Euro rose on Monday, thanks to strong industrial output and positive statements from the European Central Bank (ECB).

Meanwhile in the US, another struggle was seen yesterday, when Democrats stepped up pressure on the Senate to stop delaying the adoption of their proposed program. Tensions have escalated ahead of the meeting between Acting White House budget director Shalanda Young and White House counselor Steve Ricketti with House Democrats due today. The meeting will discuss the details of the program proposed by Biden for the development of the US economy. But so far, there are quite a number of people who disagree on the bill and want a bipartisan agreement.

For the US dollar, the adoption of such a program may result in another decline, so investors should not be surprised if the currency loses position once the Senate passes the bill.

Going back to EU, ECB President Christine Lagarde said it is "too early" to stop economic stimulus. As such, Oesterreichische Nationalbank (OeNB) head Robert Holzmann confidently said the bond purchase program will end next March, unless there is another serious wave of coronavirus infections.

"The bond purchase program was created to support the economies of the eurozone countries, and all representatives of the ECB voted for its completion in March 2022. If nothing changes, for example there is no fourth or fifth wave of coronavirus, the program will end , "Holzmann said.

At the last policy meeting, Lagarde promised that the central bank will maintain favorable funding conditions for as long as necessary. And yesterday, she said: "We need to really consolidate the economic recovery. Our plan for the bond purchase program is working and we are moving in the right direction, but it is too early to discuss its completion. "Bank of France Governor Francois Villerois de Galhau supported these statements and said the economy needs an extremely soft monetary policy to help achieve the goals.

As for the US, the Federal Reserve continues to be unworried, even though inflation has already gone beyond the target level of 2.0% and to 5.0%.

Some economists, David Rosenberg for instance, even deems the current inflation rate as good, especially since bond yields have dropped. They believe that its growth will be short-lived, as it is caused by deferred demand and supply chain problems associated with the coronavirus pandemic.

"The numbers were shocking, no doubt about it. But this is quite easy to explain, "Rosenberg said. "I don't understand why people are trying to draw a parallel between the two-month bounce, which is related to deferred demand and long-term inflationary expectations."

The lack of reaction in the bond market proves that the Fed's approach is correct. At the moment, the yield on 10-year Treasury bonds has reached its lowest level since March 3, hitting 1.45%. Profitability also dropped by 7% over the past week, and nearly 11% over the past month.

With regards to other statistics, industrial output in the eurozone is reported to have jumped 0.8% in April, much higher than the expected 0.4%. Apparently, problems in the supply chain are gradually disappearing, so orders are finally increasing. Production of consumer durables also climbed by 3.4%, while production in the energy sector gained 3.2%. Capital goods production also rose 1.4%. This continued growth makes the economic outlook optimistic, although weaker supply may slightly constrain it.

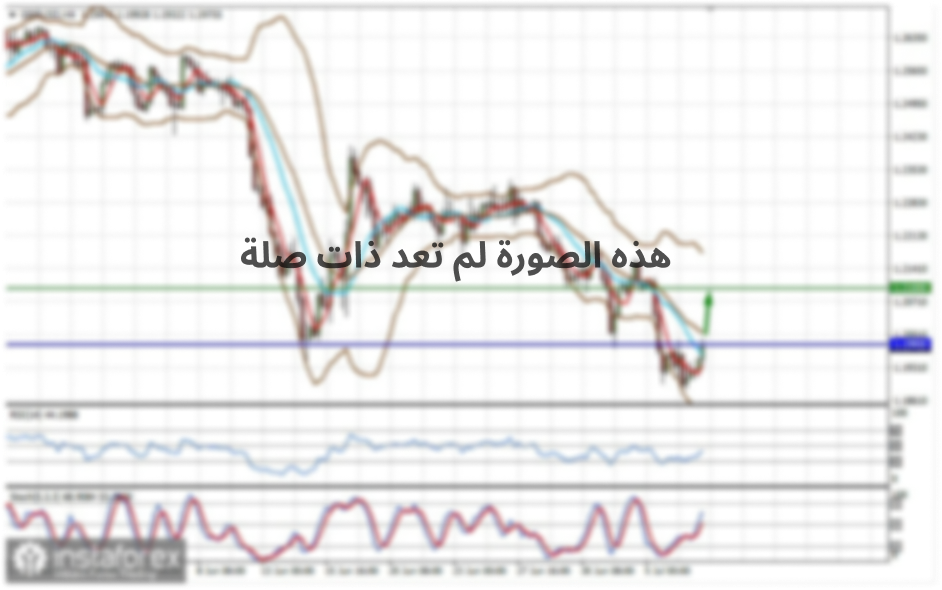

Today, a lot will depend on 1.2130, as only a break above it will lead to a jump towards 1.2160 and 1.2190. But if euro drops to 1.2095, the quote will decline to 1.2060, and then to 1.2025.