The exchange rate of bitcoin and ether is gradually recovering its positions, ignoring inflation data in the United States, which could somehow negatively affect investor sentiment, after yesterday's speech by Federal Reserve Chairman Jerome Powell.

Let me remind you that the Fed chairman told Senate lawmakers that he expects interest rates to rise this year along with the end of the monthly bond purchase program in March and the reduction of the Fed's balance sheet. Powell noted that these steps will be required to regain control over inflation, but such actions do not pose a threat to the economy - it has already largely recovered from the shock caused by the coronavirus pandemic and its various waves. Powell also did not talk about how many interest rate hikes there will be this year.

The reaction of the cryptocurrency market was lightning fast, as concerns related to the recent hawkish tilt of the Fed and the prospect of a more aggressive rate hike calmed down a bit, forcing investors to look at the cheaper assets.

Kim Kardashian and Floyd Mayweather

And while bitcoin, ether and other altcoins are "licking their wounds" after the January bear rally, two fairly well-known American celebrities were indirectly involved in a cryptocurrency scam. At least that's what those who filed a lawsuit against them claim. Celebrities have been appearing more and more in the news concerning the crypto industry lately, and as we can see, not always on the positive side.

This happened to Kim Kardashian and Floyd Mayweather, who is now accused of artificially inflating the price of the EthereumMax cryptocurrency. Let me remind you that EthereumMax lost about 97% of its value in June last year, which is why investors lost their money, calling the project a "pump and dump" scheme. The lawsuit alleges that celebrities have made "false or misleading statements" about the little-known token in their social media posts.

A class-action lawsuit filed last Friday in the US District Court for the Central District of California accuses EthereumMax and its famous promoters of working together to artificially inflate the price of the token by "false or misleading statements" through social networks.

Kardashian made a splash last year when she posted a post on Instagram advertising the EthereumMax token: "Guys, are you into crypto? My friends just told me about the Ethereum Max token!" She pointed out the hashtag #ad in the message, thus noting that she was paid to promote it. It's unclear how much the Kardashians paid EthereumMax, although her estimated fee for an Instagram post is in the range of $500,000 to $1 million.

Mayweather took a different path and in his boxing match with YouTube star Logan Paul advertised EthereumMax, which was accepted as payment for tickets to the event. Mayweather also promoted EthereumMax at a major bitcoin conference in Miami.

The lawsuit also notes that EthereumMax has nothing to do with ether, the second-largest cryptocurrency. Its branding appears to be an attempt to mislead investors into believing that the token is part of the Ethereum network. Most likely, this bet was played.

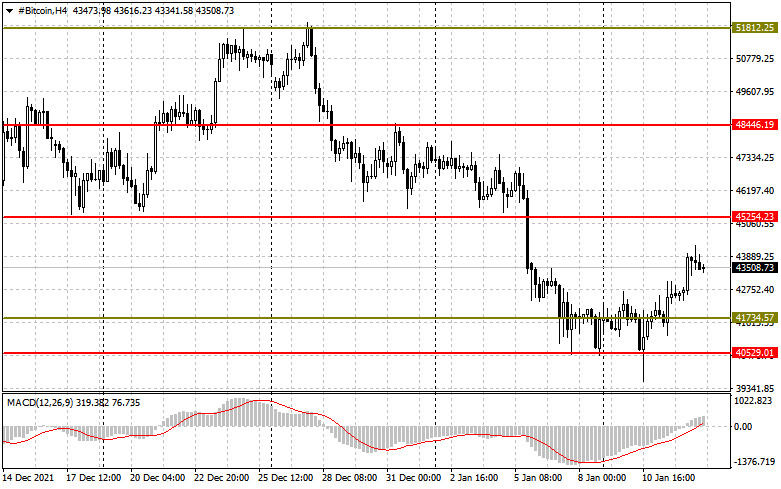

As for the technical picture of bitcoin

The bulls have managed to defend the new support of $ 40,520 and are likely to target the resistances of $ 43,200 and $ 45,524. If the pressure on the trading instrument returns in the near future, and we see a breakdown of $ 40,520, in this case, it is better not to wait for anything good in the near future. I advise you to be patient, waiting for the update of the lows: $ 37,380 and $ 33,830. It will be possible to talk about a change in the market direction of the first cryptocurrency only after going beyond $ 43,200, which will open a direct road to $ 45,250, $ 48,400, and $ 51,800.

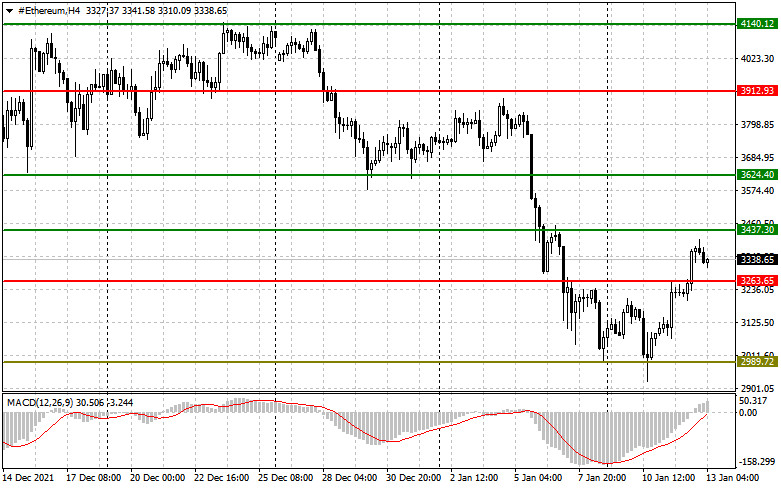

As for the technical picture of the ether

The ether has very big difficulties since the bears have fixed below the 200-day moving average, which is quite a serious problem. Trading below this level will continue to push the trading instrument lower, and a breakdown of the psychological mark of $ 3,000 will lead to a larger sale in the area of lows: $ 2,700 and $ 2,440. To return demand, a breakdown of $ 3,260 is needed, which will open a direct road to $ 3,430, where the 200-day average passes. A break in this range will resume the bullish trend, which will lead to highs of $3,600 and $3,900.