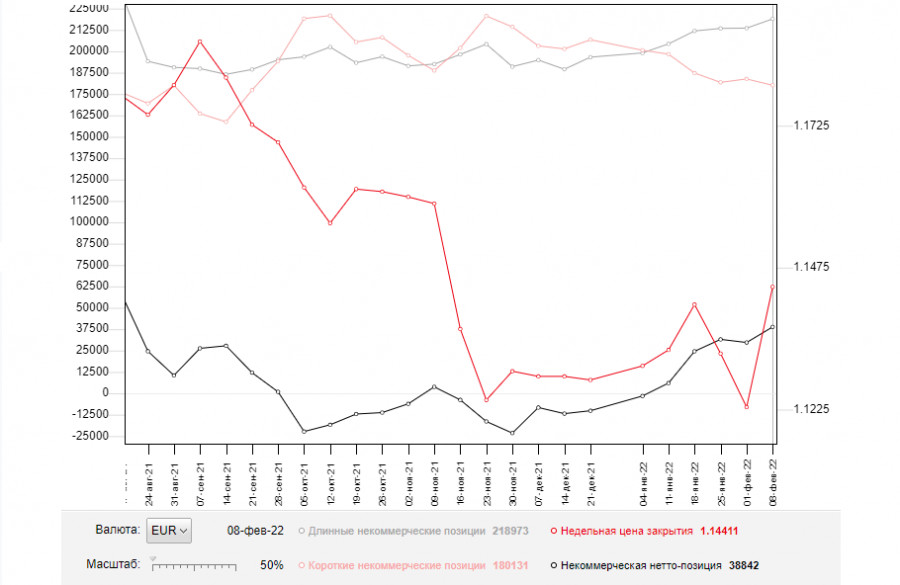

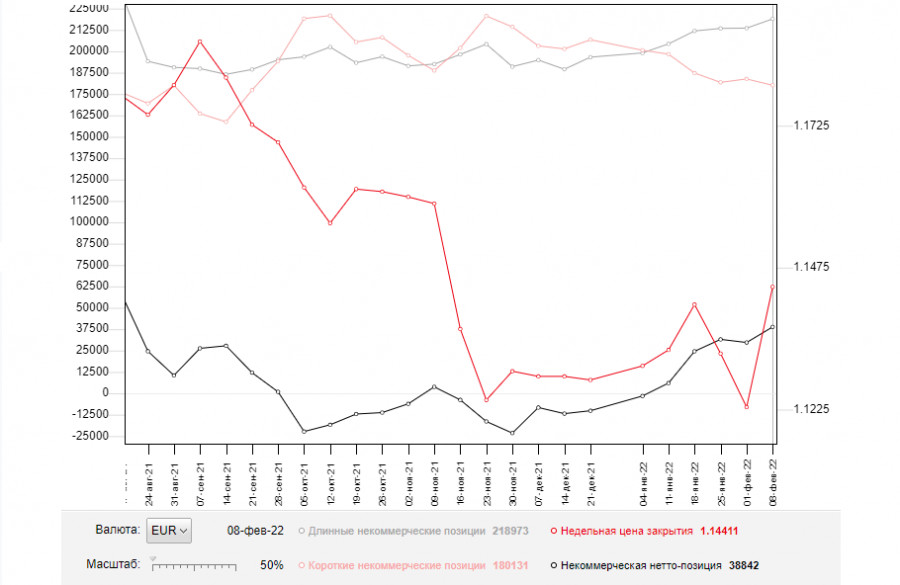

The COT report as of February 8 logged a rise in long positions and a decrease in short ones. This report already takes into account the outcome of the ECB meeting. President Christine Lagarde made it clear to all market participants that the regulator would resort to aggressive measures if the current inflation situation did not change, or changed for the worse. Last week, ECB officials adopted the waiting stance, and a reversal of the bull market led to a decline in the EUR/USD pair. Demand for risk assets also decreased due to the Russia-Ukraine tensions. However, the main driving force behind the weaker euro was the Fed's closed meeting on Monday, February 14. Some economists expect the central bank to raise rates by 0.5% in March. Initially, a 0.25% hike had been expected. This is clearly a bullish signal for the US dollar. The COT report revealed an increase in long non-commercial positions to 218,973 versus 213,563 and a decrease in short non-commercial positions to 180,131 from 183,847. This suggests that traders continue to build up long positions wherever the euro goes down. The total weekly non-commercial net position rose slightly and amounted to 38,842 versus 29,716. The weekly closing price jumped to 1.1441 from 1.1229 a week earlier.

Indicator signals:

Moving averages

Trading is carried out in the area of the 30-day and 50-day moving averages, indicating a sideways trend in the market.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

There have been no entry signals due to very low volatility.

Indicator description:

Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

Bollinger Bands. Period 20

Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

Long non-commercial positions are the total long position of non-commercial traders.

Non-commercial short positions are the total short position of non-commercial traders.

Total non-commercial net position is the difference between short and long positions of non-commercial traders.