To open long positions on EUR/USD, you need:

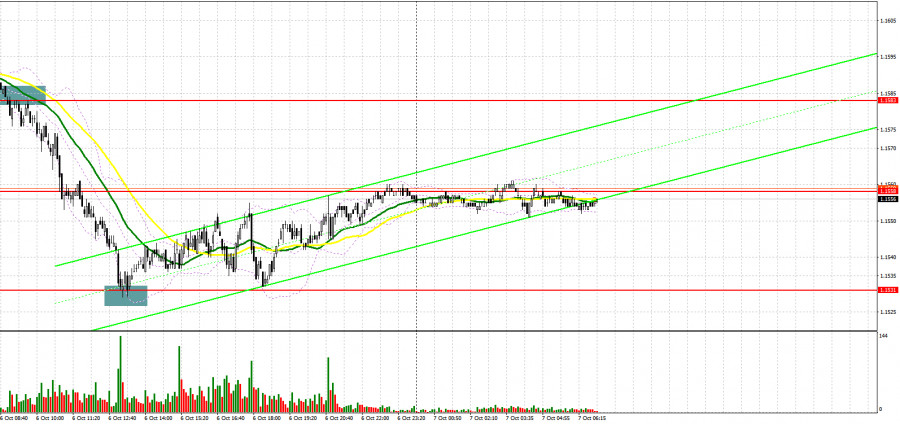

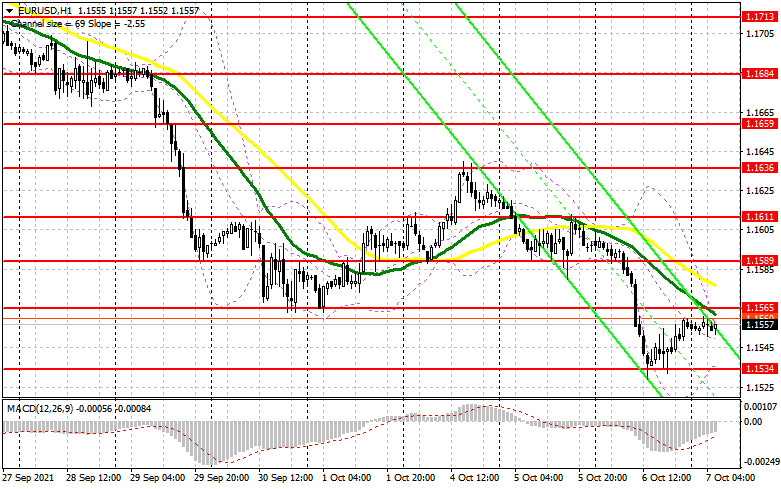

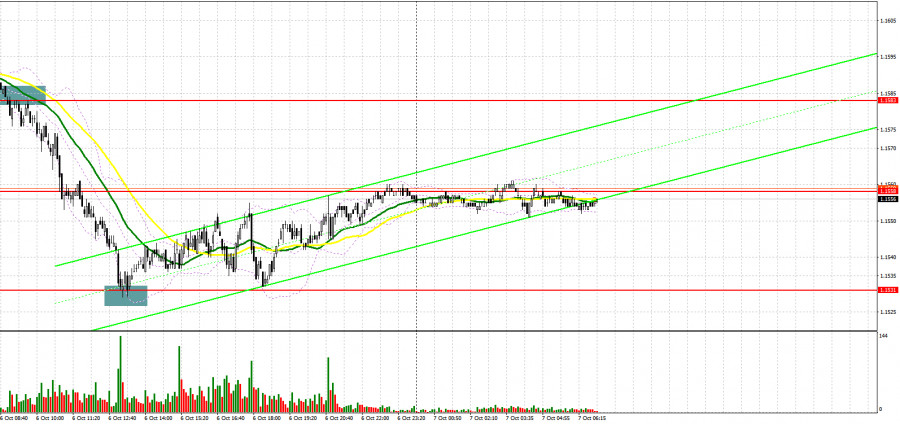

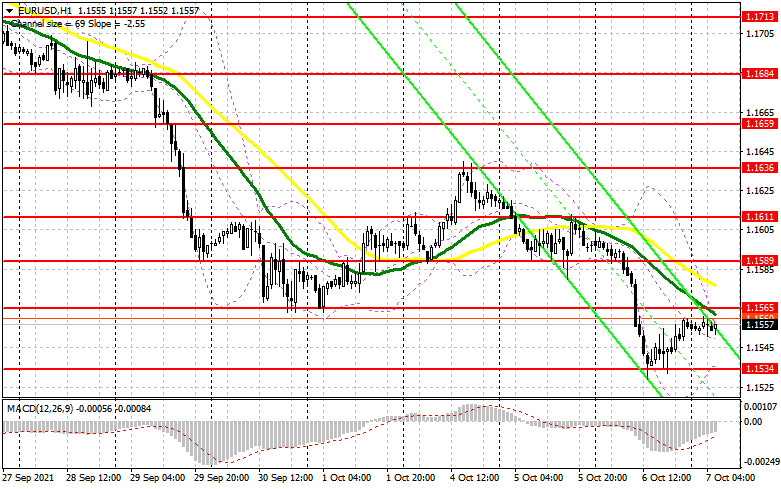

The pressure on the euro has returned, as investors are again afraid of active actions by central banks due to the increased risk of sharp inflationary pressures by mid-autumn this year. This increases the chances that the Federal Reserve will act more aggressively in November, which is supporting the dollar. Now let's take a look at the 5-minute chart and look at yesterday's trades. In my morning forecast, I paid attention to the 1.1583 level and recommended making decisions from it. A breakthrough and consolidation below the support of 1.1583 - all this resulted in forming an entry point to short positions and then to a rapid fall in EUR/USD to the 1.1564 area. After a short pause, a breakthrough of this range took place and a further decline to a low like 1.1538. In the second half of the day, the pair descended to the 1.1531 area again, however, literally a few points were missing before a false breakout was formed. I did not enter the market for this reason.

Most likely, today will be quite calm, as traders can take a break before tomorrow's data on the state of the US labor market, which will benefit the euro and the bulls. Only the European Central Bank's report from the monetary policy meeting will attract attention, but we will not learn anything new from it except for the strategy of super-soft monetary policy. Data on the number of initial applications for unemployment benefits will be released in the afternoon and ECB representatives will speak. As for buying the euro, a very important task during the European session is to protect the support at 1.1534, to which the pair can collapse very quickly at the beginning of the day. Only a false breakout there will lead to a signal to open long positions, counting on a recovery in EUR/USD to the resistance area of 1.1665, on a breakthrough of which a lot depends today. If the bulls manage to gain a foothold above this range, only its reverse test from top to bottom will generate signals to buy the euro in order to recover and reach the 1.1589 high. The next target will be the area of 1.1611, where I recommend taking profits. If the bulls are not active at the level of 1.1534, and most likely the pressure on the euro will remain quite serious this week, I advise you to postpone long positions to the next weekly low of 1.1510. Opening long positions immediately on a rebound is possible only in the area of supports 1.1482 and 1.1454, and then, counting on an upward correction of 15-20 points within the day.

To open short positions on EUR/USD, you need:

