Here are the details of the economic calendar for February 14:

Monday was traditionally accompanied by an empty macroeconomic calendar, but traders were not bored. The intrigue around the emergency meeting of the Federal Committee on Open Market Operations led to a decline in stock indices during February 10-11. The meeting was behind closed doors, limiting itself to a short press release without any comments or remarks. Based on the available information, the Fed focused on reducing the share of overdue loans, which hints at the inevitability of an increase in the refinancing rate.

It should be noted that there are more questions at the last meeting than answers. Therefore, the market, confused about what was happening, moved to stagnation.

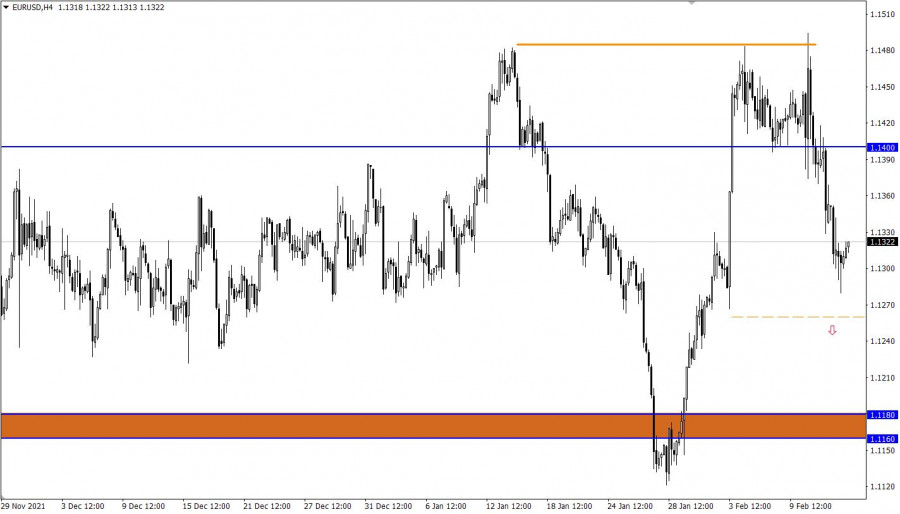

Analysis of trading charts from February 14:

The EUR/USD pair lost more than 200 points in value in three trading days. This is a strong price change, which led to the recovery of dollar positions by more than 50% relative to the recent correction.

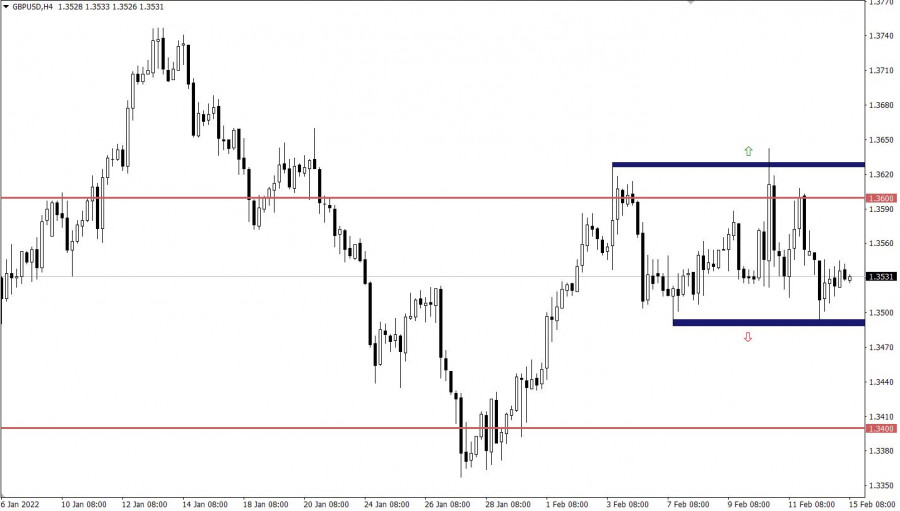

The GBP/USD pair failed to leave the long-playing side channel 1.3500/1.3600. The quote is still moving within its borders. This movement indicates the indecision of market participants for the next move. Unlike the pound, it is worth considering that the EUR/USD pair showed downward activity, ignoring the correlation between trading instruments.

February 15 economic calendar:

The UK labor market data was released today at 7:00 Universal time, where the unemployment rate remained at the same value of 4.1%. At the same time, the change in the number of applications for unemployment benefits in January fell by 31.9 thousand. Despite the positive data, they still coincided with market expectations, so there was no reaction.

As for Europe, the second estimate of GDP for the fourth quarter is expected to be published, which is likely to coincide with the first estimate. This means that the data for the EU should show an increase in the pace of the economy from 3.9% to 4.6%. The indicators are good but already considered in the quotes.

Next is the macroeconomic data in the US, where producer prices will be published. Their growth rates are expected to slow down from 9.7% to 9.1%.

Time targeting

EU GDP - 10:00 Universal time

US producer prices - 13:30 Universal time

Trading plan for EUR/USD on Feb 15:

The market stagnated since the quote is close to the local oversold status. This process may lead to a price pullback, which will lead to a regrouping of trading forces.

The subsequent increase in the volume of short positions will occur after holding the price below the level of 1.1260 in the H4 timeframe.

Trading plan for GBP/USD on Feb 15:

In this situation, price movement in a sideways range indicates the process of accumulation of trading forces, where trading within its limits is considered a less attractive tactic than trading on a breakdown.

The signal level is 1.3630 when considering buy positions, and 1.3480, in case of transition to the stage of recovery of downward interest.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.