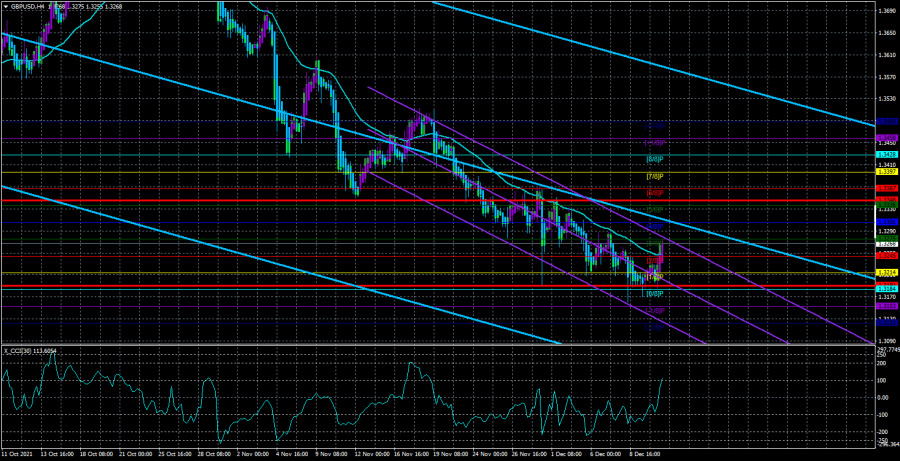

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

The GBP/USD currency pair broke the moving average line in half on Friday, so it now has little chance of forming a new upward trend. Strictly speaking, these chances are not so small, since the longer the trend continues, the higher the probability that it will end soon. Both linear regression channels are still pointing downwards, so it's too early to talk about a trend change. However, purchases can already be considered. Moreover, on Friday, traders reacted by selling the dollar while another strong report on US inflation was released and it would be more logical to see new growth of the US currency. Unfortunately, the bulls' hard-won advantage on Friday could be smashed to smithereens in the middle of this week. The meetings of the Fed and the Bank of England are extremely important events and there may be surprises at the end of 2021. If everything is clear on the Federal Reserve in principle – most likely, the QE program will be reduced by 20-30 billion dollars - then everything is confusing with the Bank of England. Last month, it seemed to have embarked on a path of gradual tightening, but this month it may get off this path. It's all the fault of the new strain "omicron", the fourth "wave" of the pandemic in the UK, the tightening of quarantine measures. All this may harm the British economy, which is already going through hard times. Therefore, in such conditions, it is impractical to curtail QE, as well as raise the key rate. The markets no longer believe in anything like that. Forecasts for a rate hike say that only one member of the monetary committee will vote in favor.

Reuters and Scotiabank also do not believe in tightening.

Many investment banks, analytical agencies, and news agencies also do not believe in raising the key rate. For example, Scotiabank said that the pound could fall to the level of 1.3000 due to uncertainty with the omicron strain, and BA is unlikely to raise the rate at the last meeting this year. Scotiabank experts believe that the Bank of England will move to tighten monetary policy in the first quarter of next year, and it is then that the British currency should be expected to grow. The bank's experts also said that the decline in Boris Johnson's popularity could harm the pound sterling.

At the same time, Reuters conducted a poll among analysts and most of them replied that they expected a rate hike from BA in the first quarter of next year, although the previous survey showed the market's belief in an increase in December. Recall that a member of the BA monetary committee, Michael Saunders, recently spoke, who said that before raising the rate, it is necessary to thoroughly study the omicron strain and understand what real threats it poses to the economy.

A similar decision (to revise the forecast) was made by the economists of Goldman Sachs bank. They also believe that now we should expect a rate increase from the British regulator no earlier than February 2022. Thus, formally, the pound sterling has a chance to start a new long-term upward trend in the coming months, since possible tightening from the Fed has already been worked out by the market several times, but tightening from the BA has not. But at the same time, this is not a fast process and it is quite difficult to say exactly when a new trend will start. As for this Wednesday and Thursday, when the most important events of the week will take place, high volatility is almost guaranteed, but this does not mean that the pound/dollar pair will move only in one direction. It can safely trade from different sides with increased volatility. Do not forget that a report on British inflation will also be published on Wednesday, which is likely to rise to 5%.

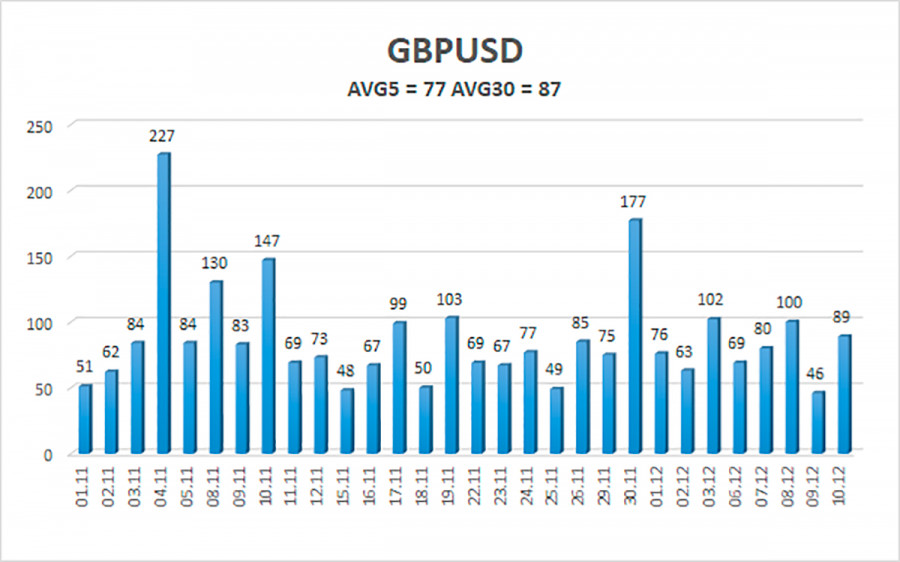

The average volatility of the GBP/USD pair is currently 77 points per day. For the pound/dollar pair, this value is "average". On Monday, December 13, thus, we expect movement inside the channel, limited by the levels of 1.3191 and 1.3346. The upward reversal of the Heiken Ashi indicator will signal a new round of corrective movement.

Nearest support levels:

S1 – 1.3245

S2 – 1.3214

S3 – 1.3184

Nearest resistance levels:

R1 – 1.3275

R2 – 1.3306

R3 – 1.3336

Trading recommendations:

The GBP/USD pair has started a corrective movement on the 4-hour timeframe. Thus, at this time, it is necessary to remain in long positions with the targets of 1.3306 and 1.3336 levels until the Heiken Ashi indicator turns down. Sell orders can be considered again if the price is fixed below the moving average with targets of 1.3214 and 1.3184 and keep them open until the Heiken Ashi turns up.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.