Euro bears continue to control the market and are clearly aiming for new monthly lows. A very important task is to protect the resistance at 1.1565, which was formed as a result of yesterday and on which the moving averages are now located, playing on the side of the bears. Only a false breakout there in the first half of the day will return the pressure to the pair, which will push it to the intermediate support at 1.1534. A breakthrough of this level with its reverse test from the bottom up will form a new entry point to short positions with the goal of pulling down EUR/USD to the 1.1510 and 1.1482 areas, where I recommend taking profits. The next target will be the 1.1454 low, but this is under the worst scenarios, which will be associated with political problems in the United States with an increase in the national debt limit. If the bears are not active at 1.1565, it is best to postpone short positions until the test of the larger resistance at 1.1589, or open short positions immediately on a rebound, counting on a downward correction of 15-20 points from the new high of 1.1611.

The Commitment of Traders (COT) report for September 28 revealed a sharp growth in both short and long positions, but there were more of the former, which led to a reduction in the net position. The fact that the United States of America is now going through hard political times has kept the demand for the US dollar all last week and put pressure on risky assets. The prospect of changes in the Federal Reserve's monetary policy as early as November of this year also allowed traders to build long dollar positions without much difficulty, as many investors expect the central bank to begin cutting bond buying programs towards the end of this year. An important report on US nonfarm payrolls is due this week, shedding light on how the central bank moves forward, as a lot now depends on labor market performance. The demand for risky assets will remain limited due to the high likelihood of another wave of the spread of the coronavirus, and its new strain Delta. Last week, European Central Bank President Christine Lagarde talked a lot about how the ECB will continue to take a wait-and-see attitude and keep the stimulus policy at current levels. However, the observed surge in inflationary pressure in the fourth quarter of this year may spoil the plans of the central bank. The COT report indicated that long non-commercial positions rose from 189,406 to 195,043, while short non-commercial positions jumped quite seriously - from 177,311 to 194,171. At the end of the week, the total non-commercial net position dropped from the level 12,095 to the level of 872. The weekly closing price also dropped to 1.1695 from 1.1726.

Indicator signals:

Trading is carried out below 30 and 50 moving averages, which indicates a continuation of the bearish trend.

Moving averages

Trading is under the 30 and 50 moving averages, which indicates an attempt by the bears to retrace the September downward trend.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the upper border of the indicator in the area of 1.1565 will lead to a new wave of euro growth. Surpassing the lower border in the area of 1.1534 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.